The European Commission has proposed new rules to regulate ESG ratings providers. The proposal, which is still subject to approval by the European Parliament and the European Council of the European Union, would establish a new regulatory framework for ESG ratings providers, including requirements for transparency, methodology, and conflict of interest management.

The ESG ratings market has grown rapidly in recent years. The proposal is part of the European Commission’s broader effort to promote sustainable finance. ESG ratings are used by investors to assess the sustainability performance of companies and other organizations. However, there is currently no single, harmonized set of ESG rating standards or methodologies, and there have been concerns about the quality and reliability of some ESG ratings.

” At present, ESG ratings are as much an art as a science.”

Claudia Hoffmann, partner, Financial Services, Eversheds Sutherland

The proposals would require ESG ratings to have adequate:

- Supervision: ESG ratings providers would be subject to supervision by the European Securities and Markets Authority (ESMA);

- Transparency: ESG ratings providers would be required to disclose information about their methodologies, models and key rating assumptions;

- Methodology: ESG ratings providers would be required to use methodologies that are “rigorous, systematic, objective and subjective to validation”;

- Conflict of interest management: ESG ratings providers would be required to have in place measures to manage conflict of interest. The providers would be prohibited from providing consulting services to investors or from developing benchmarks.

The new regulation is a significant step towards ensuring the quality and reliability of ESG ratings. The regulation is expected to have a positive impact on the ESG ratings market, by making it easier for investors to compare ESG ratings and by increasing the confidence of investors in the quality of ESG ratings.

What is changing?

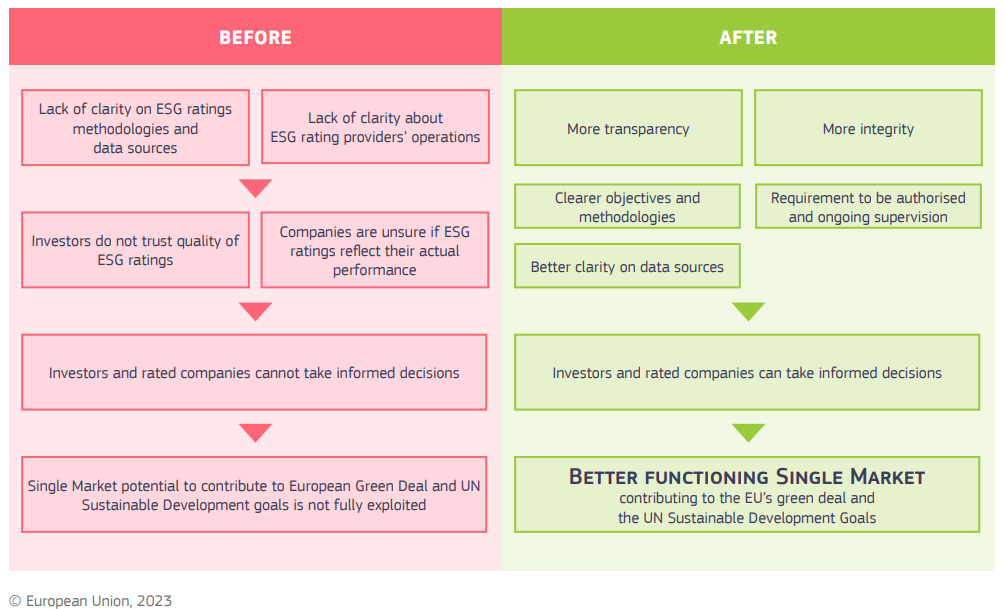

The Commission said the new rules were needed to ensure that ESG ratings are “reliable and comparable,” and to protect investors from “greenwashing.” Furthermore, it “will help to ensure that investors can make informed investment decisions based on high-quality ESG ratings”.

Mairead McGuinness, the European Commissioner for Financial Services, said: “We have the foundations of the sustainable finance in framework in place. We also need to reap the full potential of transition finance to ensure that all companies irrespective of their starting points can have adequate tools and support for their transition efforts towards sustainability.” The proposal has been welcomed by a number of stakeholders, including environmental groups, investors, asset managers and ESG ratings providers.

“We also need to reap the full potential of transition finance to ensure that all companies irrespective of their starting points can have adequate tools and support for their transition efforts towards sustainability.”

Mairead McGuinness, European Commissioner for Financial Services

“EFAMA believes that a comprehensive regulatory framework covering both ESG data providers and ESG rating providers is essential to ensure reliable and transparent ESG information.” said Chiara Chiodo, Regulatory Policy Advisor, EFAMA.

Claudia Hoffmann, partner, Financial Services, Eversheds Sutherland, said: “We welcome the European Commission’s attempt to boost investment for a sustainable future and to improve the transparency of ESG data. At present, ESG ratings are as much an art as a science. Methodologies vary because of differing data availability in differing industries and jurisdictions.

“Over time, such methodologies will naturally evolve and improve as more data becomes available and as the understanding of ESG impacts of companies improves. An acceleration of standardisation might be positive, as it could give more certainty to the market. On the other hand, however, it is important that the market has enough flexibility to develop and adjust as necessary if standardisation is to be accelerated by legislation.”

However, some stakeholders (ESG ratings providers) have raised concerns about the potential cost of compliance with the new regulation. The European Commission estimates that new regulation will cost ESG rating providers €10m-€20m ($11m-$22m ) per year to comply with. The Commission has said that it is “open to feedback” on the proposals and that it will “take the necessary steps to ensure that the final rules are proportionate and cost-effective.” The Commission also estimates that the regulation will benefit investors by providing them with more reliable and transparent ratings.

What next for sustainable finance?

These proposals follow the launch on June 9 of a four-week feedback period on a first set of sustainability reporting standards for companies. Mandatory reporting standards will ensure transparent and comparable sustainability information. The Commission will consider the feedback received before finalising the standards as delegated acts and submitting them to the European Parliament and Council for scrutiny.

Once adopted, these reporting standards will be used by companies subject to the Corporate Sustainability Reporting Directive (CSRD). This is all part of a broader effort by the European Commission to boost sustainable finance in the EU. In July 2021, the Commission launched the EU Sustainable Finance Action Plan, which sets out a number of measures to promote investment in sustainable activities.