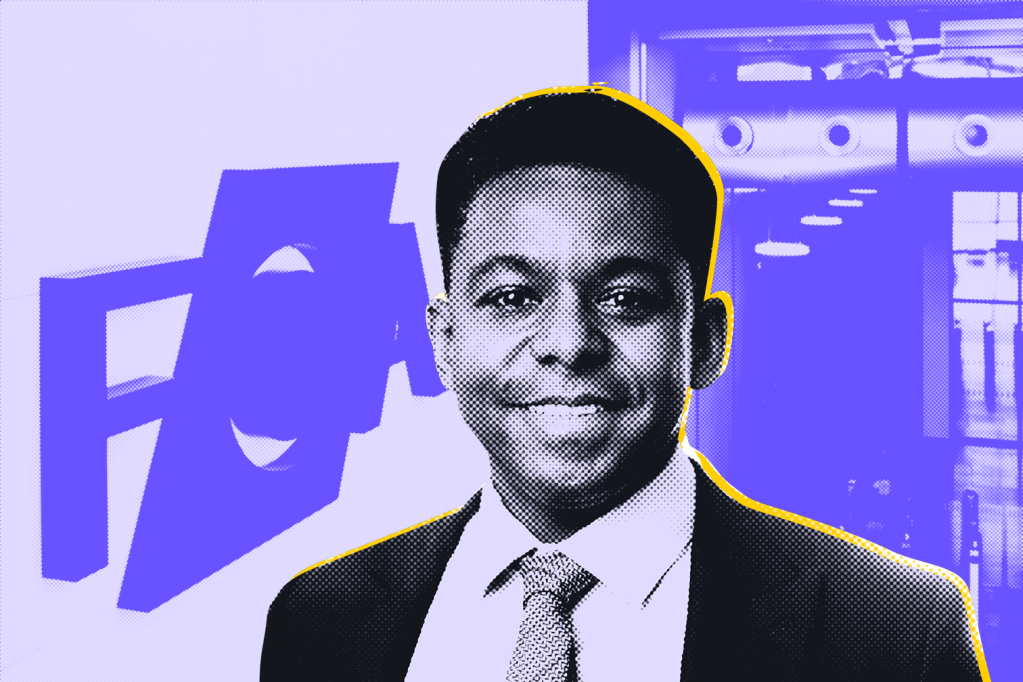

The FCA’s Sheldon Mills gave notice that “the clock is now ticking” for adviser firms to meet a Consumer Duty deadline for closed products at a speech given to a KPMG event this week.

The regulator’s executive director of consumers and competition acknowledged progress had been made on open book products, but flagged that closed products “will come under the scope of the Consumer Duty at the end of July”.

He emphasized that: “We gave firms an extra year to get to grips with the complexity of older systems and the increased work involved.” And said: “We know you may not have every answer. But you need to have a plan for how you will produce one, and how your firm will evidence that it is delivering good outcomes for customers who hold closed products. “

Right products, right services

The speech was given “to touch on the progress we have seen six months on since the first Consumer Duty deadline” and Mills referenced an FCA report setting out good and bad practice. He said many firms were now “offering the right products and services to the right customers; eradicating jargon and moving clients to less bespoke and cheaper options where that is a better fit”.

But, he said: there is “still much room for improvement. We do not want to see firms waiting to see if we will intervene to address an issue. Firms also need to get serious about their data and not assume they can just re-package existing information. And we want to see the Duty embedded across every firm at every level, with leadership from boards.”

Fair value

He also said: “Many of the fair value assessments we have seen are not relying on solid data and other credible evidence to justify the products’ value to retail customers.”

In the speech, Mills went into some detail about how firms should address gaps in monitoring data, the issue of fair value in closed products, engaging with customers and dealing with vested rights. And, he said: “we expect firms to take a risk-based approach to prioritisation”.

He concluded: “Getting it right for consumers means higher standards and healthier competition”.