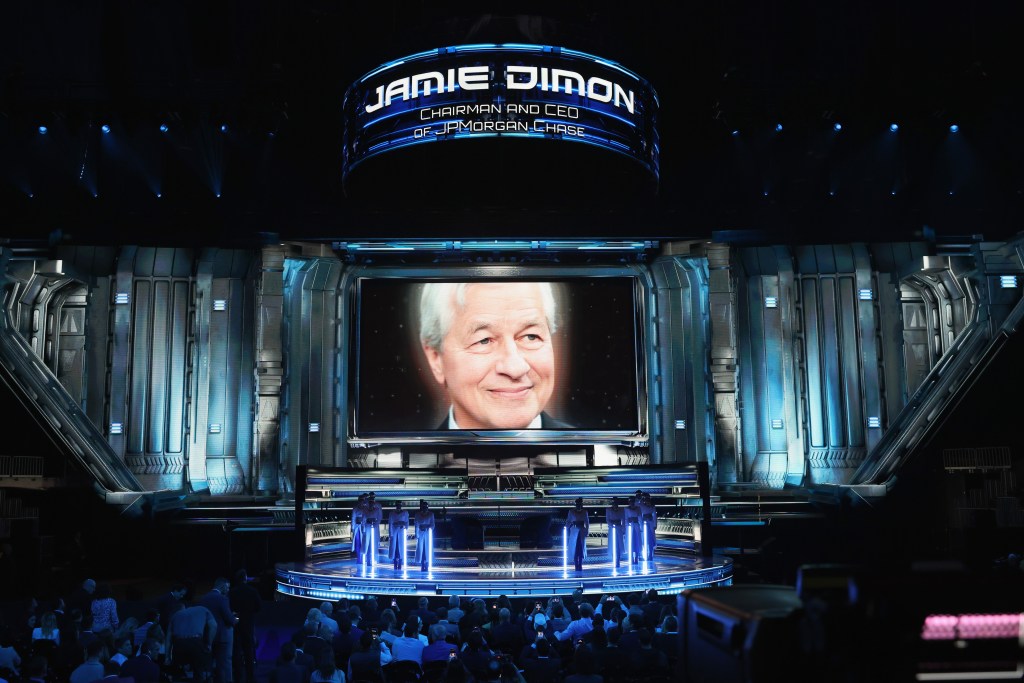

JPMorgan Chase’s asset-management unit âis ending all ties with proxy advisory firms effective immediately, The Wall Street Journal reported, citing an internal memo. The bank described it as being the first large investment firm to do so.

For this coming proxy âseason, the bank will implement an internal AI-powered platform

Register for free to keep reading

To continue reading this article and unlock full access to GRIP, register now. You’ll enjoy free access to all content until our subscription service launches in early 2026.

- Unlimited access to industry insights

- Stay on top of key rules and regulatory changes with our Rules Navigator

- Ad-free experience with no distractions

- Regular podcasts from trusted external experts

- Fresh compliance and regulatory content every day