The long awaited trial of disgraced former CEO and founder of FTX, Sam-Bankman Fried, began on Wednesday.

SBF trial

Bankman-Fried pleaded not guilty to seven criminal charges, including securities fraud, wire fraud, and conspiracy to launder money. The trial attracted significant attention across the mainstream press.

A cocoa bean trader who lost $100,000 to FTX was the first witness in the trial, CNBC reported, describing him as the poster child for the case. He said he had been drawn into using the site by adverts featuring celebrities.

SBF’s defense team says investors made their own decision and should be held accountable. His lawyer Mark Cohen portrayed Bankman-Fried as a “math nerd” who was building his startup while running it.

“It seems all eyes are on two courthouses in New York this week. But, just as the Elizabeth Holmes trial was not about diagnostic testing, the SBF trial is not about crypto. It’s a tale as old as fraud,” says Sheila Warren, CEO, Crypto Council for Innovation.

“In the US we saw the formation of a new Subcommittee on Digital Assets, Financial Technology, and Inclusion, a record number of bills voted on in the House, and continued bipartisan interest. The EU put in place comprehensive legislation and is already iterating on it. The UK is making moves to become a crypto hub – policymakers are on the move. Challenges remain, but many leaders know this technology cannot be put back in the box and will continue to evolve without the US’s endorsement.”

Firms gear up for new FCA regime

British crypto firms are updating their policies in anticipation of the upcoming financial promotions regime, due to come into force on October 8.

The FCA found that most firms have faced significant challenges preparing for the financial promotions regime, predominantly in relation to what it calls back-end processes. The FCA told CoinDesk this week it was concerned about the poor quality of responses it had received from some crypto firms.

Several platforms severely restricted crypto services for UK clients, while for others, little will change.

“In addition, for the betterment of all market participants, our collaborative dialogue with multiple FCA-authorised firms underscores a shared objective of fostering a thriving crypto ecosystem and symbolises a partnership that extends beyond mere compliance,” Nexo announced, adding that it would phase out two of its products but retain the bulk of its earn, borrow, exchange, and card products.

Head of Public Policy at Luno, Nick Taylor, told CoinDesk in september: “All compliant crypto firms with UK customers are making a number of changes to their platforms in order to comply with the new regulations. For Luno, this includes pausing the ability to invest through the platform for some customers for the time being.”

Experts have warned that unauthorised firms that continue to promote crypto assets risk professional embarrassment and reputational risk, and/or the threat of prosecution and resultant criminal sanctions.

IMF tackles crypto risks

The IMF published a report titled Assessing Macrofinancial Risks from Crypto Assets. Failures in the crypto space, such as the collapse of Terra USD and the FTX debacle, have sparked calls for strengthening countries’ policy frameworks for crypto assets, including by enhanced regulation and supervision.

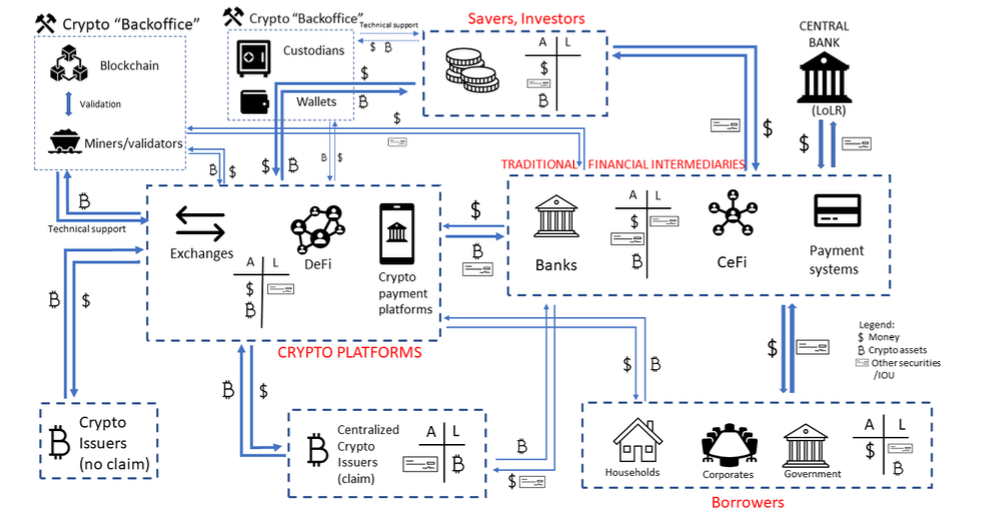

The report acknowledges the increasing importance of crypto in the global financial system, saying: “Over the last few years, the private crypto asset industry has experienced rapid growth and is becoming increasingly more integrated into the global economy. It represents a new shadow financial system with substantial risk implications for the traditional financial sector and beyond. Existing policy frameworks are yet to catch up with this new financial market amidst potential systemic risk implications”.

Graphic: IMF

The authors propose a country-level Crypto-Risk Assessment Matrix (C-RAM) to summarize the main vulnerabilities, useful indicators, potential triggers, and potential policy responses related to the crypto sector. The C-RAM would be the third step in a three step process, preceded by firstly, assessing the macrocriticality of crypto in an economy and secondly, country risk mapping.

The report uses as case studies El Salvador and the Central African Republic, the two countries that have officially adopted bitcoin as legal tender, and Vietnam, where despite no official legal recognition, crypto asset use is among the highest in the world.

A lack of data and of any centralized data collection is a key challenge that should be prioritized, the IMF concludes. It urges the establishment or reinforcement of supervisory bodies and international cooperation.