The SEC has adopted Securities Act Rule 192 to implement a provision of the Dodd-Frank Act. The rule is intended to prevent the sale of asset-backed securities (ABS) that are tainted by material conflicts of interest.

It prohibits a securitization participant, for a specified period of time, from engaging, directly or indirectly, in any transaction that would involve or result in any material conflict of interest between the securitization participant and an investor in the relevant ABS.

Under new Rule 192, such transactions would be “conflicted transactions.” With that said, Rule 192 provides exceptions for transactions that can be classified as the risk-mitigating hedging activities, liquidity commitments, and bona fide market-making activities of a securitization participant.

“I am pleased to support this rule as it fulfills Congress’s mandate to address conflicts of interests in the securitization market, a market which was at the center of the 2008 financial crisis,” said SEC Chair Gary Gensler.

Conflicted transactions

Under the new rule, conflicted transactions include a short sale of the relevant ABS, the purchase of a credit default swap or other credit derivative that entitles the securitization participant to receive payments upon the occurrence of specified credit events in respect of the ABS, or a transaction that is substantially the economic equivalent of the aforementioned transactions. (Other than any transaction that only hedges general interest rate or currency exchange risk, for which an exception applies.)

Rule 192 will become effective 60 days after publication in the Federal Register. Compliance with Rule 192 will be required with respect to any ABS the first closing of the sale of which occurs 18 months after the date of publication in the Federal Register.

Third time a charm?

The Rule 192 version that was finalized this week was first proposed in September 2011 and re-proposed in January of this year.

The new version offered clarifications of certain elements of the rule, namely by:

- defining each type of entity as to which proposed Rule 192 would apply;

- delineating the types of transactions that involve a material conflict of interest and are thus deemed to be conflicted transactions:

- providing a more specific commencement point for the prohibition on conflicted transactions;

- providing a specific standard for determining the “materiality” component of the term conflicted transaction;

- providing more specificity with respect to the risk-mitigating hedging exception and the bona fide market-making exception and imposing conditions on the availability of those exceptions; and

- including an “anti-circumvention” provision, which bars those transactions that are “economically equivalent to” a conflicted transaction.

Commissioner statements

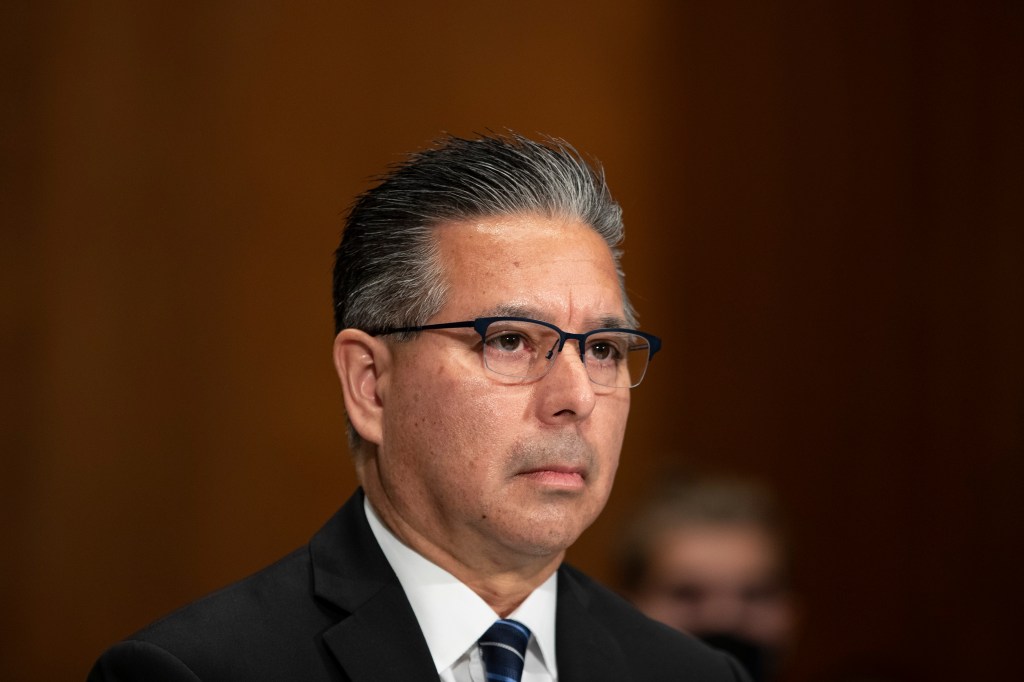

Commissioner Jaime Lizárraga issued a statement in support of the final rule, saying it would reduce the ability of securitization participants to exploit their informational advantages at the expense of investors.

“It will provide investors with the confidence that their ABS investments will perform in a manner that is commensurate with the risks they are willing to take and are not tainted by speculative bets that make them more likely to perform poorly. Overall, it will result in improved investor protections, a lower cost of capital, and enhanced market stability,” he said.

“Our pattern of proposing unrealistic rules with numerous questions, only to substantively revise the rule text after the comment period closes, inhibits our ability to receive and consider comprehensive feedback, and thus write sound final rules.”

SEC Commissioner Hester Peirce

Commissioner Mark Uyeda approved the rule, saying he thought the final version of the rule had addressed the comments received in its last go-around.

Commissioner Hester Peirce issued a dissent that lamented the fact that after so much time had passed since the rule was first introduced in September 2011, the final product is still (in her view) ambiguous and over broad.

Peirce also cited a problem she has mentioned in some other dissents. She thinks the SEC has a tendency, when it has made significant adjustments to a rule that has already been re-proposed, to not open that final round to comments. Instead, that third try is considered the final version, even though some substantive changes and clarifications were added since its last iteration, and even though some comments were addressed and others were not.

The SEC can get away with not explaining why some comments were not addressed, she said, plus the agency loses out on getting feedback on whether its final interpretations of the other concerns hit the mark.

“Our pattern of proposing unrealistic rules with numerous questions, only to substantively revise the rule text after the comment period closes, inhibits our ability to receive and consider comprehensive feedback, and thus write sound final rules,” Peirce said.

Compliance considerations

In light of the new rules, businesses must revisit their conflicts of interest policies and train all new-hires and regularly to existing employees, preferably using case scenarios to play out when exceptions may apply.

Instead of assuming an exception applies, an escalation process should be crafted (if one does not yet exist) that details who makes the ultimate determination in those cases.

If a conflict is spotted, the company with a well-trained staff will be able to tackle the conflict right away as a best practice. And tackling it means using policies and procedures that outline how to act once they are identified – to both eliminate them and create better processes for avoiding them next time.

Businesses must also have some processes for knowing when a potential conflict exists, not just an actual one, so that risk can be monitored.

Speak-up culture

But maybe the most important compliance program ingredient is having a true “speak-up” culture, so all the best training, policies and procedures actually pay off.

That means employees appreciate the fact that sounding the alarm when something might look amiss, or when they are uncertain if an exception applies, is not only an acceptable thing to do, but the best and expected thing to do. Even if it slows a transaction down or even if an authority figure’s actions are being questioned thereby.

The end of the year can be a time for the compliance program’s annual review; such a review should include testing all of the relevant policies, processes, reporting lines, lists of authorized persons, and monitoring technology relied upon in making conflicts of interest decisions.