Consumer champion Which? has placed six of the UK’s biggest high-street banks in a “red” warning category over their fossil fuel investments and commitments to tackling climate change. The research found that the 60 largest banks reportedly ploughed $669 billion into the fossil fuel industry in 2022 alone – and many UK high-street banks are among the worst culprits.

The six banks classified in the red category are:

- JPMorgan Chase;

- Santander;

- Barclays;

- HSBC;

- Lloyds Banking Group;

- NatWest Group.

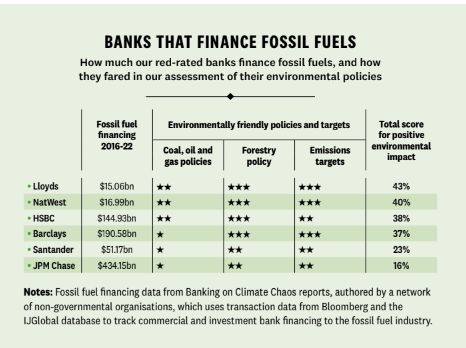

The analysis by Which? and non-profit research firm Reclaim Finance assessed the banks’ environmental policies, statements on agricultural commodities, transparency levels and targets to reduce their exposure to fossil fuels. Which? said that these banks have “too weak green credentials” and that they are not doing enough to support the transition to a low-carbon economy.

Which? found that all six of the banks in the red warning category have significant exposure to the fossil fuel industry. For example, since the Paris Agreement in 2015 JPMorgan Chase has financed more fossil fuels than all the banks Which? assessed put together. It contributed around $434 billion to fossil fuel financing between 2016 and 2022. This is despite the fact that the scientific consensus is that fossil fuels are the main driver of climate change.

Which? is calling on the banks to do more to tackle climate change. It is urging the banks to divest from fossil fuels and shift their investments to clean energy sources, set net zero emissions targets, and publish more transparent data on their environmental impact. The report also calls on the government to introduce stricter regulations on banks’ fossil fuel investments.

The UK government is under increasing pressure to take action on climate change. It has committed to net zero emissions by 2050, but critics say the government is not doing enough to achieve this goal.

The banks’ response

The six banks on the list have all defended their fossil fuel investments. They argue that they are working to reduce their exposure to fossil fuels and that they are investing in renewable energy. However, Which? maintains that these banks are not doing enough and their investments in fossil fuels are still too high.

JPMorgan said it was targeting $1 trillion dollars for green initiatives by 2030 to help its clients speed up their transition and was “the first large US bank to establish 2030 portfolio-level emissions intensity reduction targets”.

Santander does less fossil fuel financing than similar-sized banks, but it has low scores for its stance on fossil fuels and agricultural commodities. It said it has “set emission reduction targets for 2030 across a range of material emitting sectors, including steel, aviation, power generation, thermal coal, and energy (oil and gas)”.

Barclays is Europe’s biggest fossil fuel financier. However, it is the only bank that Which? looked at to set 2025 targets for power and energy and has provided more than $106 billion of green finance since 2018. It said: “Barclays can make the greatest difference by working with customers … as they transition to a low-carbon business model”, noting firms that do not reduce emissions “may find it hard to access financing”.

HSBC (including First Direct) is one of the biggest backers of fossil fuels in the UK, although it has updated its energy policies and pledged to stop funding coal expansion. It said: “We were one of the first banks to set a net-zero ambition in 2020 … We will no longer provide new finance or advisory services for the specific purposes of new oil and gas fields, or for the most carbon-intensive oil assets.”

Lloyds and NatWest are less involved in fossil fuel finance than their peers in the red category.

NatWest (including Royal Bank of Scotland) has taken strides to reduce its exposure and set ambitious targets to reduce emissions, but it still funds fossil fuels. It says it will lend to companies with a “climate transition plan” in line with the Paris Agreement, however, this potentially allows too many loopholes.

Lloyds’ (including Halifax and Bank of Scotland) exposure to fossil fuels is minor compared with peers, and it has higher scores than the other big fossil fuel funders, but it does not yet exclude all financial services for firms with oil/gas expansion plans. It said: “We are actively working with oil and gas clients to establish credible transition plans by the end of 2023. We know time is critical.”

Consumers should consider switching banks

Which? has urged consumers who are concerned about climate change to consider switching to banks that have a strong environmental record and committed to tackling climate change.

Sam Richardson, deputy editor of Which? Money said: “Consumers seeking to make more sustainable choices might want to consider switching banks if they are uncomfortable with their money being invested in the fossil fuel industry.”

The three banks that Which? has awarded its Eco Provider badge are Nationwide, The Co-operative Bank and Triodos Bank UK. These banks have no exposure to fossil fuels in their banking activities.

Which?’s research is a timely reminder of the role that banks play in climate change. Banks have a responsibility to their customers and to a wider public to invest in a sustainable future.