- Compliance

- Regulation

- Technology

Latest News

-

Man vs machine – how employers can fight back against AI-driven disputes

Aron Pope | Fox Williams3 min read

-

HHS rolls out ‘whole of department’ AI strategy and compliance plans

Kevin Kinsella2 min read

-

IAPP EU Data Protection Congress 2025: “Certainty on what the rules are and how they apply" needed

Thomas Hyrkiel5 min read

-

- Resources

- All Resources

- Announcements

- Book Reviews

- Conferences and Events

- Country Guides

- GRIP Extra

- Podcasts

Topics

Latest News

- Industry

- US Content

FCA

-

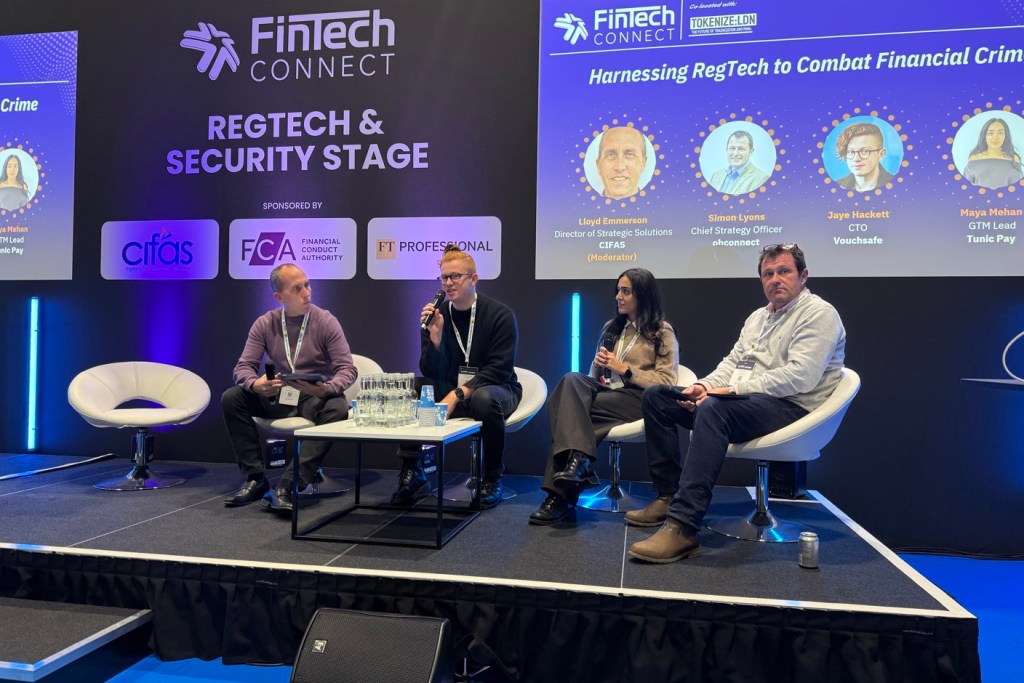

FinTech Connect 2025: Harnessing RegTech to combat financial crime

A group of experts at the FinTech Connect event in London discussed how regulatory technologies can be best used to mitigate the growing risk of financial crime.

Hameed Shuja9 min read

-

FCA to support UK-issued stablecoins as part of growth measures for 2026

The regulator’s plans include opening a stablecoins issuance sandbox where firms can test their products without having to worry about compliance failures.

Hameed Shuja1 min read

-

Nationwide fined £44m for inadequate financial crime controls

One of the largest fines of 2025 comes after building society declared itself to the FCA.

Carmen Cracknell1 min read

-

FCA work in review: December 4-10, 2025

Our weekly roundup of the latest news and developments from the FCA.

Carmen Cracknell3 min read

-

Fintech Connect 2025: Rethinking regulation in the age of DeFI

Experts from banking, crypto, and fintech discussed the challenges of regulating decentralized financial markets.

Hameed Shuja7 min read

-

The romance fraud risk paradigm

Pathlight Associates examine the evolving risk landscape for banks and payment service providers (PSPs) as romance fraud reaches epidemic proportions.

John Higgins | Pathlight Associates5 min read

-

The FCA strikes back with Firm Checker tool as 800,000 fall victim to scams

By using the tool and checking if a firm is authorized, people can significantly reduce their chances of falling victim to fraud.

Jean Hurley3 min read

-

Fintech Connect 2025: Leveraging finfluencer marketing without compromising compliance

Panel at Fintech Connect 2025 in London discussed the role and impact of ‘finfluencers’, and how to regulate unauthorized digital content.

Hameed Shuja5 min read