The FCA wants the world to know that the UK “is the best place for financial services to thrive”. This involves providing an effective and efficient service whilst maintaining high standards to protect customers and to bolster the reputation of the UK market.

This week’s report on quarterly authorizations covers operations October to December 2023. These metrics are solely for FCA-regulated firms (not those dually regulated with the PRA).

Statutory targets ahead of deadline

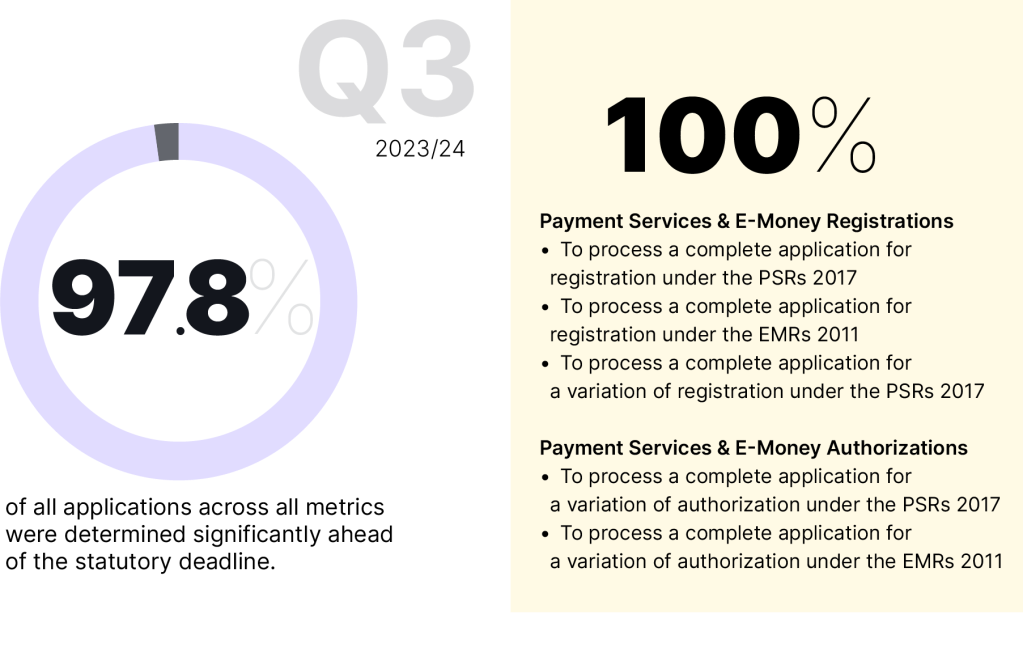

Overall, the data shows that 97.8% of applications across all metrics were determined significantly ahead of the statutory deadline, with nine metrics being green – deadline achieved (equal to or more than 98%), six amber – acceptable target achieved (less than 98% but more than 90%) and none red – deadline not achieved (less than 90%).

| Area | Description | Q3 2023/24 | Q4 2023/24 |

|---|---|---|---|

| Approved Persons – of which SMCR-related | To process an application for ‘approved person’ status for an application submitted by an authorized firm under the Senior Manager and Certification Regime | 95.8% | 98.6% |

| Approved Persons – of which AR-related | To process an application for ‘approved person’ status for an application submitted by an authorized firm under the Appointed Representative regime | 96.1% | 94.7% |

| New Firm Authorizations | To process a complete application for Part 4A Permission | 93.9% | 95.6% |

| Variation of Permission | To process a complete application from an authorized firm for Variation of Permission | 98.4% | 98.8% |

| Change in Control | To make a decision after receiving a ‘complete’ notification of a proposed change in control | 99.1% | 99.6% |

| 3/4 MLD | To process money-laundering registration under the 3MLD/4MLD directives | 96.8% | 97.4% |

| Payment Services & E-Money Registrations | To process a complete application for registration under the PSRs 2017 | 100% | 100% |

| Payment Services & E-Money Registrations | To process a complete application for registration under the EMRs 2011 | 100% | 100% |

| Payment Services & E-Money Registrations | To process a complete application for a variation of registration under the PSRs 2017 | 100% | 100% |

| Payment Services & E-Money Registrations | To process a complete application for a variation of authorization under the PSRs 2017 | 100% | 100% |

| Payment Services & E-Money Registrations | To process a complete application for a variation of authorization under the EMRs 2011 | 100% | 100% |

| Payment Service Agents | To process a notification for a UK agent under the PSRs 2017 and EMRs 2011 | 97.2% | 98.8% |

| Cancellations | To determine a complete application for Cancellation of a Part 4A Permission | 98.6% | 99.7% |

This provides further evidence of the continuing improvement of the FCA’s authorization process, and shows the regulator is now processing its applications faster than in the second quarter, (figures published August 8, 2023), where eight metrics were green, six amber and two red.

From Q2 to Q3, there was an improvement of 3% in the processing time for the approved persons category in the Senior Managers and Certification Regime (SMCR), moving that category metric to green.

Other highlights include the FCA’s 100% success rate for processing a complete application registration for Payment Services and E-Money under PSRs 2017 and EMRs 20211. Similarly, it is also a 100% rate for processing a complete application for a variation of authorization for Payment Services and E-Money under PSRs 2017 and EMRs 2011.

Processing complete authorizations

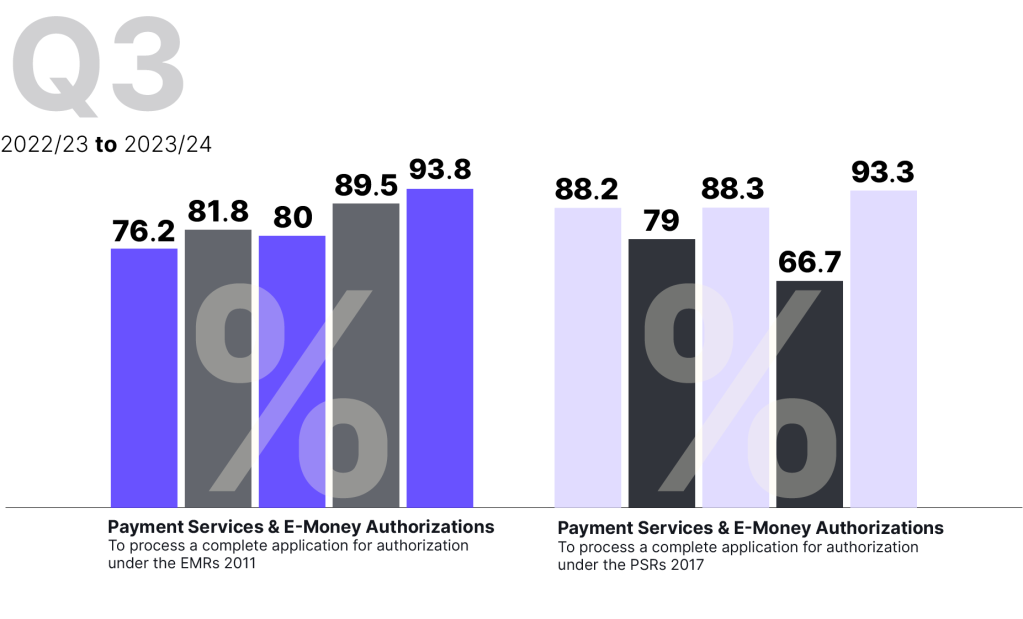

Standing out in the regulator’s data were some numbers on processing a complete application for authorizations for Payment Services & E-Money, under the PSRs 2017 and the EMRs 2011, both of which had the lowest percentage figures overall.

The FCA acknowledged that it will not always meet statutory targets due to the complexity of some cases. However, it said, “in these cases, it is right that we take the time to make sure there is greater scrutiny and engagement with the firms involved”.

The FCA advised firms that they should make sure their applications are completed and of a good standard as they see “too many incomplete and poor-quality applications”.

Firms should see the FCA’s Authorisation pages for guidance.