Begum acknowledged that the regulator is not always the natural partner for firms but hoped on the subject of women in finance it would be.

Emerging technology is shaping modern society and “digital transformation has opened up the floodgates for women to succeed”, Begum said. It has continued to transform financial services and many innovations that are being developed have had women front and centre. Mira Murati, chief technology officer at OpenAI, is credited with leading the teams behind DALL-E (which creates realistic images and art from a description in natural language) and ChatGPT.

Diversity and inclusion

“We really want to see an inclusive industry where the most capable people are able to progress and where diversity of thought is really valued”, said Begum. Diversity and inclusion is founded on a culture where it is safe to speak up. It is essential for firms to have healthy cultures to deliver consumer protection and market integrity. She said that “although progress has been made over the last few years, with most firms publicly committed to change, there is still much more to be done”.

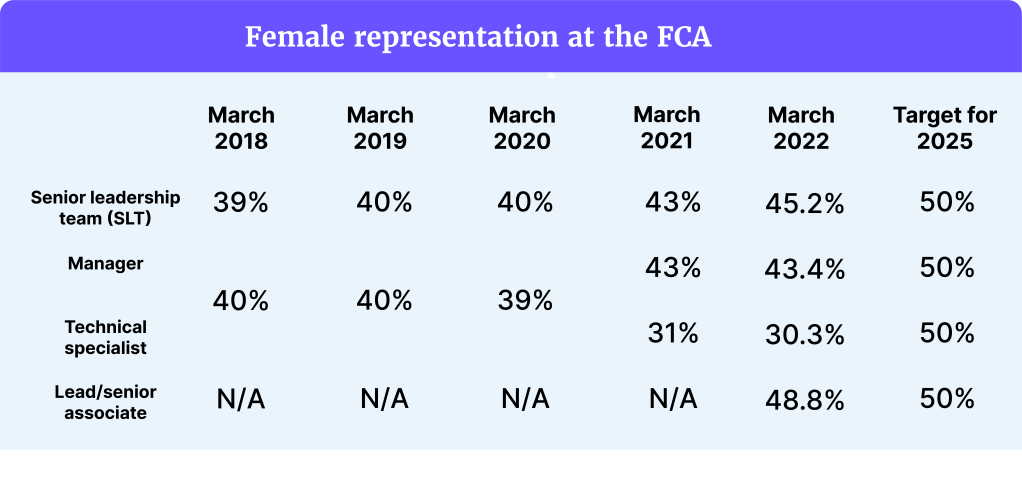

In 2016, the FCA was one of the first organisations to sign up to the Women in Finance Charter. This seeks to increase the number of women in the financial services sector, particularly at senior levels. The FCA is going to publish its Diversity Annual Report 2022/23 next week and Begum was confident that the figures showing women working at the FCA will continue to rise.

Bridging the pay gap

In April 2022, the FCA increased junior salaries and narrowed the pay ranges to reduce the pay difference between those who were performing similar roles. It is hoped this will help to close the gender and ethnicity pay gaps between long-standing predominantly male/white employees and newer but equally qualified staff from more diverse backgrounds. However, she acknowledged that the FCA must do more to meet the stretching targets, “we must really push the envelope in what we want to do. A comprehensive D&I programme supports our ambition in this area”, said Begum.

“Data is an asset with the potential to bring significant benefits to financial services.”

Sholthana Begum, head of Data and Data Strategy, FCA.

Around 54,000 firms provide the FCA with data. Financial services is still not diverse and inclusive. Begum provided the following figures and said: “There are numbers that will scare you or may give you the impetus and opportunity to make you think what can you do to change.”

- There are no black chairs or CEOs in the FTSE 100.

- The percentage of female fund managers is stuck at around 12%.

- Gender and ethnicity pay gaps for 2022 have just been published across several larger retail banks, showing;

- gender and ethnicity pay gaps are still growing;

- where there are year on year improvements, sometimes they have been marginal – less than 1%.

- Almost 9/10 of senior management roles in financial services are held by people from higher social economic backgrounds.

- Only 17% of SMF (senior management function) roles are held by women.

- 91% of women on FTSE 100 boards are in non-exec positions. Begum asked the audience: “What does that actually mean? Representation – yes. Inclusion – perhaps?”

- In the FTSE 100 only 2.9% of chair and chief exec roles are held by minority ethnic people.

Culture, diversity and inclusion

Improving diversity in financial services is an important part of the FCA’s ESG strategy. “D&I is essential to healthy culture and as a regulator we’ve had a long standing interest in the culture of firms”, said Begum. She acknowledged that there is still a very long way to go with large gender and ethnicity pay gaps still existing in the financial services sector. There are also parts of the industry which lack diversity at senior levels. Begum said: “Diverse representation supports diversity of thought and in turn leads to better decision making.”

Begum concluded: “We believe that our role as regulator is to establish a consistent standard to help bring the whole of the [financial services] industry along with those already doing great D&I work.”