The Singapore-based Terraform Labs PTE Ltd and its CEO Do Hyeong Kwon are facing charges from the SEC for allegedly orchestrating a multi-billion dollar crypto asset securities fraud. The scheme involved an algorithmic stablecoin and other crypto asset securities that played a part in Terra coin’s collapse.

According to the Commission’s complaint, Terraform and Kwon raised billions of dollars by offering and selling an inter-connected suite of crypto asset securities from April 2018 until the scheme’s collapse in May 2022. Most of the sales were conducted through unregistered transactions.

Stock prices

The assets included the security-based swaps “mAssets”, designed to pay returns by mirroring stock prices of US companies, and the “algorithmic stablecoin” Terra USD (UST). The UST “supposedly maintained its peg to the US dollar by being interchangeable for another of the defendants’ crypto asset securities, Luna”.

“We allege that Terraform and Do Kwon failed to provide the public with full, fair, and truthful disclosure as required for a host of crypto asset securities, most notably for Luna and Terra USD,” said SEC Chair Gary Gensler. “We also allege that they committed fraud by repeating false and misleading statements to build trust before causing devastating losses for investors.”

“Today’s action… holds the defendants accountable for their roles in Terra’s collapse, which devastated both retail and institutional investors and sent shock waves through the crypto markets.”

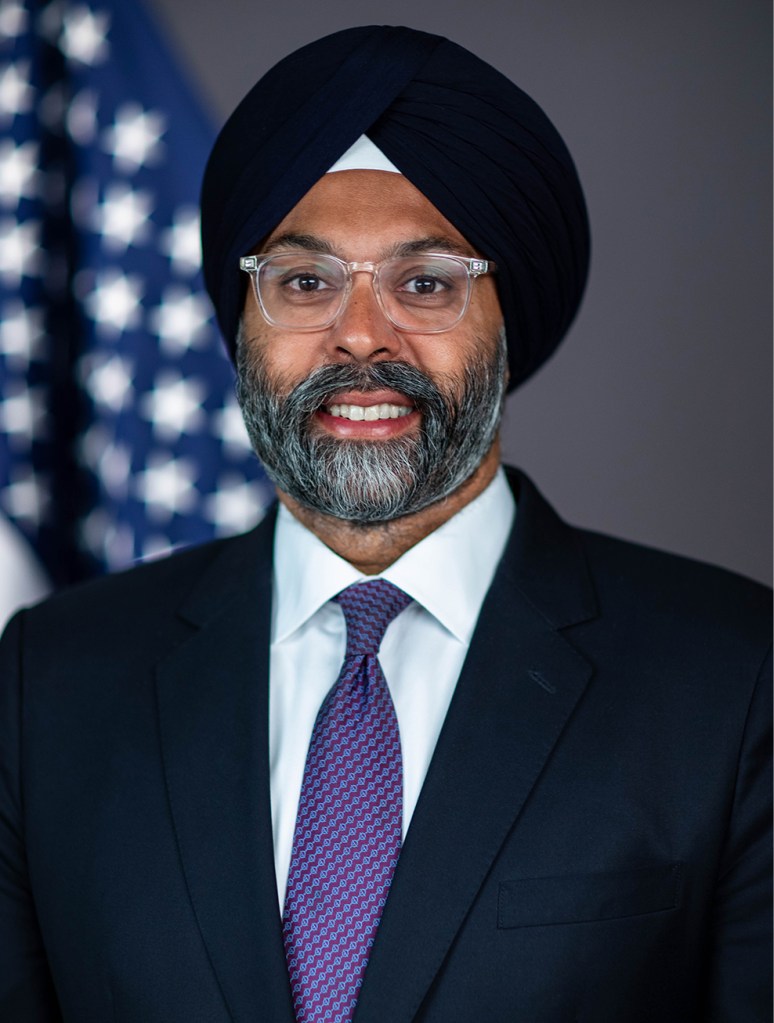

Gurbir S Grewal, Director of the SEC’s Division of Enforcement

Terra’s collapse

In order to build their crypto empire, Terraform and Kwon also allegedly offered and sold other cryptos to investors too, including the crypto asset security tokens MIR (“mirror” tokens) and Luna. Terraform and Kwon repeatedly asserted that the tokens would increase in value, and marketed the UST as a “yield-bearing” stablecoin that would pay up to 20% interest through the Anchor Protocol.

According to the complaint, Terraform and Kwon repeatedly mislead and deceived investors while marketing both the Luna token and the UST.

“The Terraform ecosystem was neither decentralized, nor finance. It was simply a fraud propped up by a so-called algorithmic ‘stablecoin’ – the price of which was controlled by the defendants, not any code.”

Gurbir S Grewal, Director of the SEC’s Division of Enforcement

With the Luna token, they advertised that a popular Korean mobile payment application, which used the Terra blockchain to settle transactions, would add value to the token. With the UST, investors were misled about the stability of UST – which depegged from the US dollar in May 2022, sending the price of it and its sister tokens close to zero.

“Today’s action not only holds the defendants accountable for their roles in Terra’s collapse, which devastated both retail and institutional investors and sent shock waves through the crypto markets, but once again highlights that we look to the economic realities of an offering, not the labels put on it,” said Gurbir S Grewal, Director of the SEC’s Division of Enforcement.

“As alleged in our complaint, the Terraform ecosystem was neither decentralized, nor finance. It was simply a fraud propped up by a so-called algorithmic ‘stablecoin’ – the price of which was controlled by the defendants, not any code.”

The complaint was filed in the US District Court for the Southern District of New York, and charges the defendants with violating the registration and anti-fraud provisions of the Securities Act and the Exchange Act.