-

SEC to focus on navigating risk, reform, and retail protection in 2026

SEC targets protection of retail investors amid rising complexity in crypto, private markets, and foreign-linked disclosures.

-

SEC issues statement on crypto asset exchange-traded products

SEC’s observations regarding disclosure practices following reviews of crypto asset ETP filings.

-

SEC roundtable discusses executive comp disclosure requirements

At the event, speakers addressed the complexity and cost of regulations, plus the significance of disclosure to investor protection.

-

Senate Banking Committee offers up crypto market structure principles

Former CFTC Chair Behnam encouraged committee to support the expansion of the CFTC and SEC’s mandate over the crypto market.

-

Brite Advisors USA breached core safeguards in cross-border asset management

SEC’s case highlights how undisclosed conflicts and custody rule violations put client assets at risk.

-

Some foreign firms could face tougher access to US markets

The SEC said it welcomes comment on the burdens or benefits that may result from the possible regulatory responses noted in its release.

-

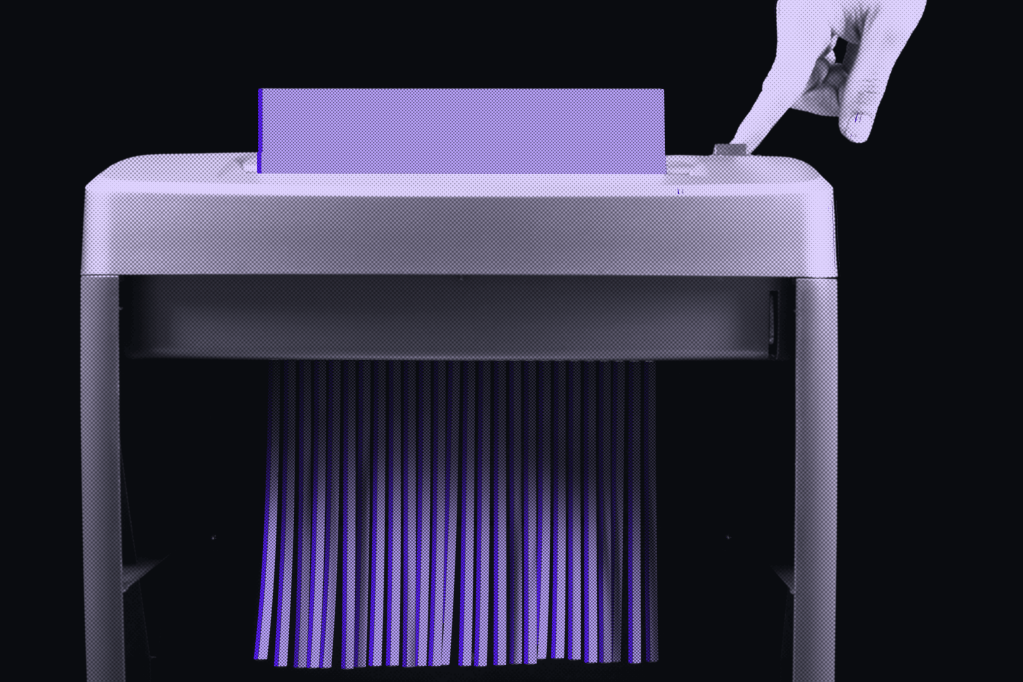

OPINION: SEC scraps 14 rule proposals, but don’t be naive

Former SEC regulator Janaya Moscony warns that rule scrapping doesn’t necessarily equate to “a hands off regulator.”

-

SEC withdraws 14 rule proposals

The pending rules would have addressed hot-button regulatory areas like predictive data analytics, climate reporting, and cybersecurity risk management.