If you’re feeling a little overwhelmed by all of the various announcements revolving around the first US exchange-traded funds investing directly in bitcoin finally going live … you have company!

After the much anticipated debut that arrived with the SEC’s green light following a more than decade-long campaign by the digital asset industry, there is much to sift through.

Let’s start sifting.

Strong start and fee wars

By all accounts, the almost one-dozen funds that were greenlighted to offer spot bitcoin ETFs – including BlackRock, Fidelity and the fund run by ARK Investment Management and 21Shares – got off to a strong start, with about $4.6 billion of shares changing hands in a turbo-charged first day. Even the ETFs that did not convert from an existing fund have seen large trading volumes.

But certain platforms, such as Vanguard and Citigroup, limited retail investor access to the funds. A representative from the latter told the WSJ it is in the process of evaluating the products for individual investors.

Robinhood has made the funds available in both retirement and brokerage accounts, although you can still purchase bitcoin directly through Robinhood Crypto.

The limited access some firms are opting for is likely due to compliance and risk concerns, some of which are noted below.

Even before the spot bitcoin ETFs launched, the battle to lower fees for customers began, with major firms dropping their costs in the days leading to the SEC’s approval on January 10.

There was going to be undue attention to them no matter what – and they were launching pretty much at the same exact time – so the race to the bottom of the fee heap due to all this attention was so pronounced that a few of them (like Bitwise) even offered their ETFs free for the first six or 12 months.

Asset managers already want more

You can hardly blame the companies and their enthusiastic investors. Some firms are already seeking to offer variations of the funds, such as options tied to the ETFs, so investment professionals can make wagers on future gains or hedge against losses.

Grayscale was born ready: The firm has issued a new filing for a new product called the Grayscale Bitcoin Trust Covered Call (GBTC) ETF, which will seek income by buying and selling options on bitcoin while also giving investors bitcoin price exposure. If it is approved, that is.

And several asset manager have filed applications to launch the first ETFs that track ether, which is the second-largest cryptocurrency.

That excites some folks and worries others incredibly. “The approval of spot bitcoin ETPs was a historic mistake, unsupported by the facts or law. It is little more than an ETP for Ponzi schemes,” said Dennis Kelleher, co-founder and president of Better Markets.

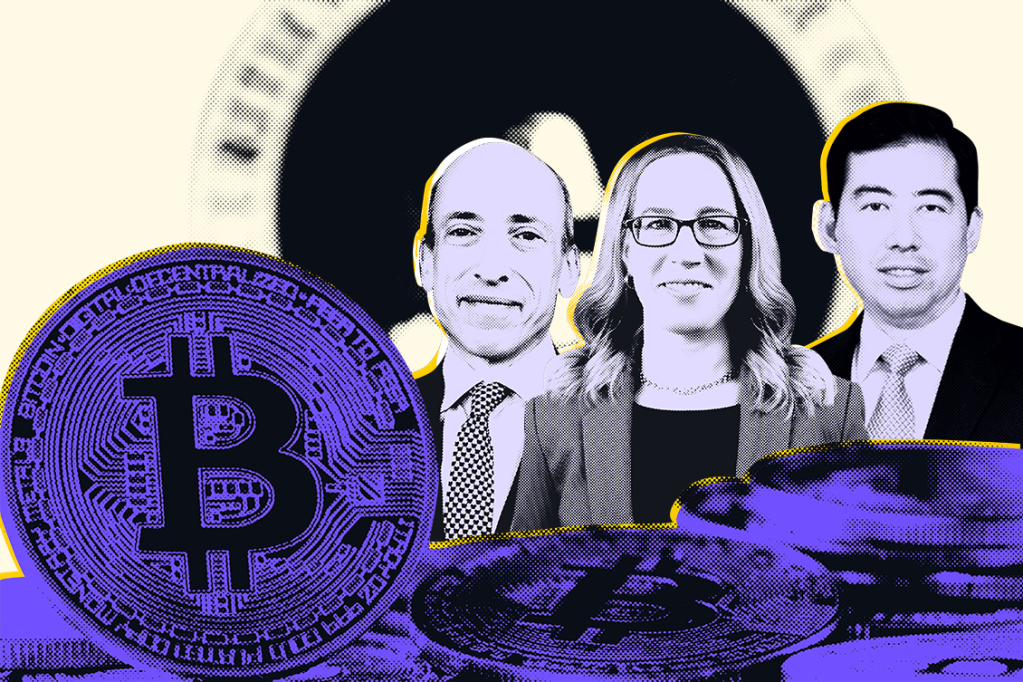

The SEC’s 3-2 vote

Gary Gensler, Hester Peirce and Mark Uyeda came together to deliver the slim 3-2 majority vote. Did Chair Gary Gensler approve reluctantly, while holding his nose? Probably, but he did it.

Gary Gensler

Under his leadership, the SEC has previously rejected applications for the spot bitcoin ETF on the grounds that digital assets for the most part have been so vulnerable to market manipulation and fraud, with the Chair specifically calling for more regulation before retail investors could gain more access to the crypto marketplace.

Gensler said a court ruling last year in favor of Grayscale had pushed him to this decision. “Based on these circumstances and those discussed more fully in the approval order, I feel the most sustainable path forward is to approve the listing and trading of these spot bitcoin ETP shares,” he said. He added that investors should remain cautious about the myriad risks associated with bitcoin and products whose value is tied to cryptocurrency in general. (ETP refers to exchange-traded products.)

In the lawsuit, Grayscale had argued that the market for spot bitcoin and the already existing bitcoin futures one at the CME were closely correlated, and the judges sided with the crypto asset manager.

Mark Uyeda

Although Commissioner Uyeda supported the decision, his statement said the approach to approval taken amounted to “merit regulation” with the SEC requiring the applying firms to jump through so many hoops. “The Approval Order invents a novel, previously unarticulated standard to form the basis for approval,” he said.

Uyeda points out that the SEC required each exchange to establish it has a “comprehensive surveillance-sharing agreement with a regulated market of significant size related to spot bitcoin”.

Peirce issued a statement (partly entitled: “Out, Damned Spot! Out, I Say!”) in which she said the decision to approve the 11 spot bitcoin ETF applications did not compensate for “the disparate treatment of spot bitcoin products”.

(All of the exchanges seeking to list bitcoin ETFs have a surveillance-sharing agreement with the Chicago Mercantile Exchange, where bitcoin futures are listed.)

This standard has been applied to other types of commodity-based ETPs, but the agency has made it so incredibly difficult for bitcoin ETPs, asking them to meet a higher standard than is customary, without giving an explanation for the different and stricter treatment, Uyeda said.

Hester Peirce

Commissioner Peirce issued a statement (partly entitled: “Out, Damned Spot! Out, I Say!”) in which she said the decision to approve the 11 spot bitcoin ETF applications did not compensate for “the disparate treatment of spot bitcoin products”.

She said the SEC should have acknowledged its error in delaying the approval, and she lamented that the SEC’s previous rejections used illogical reasoning and drove investors to find less-efficient ways of gaining exposure to bitcoin.

The fake message on X

Late drama came when the SEC’s X (formerly Twitter) account was hacked on January 9, announcing prematurely that the agency had approved ETFs for bitcoin. The SEC subsequently announced its account had been hacked, leading some US lawmakers to urge the agency to review its cybersecurity protocols.

X put put a statement confirming the hack and saying an “unidentified individual” obtained control over a phone number associated with the SEC’s account and that the SEC did not have multi-factor authentication enabled at the time.

I’ve heard a few interpretations of the hack of the account, and I’m not sure how the folks drawing a line from the riskiness of cryptocurrency to the hack of the account can rightly do so.

What I see is the lack of a line from SEC imperatives on registered firms and their cybersecurity resiliency to the looser and voluntary obligations and quality controls the regulator has established for itself.

Compliance reminders

let’s be honest, the SEC’s approval of spot bitcoin ETFs listed on regulated exchanges (such as the NYSE, Nasdaq, and Cboe Global) potentially opens up a new crypto investing possibility for those who might otherwise not want to hold actual bitcoin.

Crypto is quite different from traditional assets like stocks and bonds, and investors should be fully aware of the unique risks the vehicles pose.

One of the first things that comes to my mind is the suitability of the product to the firm’s typical clients and whether even the professionals working at the firm truly understand all they need to know about it and how it will perform under a variety of market conditions and levels of concentration. Trading parameters must be established.

“We suggest most investors continue to treat them as a speculative asset primarily for trading with money outside a traditional long-term portfolio.”

Charles Schwab

Drafting the policies and procedures that will enable your business to demonstrate compliance with Regulation Best Interest with regard to these products should be a priority. Considerations as to which types of accounts the ETFs will be allowed into are important as well, such as retirements accounts and others.

Training reps to understand and appreciate the product and its risks, and how to make careful suitability judgments should be prioritized and not treated as optional.

Compliance and risk teams need to work with their legal counsel and possibly seek out further expertise to consider how they will offer these products – whether in a more discretionary or more open-ended manner. These decisions will be analyzed carefully by regulators.

Will your firm require customers to sign a bitcoin ETF acknowledgement form that explains what the risks are with the product? Disclosure documents will be analyzed by regulators for certain, and they need to be solid, whether the documents are completely new or are existing ones with necessary adjustments.

Prepare for volatility

Supervisory oversight must be demonstrated; this means keeping a close lookout for volatility and concentration concerns, among other things, and preparing investors for volatility in the marketplace – volatility that could be far greater than any they have so-far experienced. Customer risk tolerances must be carefully mapped out and explained to investors, making sure these products align with their investing goals for the longer term.

And remember, you don’t get credit for any safeguards, surveillance and training that you do not document in writing. So you must do that too – from the ETF’s prospectus to all other documents presented to actual and potential customers and filed with regulators.

Finally, consider this carefully worded investor message from Charles Schwab: “Schwab continues to monitor cryptocurrencies as regulations and technology evolve. While some traders have made money on the change in price of bitcoin or other cryptocurrencies (and others have lost money), we suggest most investors continue to treat them as a speculative asset primarily for trading with money outside a traditional long-term portfolio.”