The WSJ on Tuesday ran an article headlined Crypto Sector Seeks Lawyers, Compliance Officers After Reputational Hits, noting that the industry desperately needs their guidance.

It came at a time when such professionals are wary of joining businesses that have endured so much regulatory and enforcement scrutiny, never mind negative press coverage. But, argues Mengqi Sun, the expertise compliance professionals can bring to these types of jobs could have a big impact in helping to rebuild the sector’s damaged reputation.

She’s right. But given the personal liability risks, the fact that fraudulent activity in the space has received enormous public attention, and that guiding a still-developing industry sector is always challenging, it can’t be an easy career decision to make.

However, I think it can be just the recipe for success for this industry sector and a win-win for the compliance professional who knows when to hold them … and knows when to fold them.

Due diligence

Cathy Yoon was profiled in the WSJ article; she has been working in various legal roles in the crypto sector since 2017 and plans to stay in the industry. She said people are still interested in joining or remaining in the space despite being laid off, but candidates are looking for more long-term stability and are more hesitant to simply jump on board after the bankruptcies and scandals of the past year.

Yoon recently started as the general counsel at Wormhole Foundation, a steward of the crypto platform Wormhole protocol, and said she has increased the amount of due diligence she does before taking on prospective projects. “I ask more questions and ask about things that as a normal job seeker I wouldn’t ask before,” said Yoon. These questions include determining what the internal approval process is like and who is in charge of the firm’s finances.

This is the sort of due diligence that compliance officers inside the institution can provide. Their presence and work is also the assurance that can be offered to business partners and clients. But to say that compliance officers in this position must question everything is simply stating the truth bluntly. This does not mean that they should assume their employer is determined to skirt regulatory imperatives and slow processes down to a crawl, but given regulatory skepticism, and a decent amount of the same from the investing public, it’s simply a good idea to employ a higher degree of professional skepticism when it comes to this sector.

The challenges can be a win-win for the compliance professional who knows when to hold them … and knows when to fold them.

Compliance officers are well-equipped to be the individuals in the room who question everything and demand documentation and tangible proof. This is especially true here. But a compliance professional joining a crypto firm should also assess how serious the business is about investor protection, record-keeping, employee training, reporting regularly and honestly and maintaining internal controls that can flag potential breaches of rules and laws.

And, just as importantly, whether the business is willing to provide the time and resources required to do these tasks, especially because work in a highly scrutinized arena might require more of these than would, say, a broker-dealer operation. In effect what needs to be evaluated is whether the need is for an effective compliance operator or simply a figurehead.

Good conduct and ethics

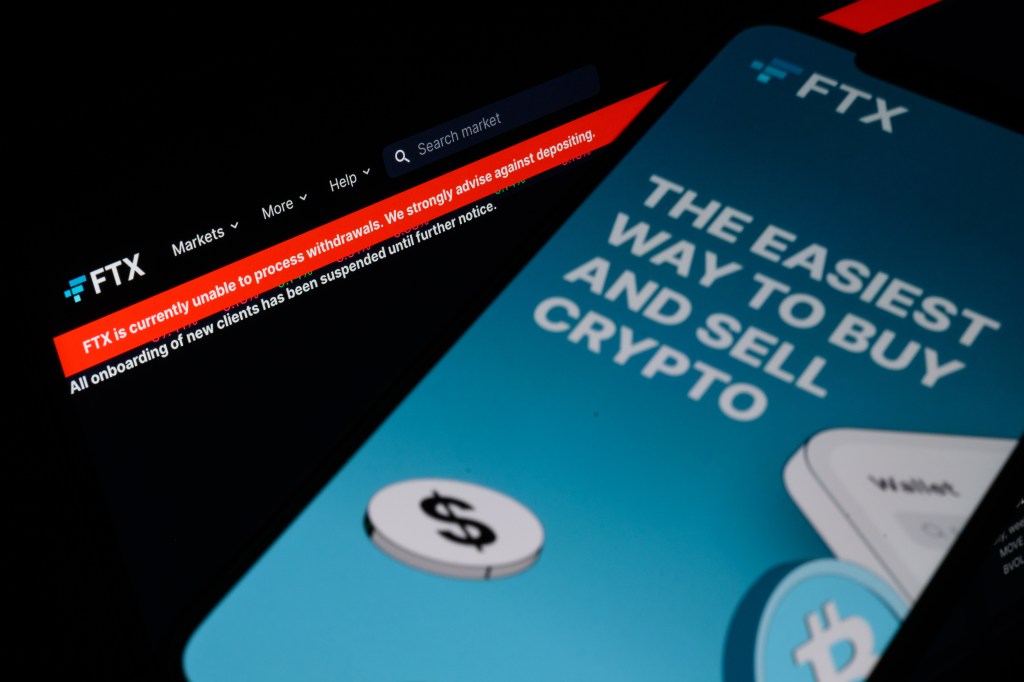

It’s the type of job in which the compliance professional must be willing to remind their company’s chief executive and board that none of their flowery words about good conduct and ethics mean anything to regulators and Americans who just watched one founder of an international cryptocurrency exchange allegedly perpetrate “one of the biggest financial frauds in American history,” in the words of US Attorney Damian Williams, allegedly stealing $8 billion from investors.

This sordid affair followed a global pandemic during which rampant frauds involving digital assets, particularly disturbing “pig-butchering” or “confidence scams,” alongside misleading celebrity endorsements and other scams occurred.

Indeed, it could be said that it is the task of the company and not the compliance professional to do what really needs to happen: Steer the business away from any type of fraud and hone in on the more fundamental question of whether the customer ultimately bought, with fiat currency, a product that is a security or commodity – or something else.

And it is the business that is responsible for things that are beyond what even the best compliance officer can seriously influence or control – a myriad of decisions about priorities, budgets, business deals, and personnel. Being involved in things outside the scope of a compliance function is another alarm signal – the opposite of being a figurehead.

When compliance officers are burdened by multiple, strenuous responsibilities within an organization, but feel that their advice and instruction is not being heeded in core compliance areas, it is time to leave.

Application to real finance problems

The benefits to those compliance and legal professionals who join crypto firms include getting into a sector that, for all its mostly well-deserved public relations troubles, continues to attract interest, talent and at least some buy-in from some major corporations.

These either accept and use cryptocurrencies or are at least investigating their application to real finance problems including the opportunity to develop new ways to hedge against weak currencies, offer new payment options, a quicker way to transact internationally, and a means for people to access financial services (such as borrowing, lending, and trading) without the need for traditional banks and brokerages, which often take large commissions and other fees.

The entire sector can also be a highly motivating area to work in simply because it is a reminder that innovation happens when by trial and error.

The sector’s expansion in terms of crypto’s many different products and offerings – and the evolving innovations that have facilitated their issuance and transactions – makes for a dynamic environment in which to work. Becoming an expert and specialist in this area could lead to lucrative opportunities that underpin crypto – including technology, innovation, cybersecurity, etc.

The entire sector can also be a highly motivating area to work in simply because it is a reminder that innovation happens when by trial and error and progress is only possible when we open the doors to the technology, talent, ideas and their refinement.

Greater efficiency, more options

It is also clear that given the size of the global economy and despite the current geopolitical tensions, or perhaps because of them, there is a need and a future for better tools, systems and technologies that offer greater efficiency and a broader range of options to businesses and consumers, particularly if the path for being faster and more efficient is also paired with a commitment to being safer and more secure.

Developments like these are of course beyond the remit and above the pay grade of the compliance professional – but the compliance pro could contribute by supplying much-needed guidance to help businesses, and society more generally, navigate to this better future.

Parting thought: Regulators are struggling to acquire the talent and internally develop the skills to keep pace with this ever-evolving sector, so there’s one possible career move for you … after the crypto compliance gig.