A UK Freedom of Information request (FOI) from financial regulation consultancy Bovill shows that only one enforcement action has been taken since the introduction of the Senior Managers and Certification Regime (SMCR) in 2016. In 2018, the FCA and PRA jointly fined Barclays chief executive Jes Staley more than £642,430 ($805,000) for failing to act with ‘due skill care and diligence’ in his response to an anonymous whistleblowing letter in 2016.

Expanded regime

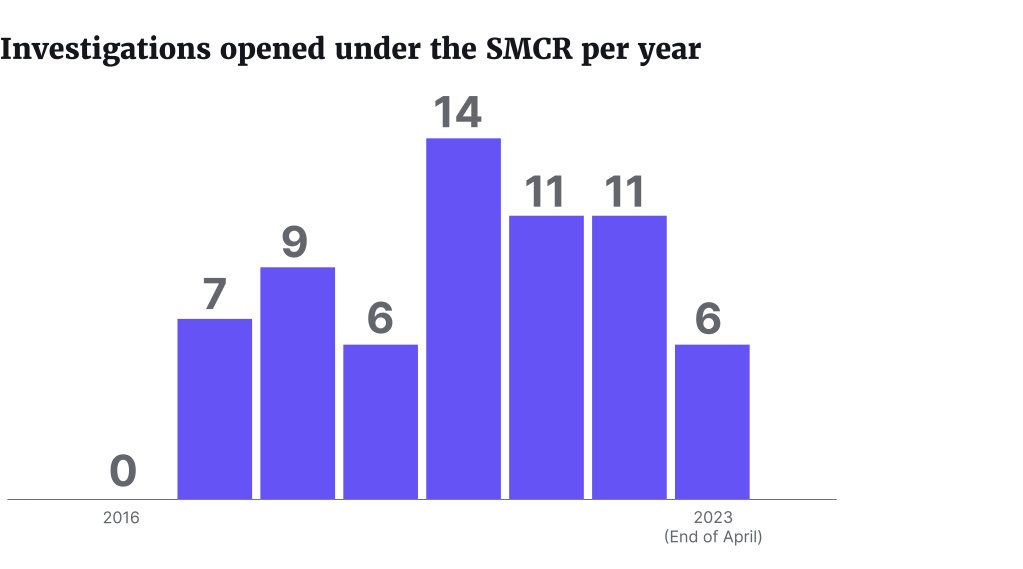

The FCA has opened a mere 64 investigations under the SMCR, despite the fact that the regime was expanded to cover 48,000 firms in December 2019. This means that just 1.5% of investigations have led to enforcement. Furthermore, over half of the investigations remain open, calling into question the effectiveness of the regime.

The Treasury’s Call for Evidence stage of its consultation on the SMCR’s effectiveness, scope and proportionality, in parallel with joint consultation from the FCA and PRA, closed on June 1.

This research has raised significant questions to be addressed both in terms of how well the regime is working, and the regulator’s ability to properly enforce it.

Bovill chief executive Ben Blackett-Ord said: “Bovill welcomed the Treasury’s decision to review the SMCR when it was announced as part of the Edinburgh Reforms.

“Unless the regulators can demonstrate that they have real teeth in relation to enforcement, it will inevitably underdeliver.”

Ben Blackett-Ord

He continued: “Whilst the regime remains broadly welcomed by the industry, the low number of investigations and lower number of enforcement actions suggests that the regulators are, once again, failing to use the powers that they have to detect and then punish misconduct. An effective system for policing senior individuals is crucial to the health of the regulatory system overall, and to UK financial services’ international competitiveness. The intent behind SMCR was always correct, and indeed the regime has significantly improved corporate governance standards, but unless the regulators can demonstrate that they have real teeth in relation to enforcement, it will inevitably underdeliver.”

Non-financial misconduct

The FOI also revealed that the regulator investigated senior managers for non-financial misconduct on just three occasions. This shows that the regime is not achieving its aim of holding individuals to account for their behaviour, and improving the culture within firms.

Blackett-Ord added: “It is essential that regulators use the powers that they have been given to hold senior managers to account, but these findings show that there remains significant work to be done before the threat of sanction will acts as a proper deterrent to misconduct at a senior level. We look forward to the publication of the findings from the Treasury and the regulators’ consultations later this year.”