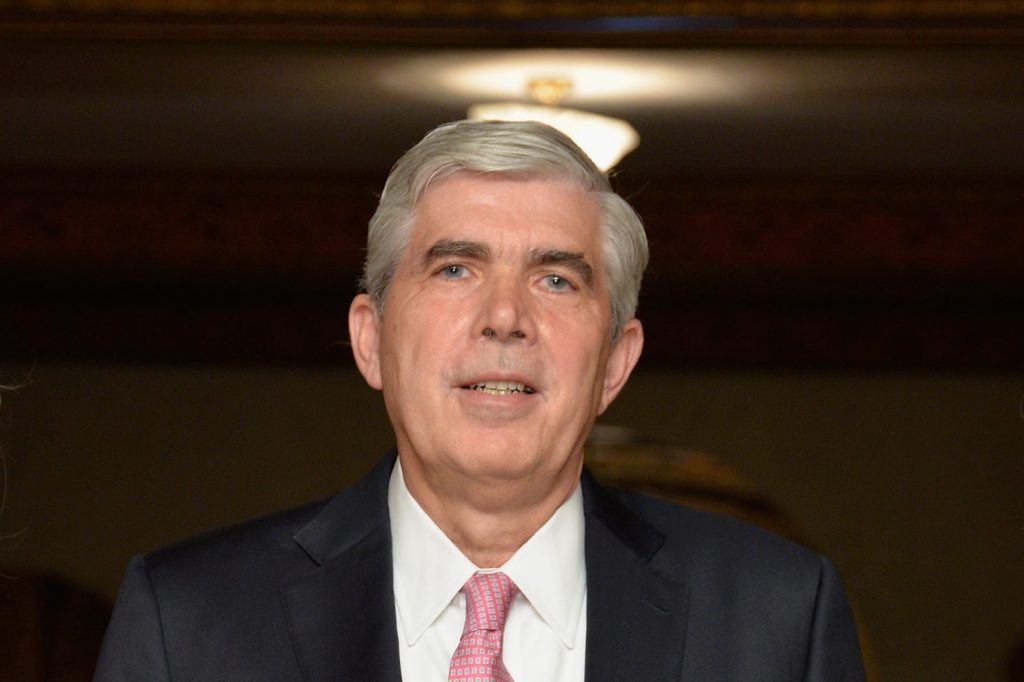

Ken Leech, the former Chief Investment Officer of Western Asset Management (WAMCO), has been charged with fraud by the SEC and DOJ in parallel actions.

The agencies allege that between 2021 and 2023 Leech engaged in a “cherry-picking” scheme by assigning trades to certain portfolios hours after they were placed. This allowed him to observe price movements and assign favored trades to WAMCO’s Macro Opportunities strategy (Macro Opps), which he launched in 2012 and closely oversaw.

Conversely, Leech allegedly assigned a large majority of disfavored trades to WAMCO’s much larger “core funds.” Because the Macro Opps portfolios charged a much steeper management fee than the core portfolios, the shifted funds were able to generate more money for WAMCO.

“The statistical probability that this pattern occurred by random chance is less than one in one trillion,” the SEC noted in its complaint.

$600m stolen

In total, Leech is alleged to have effectively stolen $600m from the core portfolios, in breach of his fiduciary duty to clients. This intervention may have been necessary to keep the strategy vital: its big gambles on Russian sovereign debt and Credit Suisse bonds went awry in 2022 and 2023, respectively.

The cherry-picking scheme also created the appearance that his Macro Opps strategy was doing well of its own accord. This was important to retain investors who were especially likely to jump ship in the case of poor returns, the SEC noted in its complaint.

Leech personally benefitted from the scheme by allocating $19m from his deferred compensation plan into the Macro Opps strategy, according to the SEC’s complaint. This is in addition to Leech’s amplified bonus, which was tied to the firm’s boosted management fee gains.

Assets liquidated

Since the SEC investigation was announced, WAMCO’s share price declined 20% and $52 billion of assets were withdrawn from under its management. The Macro Opps strategy’s remaining assets were liquidated on October 29.

Leech’s lawyer Jonathan Sack said the charges were unfounded and that Leech “received no benefit from the alleged misconduct.”

“We have a strong culture of compliance, as evidenced by the fact that this trading issue was identified internally and quickly escalated, and limitations on Ken Leech’s allocations were immediately implemented,” WAMCO executives stated in a note to clients, reported by Bloomberg.

Leech was criminally charged with investment adviser fraud and securities fraud, commodity trading adviser fraud and commodities fraud, and making false statements. The most serious charges carry penalties of 20 years in prison.

Rule violations

For the cherry-picking scheme, the SEC charged Leech with violating:

- Securities Act of 1933 Sections 17(a)(1) and (3): Prohibiting fraud in the offer or sale of securities;

- Securities Exchange Act of 1934 Section 10(b)-5: Pertaining to fraud or manipulation in securities trading;

- Investment Advisers Act of 1940 Sections 206(1) and 206(2): Preventing investment advisers from engaging in fraudulent conduct or providing advice that is misleading;

- Investment Company Act of 1940 Sections 36 and 37: Preventing fraud, mismanagement, and violations of fiduciary duties for investment companies and mutual funds.