Corporación Financiera Colombiana S.A. (Corficolombiana), a bank and lending subsidiary of the Colombian financial services institution Colombian conglomerate Grupo Aval Acciones y Valores S.A. (Grupo Aval), has agreed to pay over $80m for violating the Foreign Corrupt Practices Act (FCPA) and to resolve parallel bribery investigations over bribing high-ranking government officials in Colombia. The resolution was coordinated between the US Department of Justice (DOJ), the SEC and authorities in Colombia.

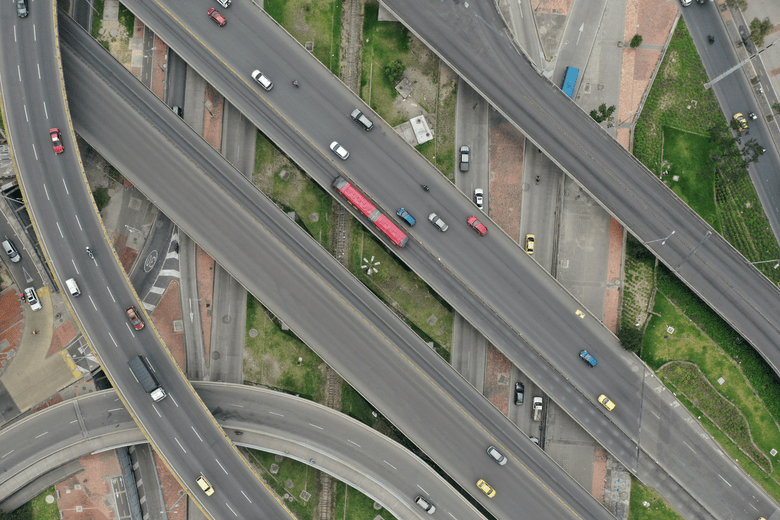

According to the orders, Corficolombiana and a joint venture partner won a contract from the Colombian government for a 328-mile highway infrastructure project. A deal it allegedly won by bribing government officials in Colombia at least $28m in illicit payments to win an extension to the contract.

“Lax control environments are fertile ground for mischief, as illustrated here where bribes were funded through payments made for invoices lacking supporting documentation and contracts for vaguely described services typically handled internally rather than by third parties,” said Charles Cain, the SEC’s FCPA Unit Chief. “This case once again highlights the importance of issuers having sufficient internal accounting controls over third-party payments.”

Bribes to government officials

“Today’s resolution shows that justice has a steep price for those who attempt to bribe foreign government officials,” said Assistant Director Luis Quesada of the FBI’s Criminal Investigative Division. “Schemes like these violate the Foreign Corrupt Practices Act and are an attempt to fundamentally undermine the spirit of economic competition.”

According to court documents, between 2012 and 2015, Corficolombiana conspired with Odebrecht S.A., a global construction conglomerate based in Brazil, to bribe high-ranking Colombian government officials in order to win a contract to construct and operate a highway toll road known as the Ocaña-Gamarra Extension.

To carry out the payments, Corficolombiana made other entities enter into fictitious contracts with companies associated with intermediaries that passed along the bribe payments to the Colombian government officials. Corficolombiana approximately earned $28.63m from the corruptly obtained business.

Foreign Corrupt Practices Act

Answering to the DOJ’s charges of conspiracy to violate the anti-bribery provision of the Foreign Corrupt Practices Act (FCPA), Corficolombiana has entered into a three-year deferred prosecution agreement (DPA) with the Department.

Pursuant to the DPA, Corficolombiana will also pay a penalty of $40.6m, which the DOJ has agreed to credit up to half of against money that the company and its subsidiary, Estudios y Proyectos del Sol S.A.S. (Episol), paid to Colombia’s Superintendencia de Industria y Comercio (SIC), for violations of Colombian laws related to the same conduct, so long as the company and Episol drop their appeals of the SIC resolution.

“Bribes were funded through payments made for invoices lacking supporting documentation and contracts for vaguely described services typically handled internally rather than by third parties.”

Charles Cain, the SEC’s FCPA Unit Chief

Corficolombiana has also agreed to continue its cooperation with the DOJ in any ongoing or future criminal investigations relating to this conduct. The company has also agreed to continue strengthen its compliance program and provide the DOJ with reports regarding remediation and the implementation of compliance measures for the term of the DPA. With the company’s quick and extensive engagement to remedial measures to the DOJ, the criminal penalty was reduced 30%.

“Corficolombiana has acknowledged its role in a significant foreign bribery scheme, and for that it is being held accountable,” said US Attorney Erek L. Barron for the District of Maryland. “Under the DPA, the company is paying a substantial criminal penalty and will continue to cooperate with the United States in criminal investigations relating to this conduct.”

For the SEC’s charges, Grupo Aval and Corficolombiana has agreed to pay a $40m penalty to settle the charges. The companies have also consented to a cease-and-desist order over finding that they violated the accounting provisions, and Corficolombiana was charged for violating the anti-bribery provisions of the FCPA.