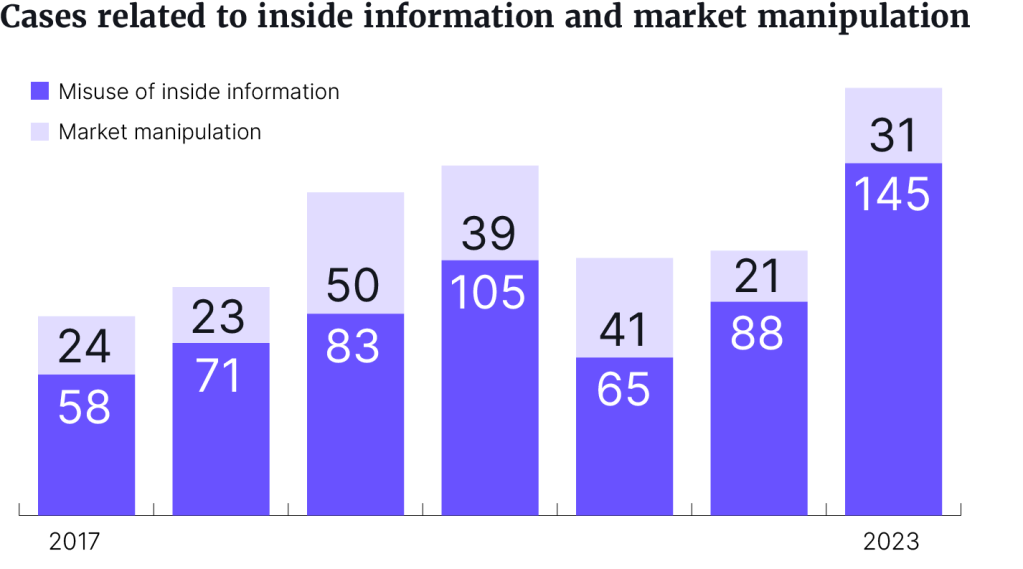

Close to 200 supervision cases around securities market trading and disclosure obligations were processed by Finanssivalvonta, the Financial Supervisory Authority in Finland (FIN-FSA), last year – an increase of 50% on 2022.

A majority of the cases tackled concerns regarding abuse of inside information (145) and market manipulation (31).

The FIN-FSA said that the increase in cases was partly due to the development of the authority’s supervisory processes and methods, especially for investigating misuse of inside information.

“Our aim in the supervision of listed companies’ disclosure obligations is to ensure that investors have access to adequate information for making an informed assessment of listed companies and their securities. Reliability, transparency, timeliness and fairness of investor information are central to this,” the authority said.

The new concept for inspections directed at listed companies launched in 2022. FIN-FSA said it wasaiming to assess “what capabilities and processes the company has in order to handle the obligation to disclose inside information laid down in the Market Abuse Regulation, as well as what capabilities and processes the company has in managing inside information”. That includes delaying the disclosure of inside information, and how companies are preparing and maintaining insider lists among more.

FIN-FSA intents to continue such inspections in the future.

“Recently, supervision has focused particularly on companies’ future outlook and the timely publication of changes in future outlook. We have paid further attention to the definition of inside information and the timeliness of delaying the disclosure of inside information and the establishment of insider lists,” it said.

Abuse of inside information

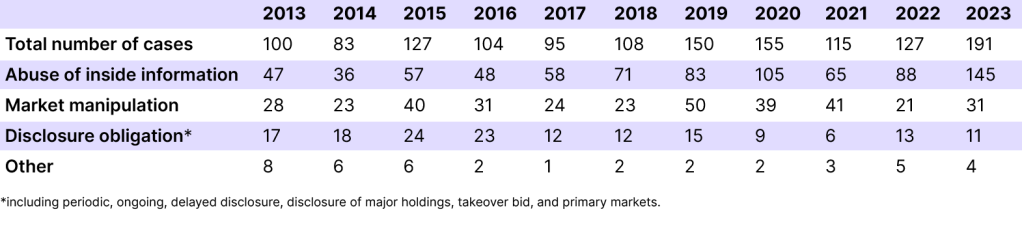

During 2023, FIN-FSA opened a total of 191 cases, which have constantly increased since 2013 when 100 cases were started. Abuse of inside information made up about half of the cases in 2013, but this figure has now increased to about 76% of all investigations. Cases of market manipulation peaked in 2019, with a total of 50 cases – compared to 31 in 2023 – and cases of disclosure obligations decreased, with only 11 last year.

From all the cases in 2023, eight were referred to the police, which of most related to misusing inside information, market manipulation and failures to listed companies’ disclosure obligation.

The authority also imposed two administrative sanctions, where Bank of Åland Plc was fined €60,000 ($65,007) in February for neglecting its obligation to ensure that details of all derivatives contracts it concludes are reported in accordance with regulation to a trade repository.

Then in September, a public warning was issued to Pohjola Insurance Ltd for failing to process claims, issue decisions and submit statutorily required documents to the appropriate appeal body within the time limits under the Workers’ Compensation Act. The company was also found lacking proper internal provisions concerning systems of governance.

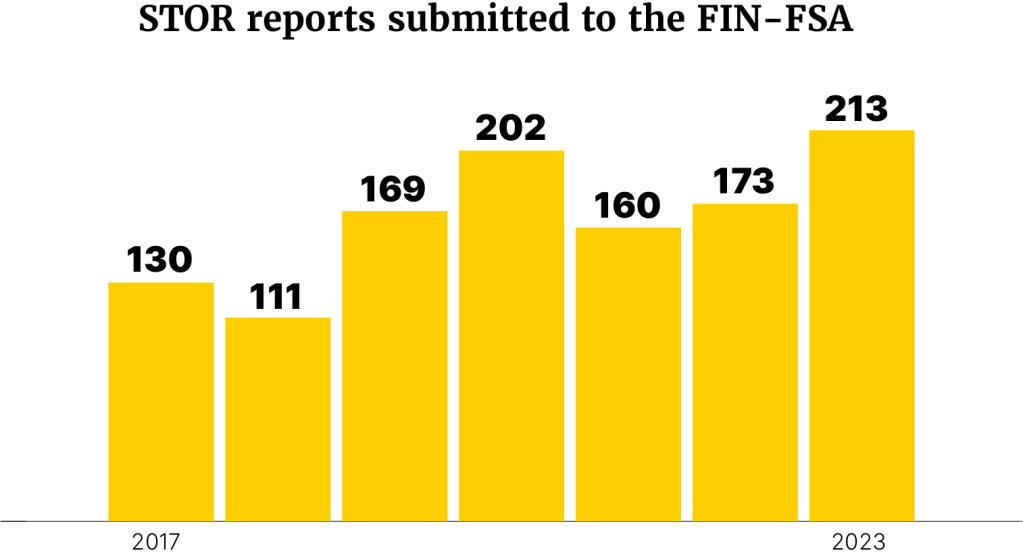

Fin-FSA also received 213 suspicious transaction and order (STOR) reports, which have also increased during the years. Two-thirds of the STOR reports came from Finnish entities and one-third were sent to the FIN-FSA by other foreign national securities market supervisors.

During the year, the authority also obtained 18 reports under suspected infringement (whistleblowing system) or informal market observations, which contained suspicions on either insider trading, market manipulation or managers’ transactions.

Supervisory priorities 2024

In February, the FIN-FSA announced its supervisory priorities for 2024. The focus is on operational and financial risks in an uncertain operating environment, long-term trends and risks, and the soundness of supervized entities’ governance within:

- governance and control systems;

- increase in credit risks;

- increase in ICT and cyber risks;

- code of conduct;

- quality of data;

- sanctions;

- preparedness and continuity management;

- tighter and changing regulation; and

- liquidity management.

The authority said that it will “continue our supervision on broadly the same themes as in 2023”, and keep working closely with the Helsinki Stock Exchange’s Market Surveillance, which oversees listed companies’ disclosure of information from the perspective of compliance with stock exchange rules.

“Our objective is to be a proactive and predictable supervisor, in line with our strategy. We will enhance predictability by, for example, communicating our supervisory plans so that our supervised entities know what we consider to be important at any given time. We also aim to be flexible and ready to review supervisory priorities, if necessary, throughout the year,” commented Tero Kurenmaa, Director General of the FIN-FSA.