The UK’s light-touch regulatory approach to AI is coming under pressure as concerns grow about the market dominance of the big players developing AI Foundation Models (FMs).

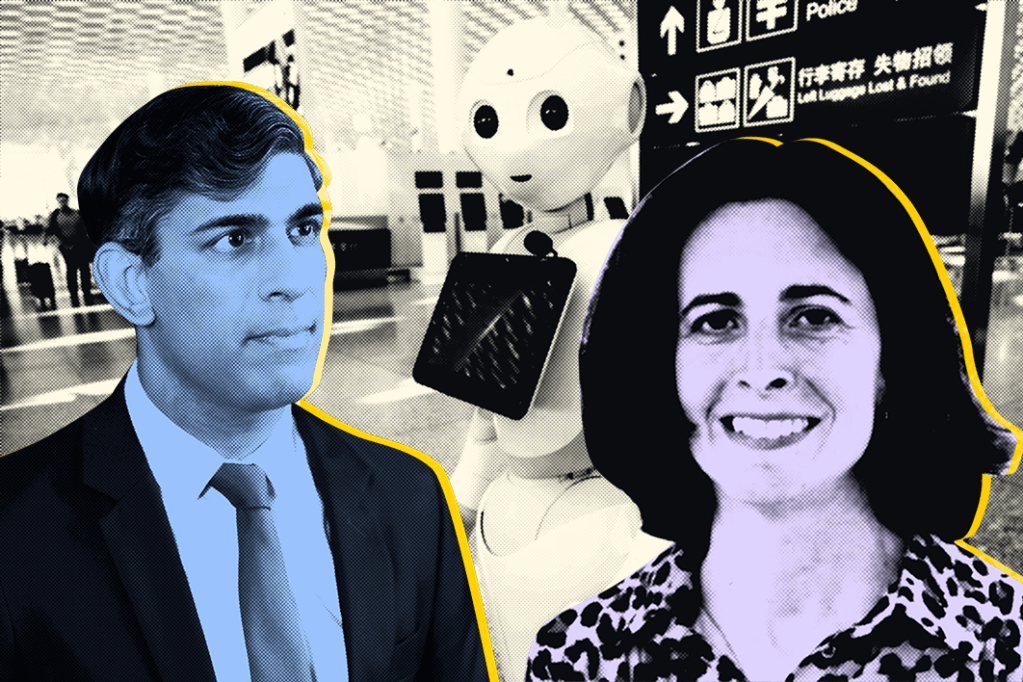

Sarah Cardell, the CEO of the UK Competition and Markets Authority (CMA), gave a speech in Washington last week warning of concerns as the regulator published an update paper that set out “three key risks to fair, open and effective competition”. And at the beginning of this week the Financial Times quoted a senior source saying UK government “officials are exploring moving on regulation for the most powerful AI models” as the Department for Innovation Science and Technology is “developing its thinking”.

Regulation and innovation

Prime Minister Rishi Sunak has previously said his government’s position was “not to rush to regulate” and that this was “a point of principle” because “we believe in innovation”. That stance was already under pressure after Conservative peer Lord Holmes tabled a private member’s bill urging the government to move on from its wait-and-see approach.

Holmes believes that “all the lessons from history demonstrate to us that if you have the right legislative framework, it’s a positive benefit, because investors and innovators know the environment they’re going into”.

In her speech, Cardell said: “When we started this work, we were curious. Now, with a deeper understanding and having watched developments very closely, we have real concerns. The essential challenge we face is how to harness this immensely exciting technology for the benefit of all, while safeguarding against potential exploitation of market power and unintended consequences.”

“The essential challenge we face is how to harness this immensely exciting technology for the benefit of all, while safeguarding against potential exploitation of market power and unintended consequences.”

Sarah Cardell, CEO, CMA

The CMA paper says one of its major concerns is that “the growing presence across the FM value chain of a small number of incumbent technology firms, which already hold positions of market power in many of today’s most important digital markets, could profoundly shape FM-related markets to the detriment of fair, open and effective competition, ultimately harming businesses and consumers, for example by reducing choice and quality, and by raising prices”.

To illustrate the extent of the take-up of generative AI, the CMA quotes research carried out by UK communications regulator Ofcom showing;

- 31% of adults have used generative AI tools;

- 79% of 13-17-year-olds have used generative AI tools;

- 46% of the largest businesses (over 250 staff) are using at least one form of Ai;

- 36% of businesses are using AI to improve business operations;

- 15% of all businesses are using at least one form of AI.

And research by the Stanford Center for Research on FMs is quoted to reveal that over 120 FMs were released between September 2023 and March 2024.

The CMA says: “The FM value chain is becoming more interconnected, through a combination of vertical integration, partnerships, and strategic agreements between firms”. The dominant firms are Google, Amazon, Meta, Microsoft and Apple – known collectively as GAMMA. In order to counter the potential threat posed by the dominance of the GAMMA companies, the CMA has updated the core AI principles it set out in its first paper and urges companies “to align their business practices with the principles, and to work with us to shape positive market outcomes”.

The principles are;

- Access – Ensuring ongoing ready access to data, compute, expertise and funding and ensuring a continuing and effective challenge to early movers from new entrants.

- Diversity – Encouraging and sustaining diverse business models and types.

- Choice – Making sure businesses and consumers have sufficient choice and preventing lock-ins to one ecosystem or provider.

- Fair-dealing – Preventing anti-competitive conduct.

- Transparency – Ensuring consumers and businesses are able to make informed choices about the use and effects of FMs.

- Accountability – Getting all firms to take responsibility for fostering a competitive market that has the confidence of consumers and businesses.

As the CMA sees it, there are “three key risks to fair, open and effective competition”. These are;

- Firms that control critical inputs for developing FMs may restrict access to them to shield themselves from competition.

- Powerful incumbents could exploit their positions in consumer or business facing markets to distort choice in FM services and restrict competition in FM deployment.

- Partnerships involving key players could reinforce or extend existing positions of market power through the value chain.

To combat these risks, the CMA is “Examining the conditions of competition in the provision of public cloud infrastructure services as part of our ongoing Cloud Market Investigation.” It is also “Examining Microsoft’s partnership with OpenAI to understand how it could affect competition in various parts of the ecosystem” and “Examining the competitive landscape in AI accelerator chips and the impact on the FM value chain”.

Other measures the CMA is actively considering are new powers in the Digital Markets, Competition and Consumers Bill, and stepping up monitoring of current and emerging partnerships and the use of merger control. Microsoft’s relationship with OpenAI will be under particular focus.

A further update on work is scheduled for August 2024.