In an effort to provide a fair opportunity for supervised entities to challenge its decisions, the US Office of the Comptroller of the Currency (OCC) is proposing updates to its bank appeals process.

The regulator’s announcement of proposed rulemaking, issued on February 17, is aimed at revising the procedures available for institutions the OCC oversees to appeal its “material supervisory determinations.” The regulator describes the revisions as designed to augment the “independence and efficiency” of the appeals function.

The proposed changes would affect 12 CFR 4, appending a section covering bank appeals of supervisory decisions.

Rationale for the revisions

The OCC explains in its notice of proposed rulemaking that entities it governs are bringing “few formal appeals.” The regulator says it supervised 1,040 institutions in 2024, but received a mere 11 appeals filed with the Ombudsman – meaning just 1% of the institutions it watches over used the existing appeals process.

The regulator expresses concerns about having a low rate of appeals, and proposes that one reason for such a rate could be related to a perception held by the institutions it governs that the current appeals process isn’t structured to fairly consider the raised issues. It proposes another reason could be that supervised organizations are concerned about possible harm to their relationships with the OCC as a consequence of making an appeal.

Further, the OCC claims that the high percentage of appeals ending in favor of the regulator is causing governed institutions to perceive that attempts to challenge supervisory determinations will not be successful. This could also be discouraging institutions from making appeals in the first place.

To address this problem, the regulator says its proposed revisions are designed to build supervised institutions’ confidence in the appeals process, further protect entities from retaliation for making appeals, and provide the public with the chance to comment.

The OCC writes that it has reason to expect that the revised process would “significantly increase the number of appeals.”

Highlights of proposed changes

As set out in an official statement from the regulator, highlights of the updates to the appeals process include the following:

- “replace the OCC’s existing guidance for handling bank appeals;”

- “establish a board, called the ‘appeals board,’ to decide bank appeals;”

- “clarify a de novo standard of review for deciding appeals;”

- “establish standards for when stays of material supervisory determinations would be issued pending an appeal;”

- “strengthen the agency’s ombudsman function;”

- “establish standards for expedited appeals;” and

- “prohibit retaliation against a bank for filing an appeal.”

The parties subject to the proposed appeals process changes include about 998 national banks and Federal savings associations.

The OCC also mentions that the proposals would cover appeals from payment stablecoin issuers that it is likely to supervise at a future date.

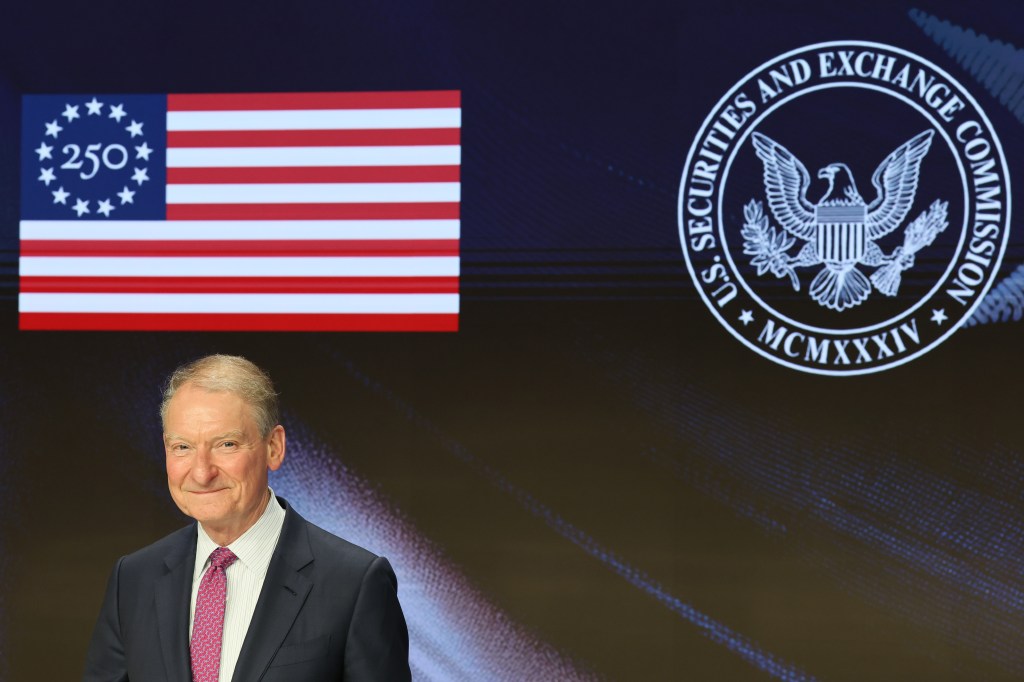

This announcement follows a recent and unusually explicit critique from OCC head Jonathan Gould of the post-crisis resolution planning regime. Speaking in Washington at an American Bar Association banking law event, Gould questioned whether mandatory resolution plans for large banks have meaningfully improved the government’s ability to manage bank failures.