Appointments of female board directors to Europe’s largest financial services firms declined seven percentage points year-on-year, according to the latest EY European Financial Services Boardroom Monitor. It reports that 44% of all appointments last year were of women, down from 51% in 2022.

While all European financial services firms monitored have female representation at boardroom level, the current gender split across all firms stands at 57% male and 43% female (down from 58:42 in 2022), and 31% of listed European financial services firms are still reporting under 40% female representation in their boardroom.

This is below the level required by June 2026 to comply with the European Commission’s European Women on Boards Directive, which requires all companies in EU member states to meet a 40% female target for non-executive boards or 33% for all board members.

“The 40% level of female representation at board level is a minimum to build from, not a level to work towards.”

Omar Ali, Financial Services Managing Partner, EY EMEIA

C-suite experience

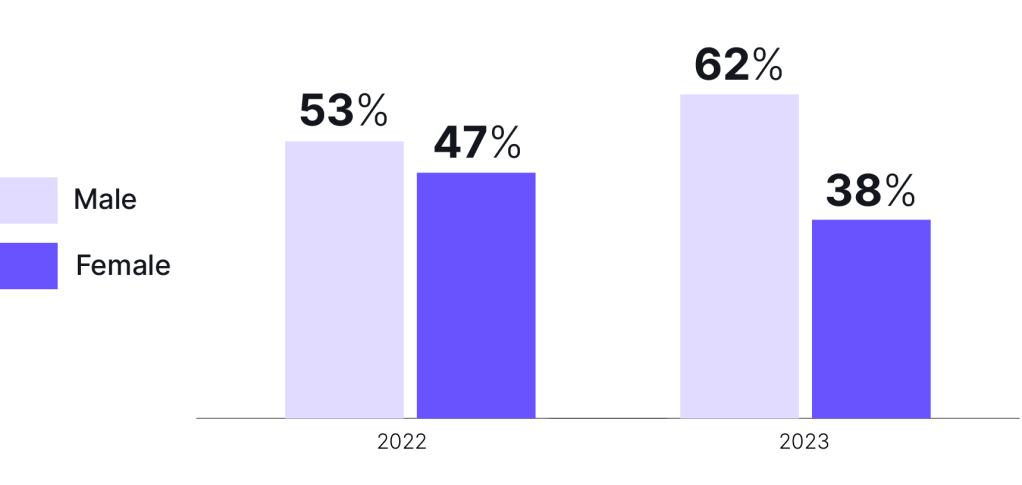

C-suite experience was the top criteria for new board director recruitment in 2023 – for the second year running – with 59% of appointments during the year bringing current or past executive management team experience. However, of directors with c-suite experience appointed this year, just 38% were female, down from 47% in 2022.

Across European financial services boardrooms, female directors remain significantly less likely than their male counterparts to have the experience of C-suite role or hold a senior board position. Just over half (51%) of female directors have the experience of an executive management team role, while 64% of male directors have similar experience.

Across the population of directors tracked, senior board positions (defined under the FCA’s proposed changes to UK Listing Rules as Chair, Chief Executive Officer, Senior Independent Director or Chief Financial Officer) are held by women at only 29% of listed European financial firms.

Omar Ali, EY EMEIA Financial Services Managing Partner, said: “Of course, increasing appointments of female directors with C-suite experience can only take place if there is a strong talent pool and a growing pipeline. Positively, the 40% gender diversity threshold under the European directive should help to galvanise firms’ efforts to recognize and nurture female talent throughout career paths – not just towards directorships, but at all levels. The 40% level of female representation at board level is a minimum to build from, not a level to work towards.”

Boardroom skills in demand

Data from the EY Boardroom Monitor shows that 14% of European financial services board directors left their role in 2023, with new appointments lagging departures at 11%.

However, financial services firms have used new appointees to continue to deepen political, technology and sustainability skill sets and experiences on their boards. Of directors appointed in 2023, 36% bring political experience (down from 41% in 2022), 27% have professional experience in tech (up from 22% in 2022), and 22% have professional experience in sustainability or ESG (down from 23% in 2022).

“Bringing new skills and breadth of experience to the boardroom is a priority for financial services chairs across Europe”

Omar Ali, Financial Services Managing Partner, EY EMEIA

New appointments are still more likely than existing directors to have sustainability, tech and political knowledge and experience. Across all board members, 15% have experience in sustainability, 18% have experience in tech, and 33% have political experience.

In the past year, a greater proportion of female directors have brought experience in tech (33%) and ESG (27%) relative to male peers, 23% of whom have tech experience and 18% have ESG or sustainability experience.

Ali said: “As global geopolitical dynamics continue to evolve, and technology and sustainability demands on firms grow ever more complex, bringing new skills and breadth of experience to the boardroom is a priority for financial services chairs across Europe.”