The FCA “is determined to be seen as an enabler, not a blocker”, and sees itself as taking a “proportionate and risk-based” approach in contrast to the SEC’s “strict liability approach”. And on the challenging area of crypto: “We will not over promise on protection we can’t deliver on”. The regulator is also “inflecting” and “pivoting” towards FICC markets.

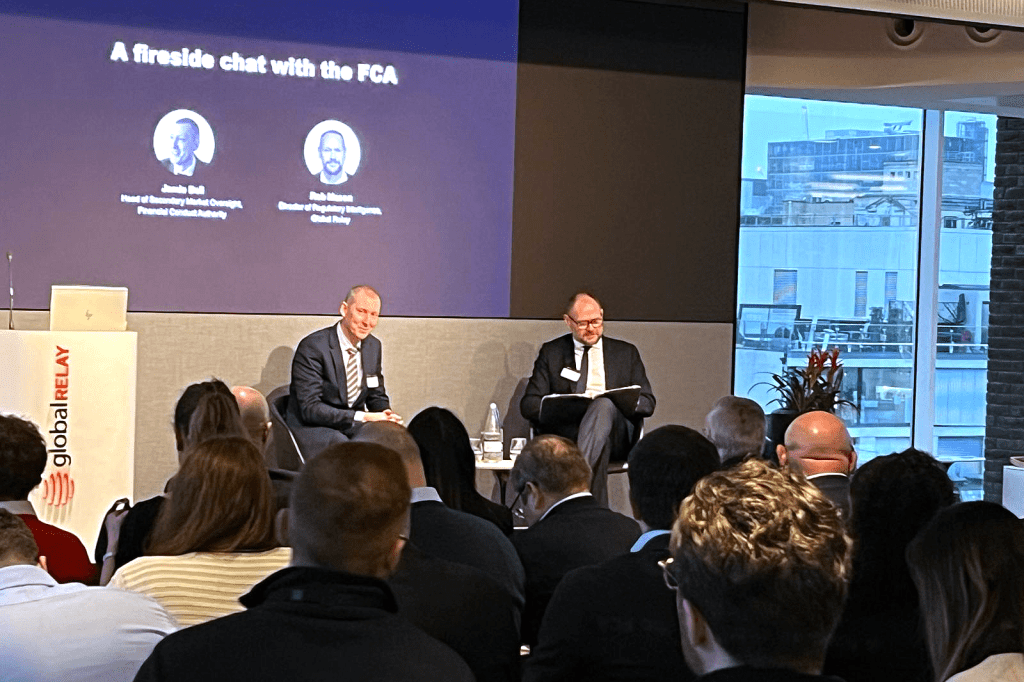

Those were the key takeaway comments from Jamie Bell, the FCA’s head of secondary market oversight, at a Global Relay event in London in front of an audience of over 140 compliance professionals.

The remarks came as part of a refreshing effort to engage and explain. Bell discussed the regulator’s approach and priorities in a fireside chat with Global Relay’s director of regulatory intelligence, Rob Mason, at an event organised at the compliant communications company’s London offices.

Bell’s straightforward answers and willingness to engage impressed the audience, many of whom said they hoped this indicated a new approach by the regulator. He wouldn’t reveal the detail of changes to the FCA’s enforcement strategy – although he tantalized the audience by promising that in the very near future they will hear about cases in the pipeline – but he was willing to discuss and explain some of the thinking behind it.

Market abuse a priority

He said that market abuse strategy is a priority for the FCA. It is currently in the process of revising its enforcement strategy and he advised the audience to look out for Therese Chambers’ upcoming speech at the City & Financial Conference.

Bell started his role in 2021 and knew the FCA needed an ongoing and robust deterrent to insider dealing. The regulator is looking at market manipulation and systems and controls. There’s an enforcement team dedicated to insider dealing and he expects a change in the velocity of cases – “you can expect to see more”.

Explaining why the FCA chose One Tick as a partner to power its trade surveillance solution, Bell said it has been a “journey”. He explained that the FCA had some fairly “atypical needs” and was therefore looking for an agile vendor who could develop new tools quickly and was also responsive to the FCA’s specific needs and unique requirements.

By procuring a smaller vendor the FCA could include its own IP to make the system “more flexible and more targeted to [its] needs” but also help “move the surveillance industry along and make it more competitive”, which would be good both for the financial services ecosystem as well as the FCA.

He thinks the benefits will be seen within five years, and that the FCA’s focus is to ensure that it remains a world-class enforcement body: “We need world-class information, we need to be jury ready.” The enforcement challenge is to prioritize cases and develop a moving market abuse pipeline.

Mason asked if the FCA would go hard on pursuing firms for comms and recordkeeping capture failures, articulating the thinking at the forefront of many minds in the sector. He suggested that firms want regulations in place so they know what to capture. Bell teased “Be careful what you wish for!”

The SEC has a strict liability approach and will fine firms for failing to capture any communications no matter how trivial. The FCA, though, supports a risk-based, proportionate approach. “Our view is that communications surveillance needs to be targeted at the risks in your business and proportionate to the risks of your business” said Bell.

“We are very sensitive to joining the dots between compliance and conduct problems.”

Jamie Bell, head of secondary markets oversight, FCA

He advised firms to follow through on their polices, adding that the FCA “will be unsympathetic to firms” if they have not considered the risks to their business and put surveillance policies and procedures in places or have not taken action against individuals who breach those policies. “We do expect you to follow through on your own policies,” he explained.

Firms must have a compliance culture embedded in their organizations according to Bell. Later on in the talk he also suggested that keeping policies up to date is a key starting point in being able to effectively surveil the market.

Comms compliance has been a dominant issue in recent years, and continues to be so, but Bell offered a blunt take on the subject. “I’m not very sympathetic to the idea that we have to pander to the way people want to work,” he said, referencing discussions about BYOD policies and use of various social media channels. “Some things are required, and if social media poses an unacceptable risk, don’t use it. We all make compromises to earn money.”

Conversation inevitably turned to the recent letter instructing insurance companies to set out their policies for monitoring and dealing with non-financial misconduct, and Bell was quick to emphasise that this wasn’t something specifically aimed at the insurance sector.

“I wouldn’t read too much into that”, smiled Bell, “We’ll be writing to about a thousand firms in the next few weeks” with insurers, insurance brokers, banks and brokers “all also on the list”. The FCA is looking for “headlines” in terms of misconduct being detected by firms and is not trying to “get under the skin of individual cases”.

He went on to say that the FCA is “very sensitive to joining the dots between compliance problems and problem firms”. If you’re bad at transaction reporting then you’re very likely to be bad at all systems and controls.

He said the letter to the insurance sector was part of a much wider effort to “understand what control frameworks are in place”.

Role of voice

Bell added that the FCA had noted that “when we do get voice recordings of alleged market abuse, they often coincide with pretty terrible examples of non-financial misconduct” and went on to emphasize that “there is clearly very strong correlation between market abuse failure and other kinds of compliance failure and also non-financial misconduct”.

He said that as a result of this he thought that it was “inevitable, frankly, that voice recording and voice surveillance would end up being deployed in this context”.

On the subject of voice capture, Bell said it is at its most “powerful in combination with other types of surveillance” for example when enriching trade-based surveillance and is enormously helpful in that regard, or can be used when other techniques are not available. However, there are lexicon and flexibility issues with voice analytics. It’s inflexible and can’t deal well with regional accents and multiple languages.

AI has potential to cut through these issues, but has an explainability problem that needs to be resolved first, he suggested.

Returning to discussion of more general issues, while Bell repeatedly emphasized the FCA’s wish to be pragmatic and work with firms, he took a tough line on what the regulator would and wouldn’t tolerate. Principle 11 requires firms to cooperate with the FCA so “let’s be clear, that’s not an option for you, that’s a requirement.”

Firms should embrace the potential of the FCA’s pragmatic and risk-based approach as a regulator. “A firm must deal with its regulators in an open and cooperative way, and must disclose to the FCA appropriately anything relating to the firm of which that regulator would reasonably expect notice.”

“AI is new and exciting technology and will make routine jobs more rewarding and easier to do.”

Jamie Bell, head of secondary markets oversight, FCA

Asked about future trends, Bell said: “I’m going to be very dull here and say AI and crypto.” He described crypto as “commodities on steroids” and said the area “poses unique challenges”. The FCA doesn’t want to block innovation and doesn’t want to “over promise” on protection. It is focused on delivering “a proportionate market abuse regime”.

On AI, Bell said that the FCA is determined to support the transition and that it “is an enabler, not a blocker to that development”. He’s with Bank of England governor Andrew Bailey on this and is relaxed with going forward and looking at AI use cases. He really does not believe that we are all “about to be replaced”. He said we have to be comfortable with less explainability; and ideally get to a position where people who aren’t data scientists can put their faith in AI tools available to them.

Bell picked up on a comment about the problem with going straight from a rules-based approach to an AI-based approach and suggested that people should be careful in moving from manual to AI and thus unintentionally deskilling the workforce. He believes that even with the best AI tools out there you’ll still need people to have the skills to read and understand the results at the “other end of the machine”. He suggested that we are on the cusp of a “new and exciting technology that will make our jobs more rewarding and easier to do”.

He also mentioned that the FCA is making efforts to make some of its data available to firms in order to help them build more effective surveillance tools and methodologies, but is also working on an additional strand to this effort centered on assurance – so that firms can invest in technologies with confidence because the regulator understands it, its challenges, and can effectively supervise it.

Social media and market volatility

He also spoke about “feedback loops” between AI and social media increasing market volatility in extreme stress events (such as the SVB collapse in the US), and said this was something that would take up increasing amounts of the regulator’s time because there is real potential for market manipulation as well and that some of these issues are increasingly becoming more closely intertwined.

Questions from the audience included one on why Market Watch 76 included such emphasis on ‘printing’ and ‘flying’. “There’s a lot of it and we don’t like it”, answered Bell. He said it feels dishonest and not in keeping with the culture expected in firms. The Market Watch was telling firms “to get your house in order”, not an enforcement warning. It was clear that the audience relished this direct response!

Another asked his views on a recent pre-hedging case in Australia. Bell said that pre-hedging is often front running. Firms need to manage that risk carefully. So it’s important to have a risk policy about pre-hedging and follow through. If you have that policy in place and followed through then you’re in a good place to have a conversation with the regulator. If you are taking positions you would not normally take, you are probably on the wrong side of the line.

For asset managers, stewardship is a “huge potential issue” he said, one that poses an insider dealing risk. This will be raised in the next FCA communication to asset managers.