We spoke to Carroll Barry-Walsh, one of the most experienced lawyers and financial services investigators in the business. She is the Founder and Director of Barry-Walsh Associates Limited.

Tell us about yourself

I became a lawyer because I liked the idea of having a skill which would help me sort out problems. The intellectual aspect of law interested me when I looked at it as part of my politics course. But it was the practical side which really made me want to do it.

Photo: Private

In my first proper job as a government lawyer, I uncovered some illegal behaviour by a government department and an outside agency (in a very early prefiguring of what we’ve seen recently with the Post Office). When I brought it to people’s attention, some were not best pleased. But I persevered and the problem was eventually put right. That really got me the investigative bug. I realised that a combination of legal skills, natural curiosity and a bloody-minded determination not to give up could form the basis of an interesting career.

I became a litigator in Slaughter and May at a time when they were building up their litigation practice and Big Bang happened. It was a fascinating time to be there because of the range of work, much of it in the financial sector (for instance, the Guinness case and Maxwell during a time when financial self-regulation was all the rage), the responsibility I was given and the inspiring people I worked with.

I learnt so much, not just about how to be a good lawyer, but about the endless ways in which people can do the most stupid and irrational things. That mix of legal principle, coming up with practical solutions and being at the heart of many of the financial and other stories of the 1980’s and 1990’s was tremendous fun.

I moved in-house to Salomon Brothers in the wake of the Treasury Bond scandal when Warren Buffet and Charlie Munger were trying to clean it up. Salomon had quite the reputation then so learning about compliance and trying to enforce it on a largely unwilling population was quite the eye-opener. The Treasury Bond scandal meant that the Legal and Compliance Department was given the authority to to do what it needed to.

“What I learnt more than anything else was how often you see the same behaviors and mistakes repeat themselves, how often it is the underlying human behaviors which lead to problems.”

But it also meant that we uncovered many other problems which took a lot of work to sort out. Salomon’s conduct culture – not that anyone ever used that phrase then – was a long way from what it should have been. I never imagined, when I joined UBS in 2003 to set up their investigations team, that matters could get quite as bad as they did in the financial sector. Everyone was really still at the “one or two rotten apples” stage. It rapidly became clear that we were facing whole orchards of them!

I loved doing the investigations the team had during my 14 years at UBS: a list of the more publicly known ones would be a list of some of the most important and egregious financial mishaps and scandals of recent years. The unknown and smaller ones are equally eye-opening and challenging. What I learnt more than anything else was how often you see the same behaviors and mistakes repeat themselves, how often it is the underlying human behaviors which lead to problems – people either doing the wrong thing or failing to do the right thing, how cultures can go wrong and what it takes to put them right.

It was that which led me to set up my consultancy when I decided to lead a slightly less stressful life: to teach the lessons learned from all this, to show how those behaviors can be changed for the better and to help firms manage problems when they do arise. I firmly believe that you can earn yourself some credit for how you handle problems. It’s a lesson which many outside finance could do with learning.

What advice would you give to your younger self?

Three pieces of advice:

- Find your voice and do not be afraid to use it.

- Learn how you make your best and worst decisions.

- Put yourself forward. Don’t wait to be asked. Hard work alone does not bring you rewards. You need to be your own entrepreneur and sell yourself.

What has been the proudest moment of your career?

There have been lots of these. But the best was persuading someone to leave a permanent job to come and work in my team on a temporary contract without a guarantee then that it would be made permanent. They had faith in what I was trying to build and do and trusted me. (And, yes, they did become a permanent and immensely valued team member.)

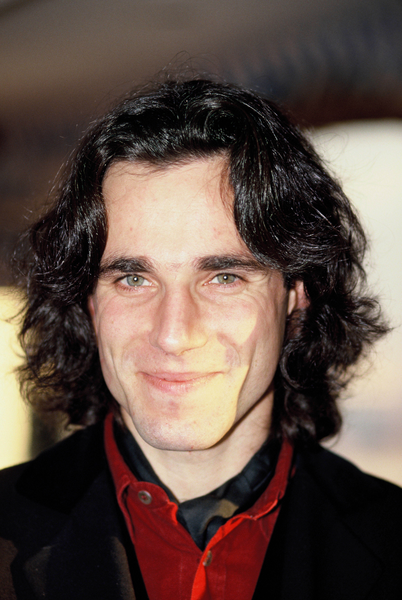

Photo: Getty Images

Tell us an amusing anecdote.

- As a teenager I beat Daniel Day-Lewis in an acting competition.

- My Juliet was to die for.

- He is now a three-times Oscar winner. And I am here – teaching bankers how to behave.

- Sometimes life doesn’t quite go to plan!

Can you recommend a good book?

Vanity Fair by William Thackeray: its sardonic view of its times is as relevant and apposite now as when it was written.

“Please remember Vanity Fair is a very vain, wicked foolish place full of all sorts of humbug, falseness and pretension … Not a moral place certainly, nor a merry one, although very noisy – a world where everyone is striving for what is not worth having.”

What are your predictions for 2024?

Three predictions:

- How to handle personal misconduct by those in regulated sectors will require sensible and sensitive judgment. How does one sensibly monitor and regulate such conduct?

- The woeful lack of understanding of IT by many in positions of power has led to “lax legislation, lax regulation and lax procurement”. The arrival of AI is going to really tax our understanding and require real thoughtfulness about what it is and what it can do. We must be wary of outsourcing our judgment to machines. If anything, good judgment will be at a premium.

- The revelations of the conduct of lawyers and in-house investigators at the Post Office Horizon Inquiry should – and I hope will – lead to significant changes in how such teams are managed and scrutinised and the lawyers/investigators themselves understanding the importance of an ethical underpinning to their work. Understanding the importance of avoiding and mitigating conflicts of interest should also come back into fashion.

What’s your New Year’s resolution?

There are two qualities a good investigator needs above all: empathy and what Graham Greene said about writers – the “splinter of ice in the heart” – ruthless analysis coupled with empathetic curiosity. I am going to continue bringing that analysis, curiosity and the perspective of the many investigations I’ve been involved in to as many as I can, in person, in talks and in my writing.