Development and regulation of emerging industries will be central to the work of China’s new financial regulator as fintech continues to emerge as a major player in the country’s economy.

Details of the responsibilities of the new National Administration of Financial Regulation (NAFR) have been revealed after the establishment of the new body was announced in March. It is part of what the ruling Communist Party has termed an institutional reform plan aimed at enhancing governance for the next 10 years.

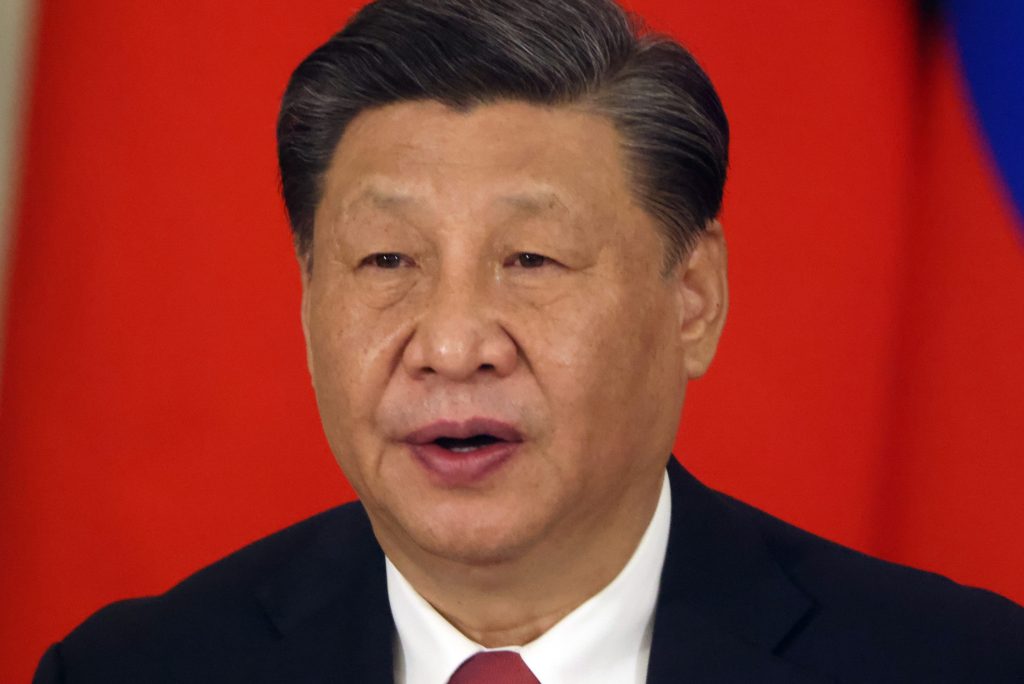

President Xi Jinping is carrying out widespread reform of the state apparatus in moves presented as positioning China to compete more effectively with the West in science and technology, but also seen as strengthening central Party control and getting to grips with corruption particularly in the real estate sector.

Power of one

An enlarged NAFR will have 27 departments and will take over functions from the securities regulator and the central bank. The revamp of the previous system of regulation is being dubbed “one committee, one bank, one administration, one commission”.

A new Central Financial Commission, given status on a par with the State Council and reporting directly to the Central Committee of the Communist Party of China, becomes the primary body for financial decision-making and coordination. It takes over responsibilities previously held by the Financial stability and Development Commission.

The NAFR will sit alongside the People’s Bank of China (PBOC) and the China Securities Regulatory Commission (CSRC). It replaces the China Banking and Insurance Regulator Commission and also gains regulatory power over consumer and investor protection. The focus on this area comes in the wake of a number of financial scandals, including last year’s Hunan bank run in which 40 billion yuan ($54.7 billion) in deposits disappeared – prompting protests in many rural areas – and the collapse of property developer Evergrande.

NAFR will operate 31 provincial, five municipal and 306 city-level regulatory agencies. The PBOC will focus on monetary policy and macro-prudential supervision, while the CSRC will supervise both enterprise and corporate bond issuance.

$61 trillion financial sector

China’s financial sector is estimated to be worth $61 trillion, according to the Financial Times, and the Central Financial Commission will operate as the watchdog, planner and decisionmaker for the sector.

Nearly 100 officials are reported to have been recruited to staff the Commission in a move seen as more evidence of Xi’s attempt to govern through special Party bodies and strengthen central control of the financial sector. This, in turn, is seen as a means to deleverage the real estate sector, secure the finances of indebted local government bodies, and clamp down on speculation and corruption. The Commission will also have final say on major merger deals and joint ventures.

Some observers worry that greater Party oversight of the financial system will diminish confidence in the country’s financial system. Rob Mason, Global Relay’s Director of Regulatory Intelligence, said: “It is always difficult to interpret messages coming out of China, but this feels like an authentic progressive step towards greater investor protection.”