Confidence, as was once observed, is a preference. And confidence is central to the discussion emerging after the shocks to the global banking system we’ve seen in the first three months of 2023. The fallout has prompted something of an existential crisis for banks, and is fuelling debate among regulators about what can be learnt.

For banks, particularly smaller ones, the US Treasury’s decision to invoke a systemic risk exception to the FDIC’s deposit insurance scheme in order protect investors with over $250,000 deposited poses a challenge, if not a problem.

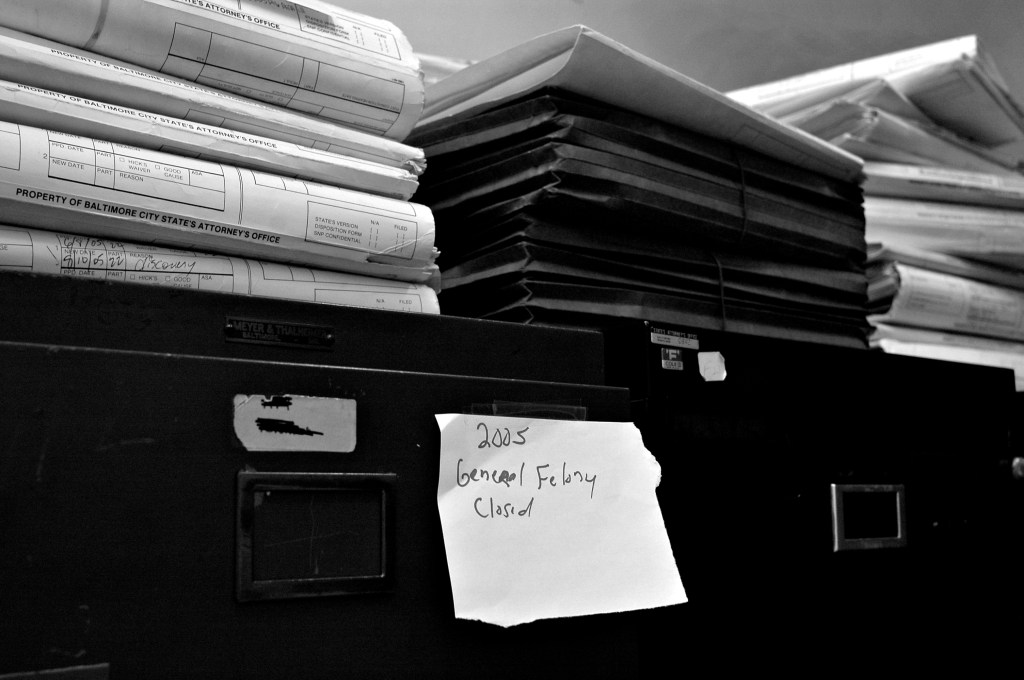

Deposit insurance was introduced in 1933, during the Great Depression, so that small depositors’ funds were guaranteed even if their bank failed. Between 1929 and 1933, 40% of all US banks disappeared because people lost confidence in them and pulled their money out. Since then, the number of bank runs has sharply reduced.

US Treasury Secretary Janet Yellen said the decision to backstop the funds of investors with deposits of more than $250,000 was taken “to protect the broader US banking system”. But by sweeping aside the distinction between deposits over and under $250,000, the FDIC and Federal Reserve have signalled that it doesn’t really exist in practice (although it’s important to note here that the Dodd-Frank Act requires Congressional approval for making an increase in the $250,000 limit “widely available”).

While that reduces the risk of bank runs – people won’t rush to withdraw their money if they know it is guaranteed – it also raises questions about the role of banks themselves, and about the decisions they make. The immediate question concerns the concept of moral hazard. Does the very existence of deposit insurance incentivize risky behaviour? Some have argued that and “overly generous” deposit insurance scheme triggered the biggest wave of bank failures since the 1930s when a number of US banks crashed in the late 1980s and early 1990s.

While backstopping investor’s funds reduces the risk of bank runs – people won’t rush to withdraw their money if they know it is guaranteed – it also raises questions about the role of banks themselves.

But deposit insurance also removes the risk of depositing funds from the depositor – if the funds are insured, it doesn’t matter where they are. This could level the playing field between bigger and smaller banks as the question of confidence in who you are banking with becomes less important.

However, Dodd-Frank also excluded banks with under $250bn in assets from the same regulatory pressure as those with assets above that. Smaller banks were simply not seen as contributing risk to the wider financial system. SVB was one of those banks. Any levelling of the playing field could see the end of lighter-touch regulation for smaller banks. Yellen herself has reiterated her support for keeping the $250,000 limit, but this has further added to confusion.

The signals sent indicate that there is no desire from within the Treasury to lift the limit permanently, but the Treasury’s actions have shown that it will do so when it perceives there is a big enough risk. So how to define big enough?

Senator Elizabeth Warren and Congresswoman Maxine Walters have expressed support for lifting the insurance cap, with figures of $2m, $5m and even $10m mentioned. They see such a move as helping businesses operate and make payroll, and also as eliminating the need for large depositors to withdraw money at the first sign of unease.

There are bigger questions raised about the nature of the banking system itself, though.

Claude Wampach, a member of the Basel Committee on Banking Supervision has been quoted as calling for regulators to more closely scrutinise the calibration of liquidity coverage ratios. The ratio means banks have to hold sufficient assets that can be sold quickly to cover outflows of deposits in the event of a crisis.

Wampach said that the only certain way to prevent a bank run would be to require all deposits to be kept in highly liquid assets. “But then,” he said, “you wouldn’t have banks any more”. The signals being sent about guarantees to investors could also be interpreted as questioning the need for banks, or at least traditional ones. If it doesn’t matter where funds are, because all deposits are guaranteed, where does that leave all the debate about the potential risks of digital currencies, for example?

Pablo Hernández de Cos, chair of the Basel Committee on Banking Supervision, has called for tighter controls on the risk posed by increasing interconnectedness in the banking sector. He said links between lenders and shadow banks, known officially as non-bank financial intermediaries (NBFIs), might benefit from the introduction of additional measures “aimed at mitigating risks to the banking system from interconnections with NBFIs”.

Common set of principles

He also floated the idea of forging “a common set of global principles” around restrictions on how much banks could lend in mortgages in relation to the value of a property or the buyer’s income.

The SVB and Credit Suisse ripple effect is extensive. Regulators are trying to understand implications and learn lessons while, as always happens in any crisis, attempting to answer questions about why they didn’t see it all coming. The role of governments, too, has been thrown into stark relief.

Much of the debate comes back to the question of that amorphous concept of confidence and how it is applied.