The number of administrative sanctions imposed in Europe in 2021 as a result of market abuse has gone down, but total financial penalties significantly increased. The findings come from a new report published by the European Securities and Markets Authority (ESMA) on administrative, criminal sanctions and other administrative measures.

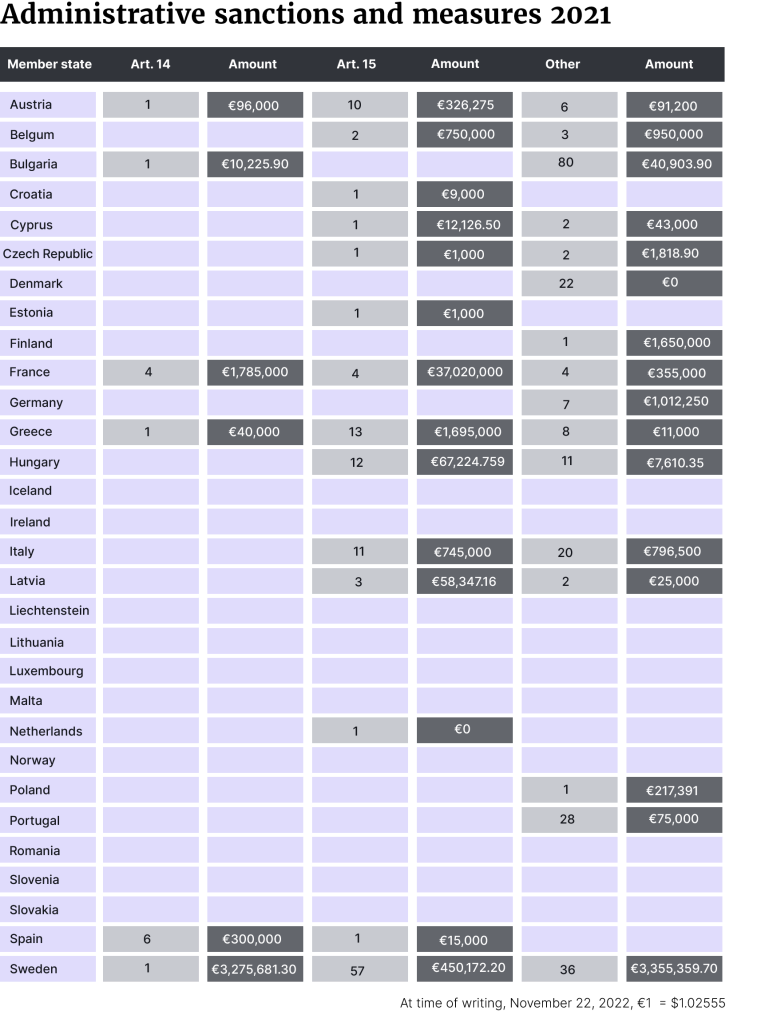

National Competent Authorities (NCAs) reported a total of 366 administrative sanctions and measures last year, compared to 541 in 2020. There were also 29 criminal sanctions for infringements of Regulation (EU) No 596/2014 on Market Abuse (MAR).

The total value of the financial penalties to the administrative sanctions reached €54,273m ($55,973m), a big increase from €17,840m ($18,398m) in 2020. And the financial penalties in relation to criminal sanctions totalled €5,340m ($5,507m).

This is the fifth report on this topic from the ESMA, and it focuses on data from January 1, 2021 to December 31, 2021.

More Article 15 sanctions

In line with previous years, the most sanctions and measures were imposed under ‘other infringements’ (230), followed by the sanctions under Article 15 of MAR (market manipulation) (118) and by the sanctions under Article 14 of MAR (prohibition of insider dealing and of unlawful disclosure of inside information) (14). Still, more sanctions were issued in total in 2020. It was only sanctions imposed under Article 15 of MAR that increased, 74 in 2020 vs 118 in 2021.

Graphic: Martina Lindberg

While the number of administrative sanctions and measures was lower than last year, the aggregated value was up, fuelled by sanctions imposed in France with €38,905m ($40,017m) and Sweden €7,071m ($7,302m).

Issue warnings and suspensions

Article 30(2) of MAR provides NCAs with power to act on administrative sanctions and measures, including issue public warnings, withdrawal or suspension of the authorisation of an investment firm, and temporary or permanent bans on exercising management functions in investment firms.

Regarding financial sanctions, NCAs can issue “maximum administrative pecuniary sanctions of at least three times the amount of the profits gained, or losses avoided because of the infringement, where those can be determined”.

However, in regards to Article 30(1) of MAR, a member state could “decide to not lay down rules for administrative sanctions where the infringements referred to in the same provision already has been subject to criminal sanctions in their national law by July 3, 2016”. Denmark, Finland, Germany, Ireland and Poland exercised this option.

Criminal sanctions

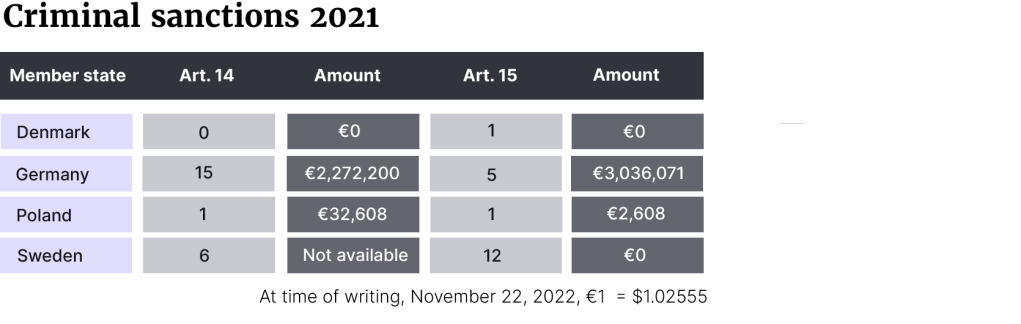

A total of 29 criminal sanctions were imposed in 2021, adding up to the aggregating value of €5,340m ($5,513m). All these sanctions were imposed in Germany, Poland and Sweden.

More sanctions were imposed last year though, with 60 criminal sanctions with just a slightly higher total value of €5,524m ($5,708m). However, it’s important to note that Sweden could not provide information on the aggregated amounts imposed for the criminal sanctions in its jurisdiction this year, which could have made 2021’s sanctions value higher.

With Article 33 of MAR, the NCAs must annually provide ESMA with:

a) aggregated information regarding all administrative sanctions and other administrative measures imposed by them in accordance with Articles 30, 31 and 32 of MAR;

b) anonymised and aggregated data regarding all administrative investigations undertaken pursuant to the above articles;

c) anonymised and aggregated data where member states, in accordance with the second subparagraph of Article 30(1), have laid down criminal sanctions for market abuse conduct for:

(i) criminal investigations undertaken pursuant to Articles 30, 31 and 32 of MAR, and

(ii) criminal penalties imposed by the judicial authorities for the same Articles.

Read the previous reports here: 2017, 2018, 2019, 2020.