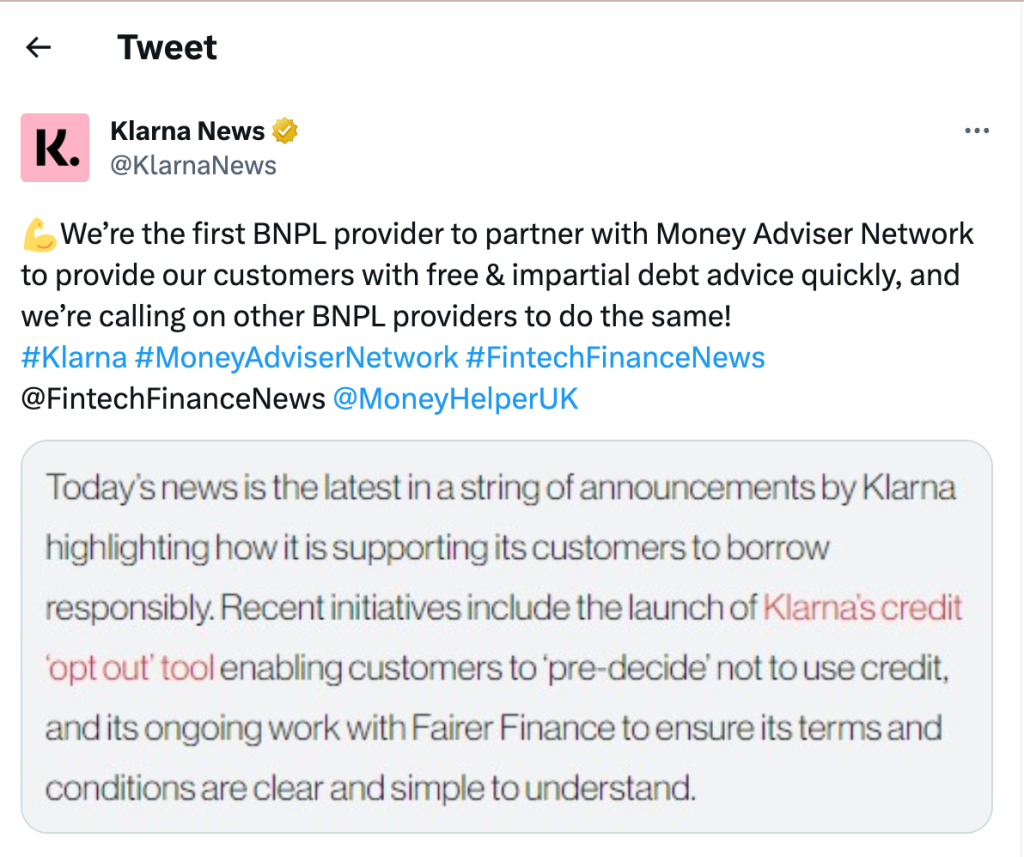

Klarna has become the first buy-now-pay-later (BNPL) credit provider to partner with the Money Adviser Network, aiming to provide UK customers with “free and impartial debt advice quickly”.

The move seems to be an attempt by the firm to be seen as acting in the interests of consumers, with the upcoming Consumer Duty an influencing factor. “This comes as Klarna, along with the rest of the financial services industry, prepares for the FCA’s implementation of its Consumer Duty, which will set higher and clearer standards of consumer protection across firms and requires them to put their customers’ needs first,” said the Klarna press release.

Flora Coleman, director of global policy and government relations at Klarna, said: “We are proud to be the first BNPL service to join forces with Money Adviser Network … and are calling on other BNPL providers to join us in providing the same access to advice and support, to ensure that customers’ interests are always put first.”

Point-of-sale payments

BNPL accounted for 1% of global PoS payments in 2021, with Sweden and Germany leading. In 2016, BNPL accounted for only 0.4% of the e-commerce payments avenues. The share increased to 1.6% in 2019, 2.1% in 2020, and 3.0% in 2021.

According to the Consumer Financial Protection Bureau (CFPB), from 2019 to 2021, in the US alone the number of BNPL loans offered by five surveyed lenders grew 970%, from 16.8 million to 180 million.

There is increasing social pressure on startups to act compassionately with debtors, allow more visibility with transaction, and report their data. BNPL is seen as an opaque form of lending that has nonetheless gained popularity with younger consumers who would typically be cautious of running up debts. Klarna says it is making use of Open Banking data and other tools to help customers borrow responsibly.

“”As many as 56% of BNPL users were negatively affected when a BNPL transaction was added to their credit profile. Approximately 30% of BNPL users have credit scores considered prime and super prime.”

Experian Report: Making buy now, pay later payments visible

BNPL is a misunderstood form of credit, Experian says, adding “many consumers are unaware that it is credit at all and view it simply as a mode of payment”. BNPL users typically already have low credit scores, or see a decrease in their score following use of BNPL products. “As many as 56% of BNPL users were negatively affected when a BNPL transaction was added to their credit profile. Approximately 30% of BNPL users have credit scores considered prime and super prime, yet they would see a negative impact to their score, for as long as a year, even if they paid off the loan and were never late with payments.”

BNPL regulation

Despite a rocky start to 2022 with mass layoffs and the company’s valuation crashing from $46bn to $6.7bn, Klarna secured one of the largest VC deals that year.

Klarna itself has reiterated the view that BNPL should be regulated. “It is, of course, important that regulation is introduced wisely. There are many examples of poor regulation akin to a tick box exercise which leave consumers unprotected and established banks entrenched,” the company says.

“BNPL is a rapidly growing type of loan that serves as a close substitute for credit cards. We will be working to ensure that borrowers have similar protections, regardless of whether they use a credit card or a BNPL loan,” said Rohit Chopra, Director, CFPB.

In the UK, concern about BNPL was brought up in the Woolard Review in 2021 and since then there have been various consultations on how to regulate the sector.