- Compliance

- Regulation

Latest News

- Technology

Latest News

- Resources

- All Resources

- Announcements

- Book Reviews

- Conferences and Events

- Country Guides

- GRIP Extra

- Podcasts

Topics

Latest News

-

Podcast: A chat about crypto with former FBI agent and financial crime expert, Ren McEachern

Julie DiMauro38 min listen

-

Eversheds Sutherland 2026 Legal Forum: The 'real-time rewrite' of ESG

Jean Hurley2 min read

-

Podcast: Maria Symeon & John Higgins of Pathlight Associates on AI, psychological safety and groupthink

Jean Hurley39 min listen

- Industry

Latest News

-

SEC’s Atkins praises Texas corporate law, promises to scale back disclosure rules

Alexander Barzacanos2 min read

-

Podcast: A chat about crypto with former FBI agent and financial crime expert, Ren McEachern

Julie DiMauro38 min listen

-

![What [the heck] is going on with vaccine policy in America?](https://www.grip.globalrelay.com/wp-content/uploads/2026/02/G-Vaccine-signage-2259640793.jpg?w=1024)

What [the heck] is going on with vaccine policy in America?

Julie DiMauro3 min read

-

- US Content

Sam advises clients include banks, asset management firms, broker dealers, payment institutions and corporate finance houses on a broad range of regulatory and compliance matters within the financial services sector. Prior to working in private practice, Sam worked for seven years at the UK financial services regulator, the Financial Services Authority (the majority of this time in the FSA’s General Counsel’s Division), and has also spent time on secondment at Santander Asset Management UK Limited.

-

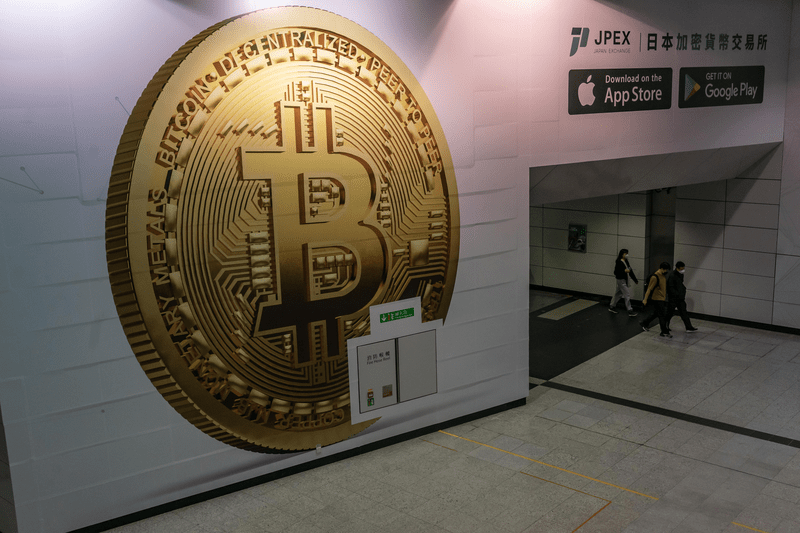

FCA publishes second paper on prudential regime for cryptoasset firms

A summary of the key proposals, drawing out the practical implications and next steps for affected businesses and markets.

Tom Callaby | CMS, Sam Robinson | CMS13 min read

-

FCA consults on admissions and disclosures for cryptoassets

The A&D regime will apply to the admission to trading of qualifying cryptoassets on cryptoasset trading platforms that allow retail participation.

Sam Robinson | CMS, Yasmin Johal | CMS7 min read

-

FCA consultation paper on approach to regulating crypto-asset activities

Non-UK operators in this space should start considering the proposed requirements and how they intend to structure their UK business models.

Sam Robinson | CMS, Yasmin Johal | CMS11 min read

-

FCA proposals to promote good business practices amongst crypto firms

The FCA plans to extend the High-Level Standards in the FCA Handbook to cryptoasset firms in line with FSMA-authorized entities.

Sam Robinson | CMS, Justin Kwik | CMS5 min read

-

New safeguarding regime presents high compliance burden

Payments and e-money firms impacted by codification of guidance and new requirements including the imposition of a statutory trust.

-

10 things you need to know about PISCES

The new UK Private Intermittent Securities and Exchange System (PISCES) is a platform for secondary trading in freely transferable shares issued by UK or non-UK companies.

-

FCA publishes final rules and draft guidance on financial promotions for cryptoassets

New rules apply to all firms marketing cryptoassets to UK consumers, whether based in the UK or overseas.

Sam Robinson | CMS, Chris Glennie | CMS5 min read