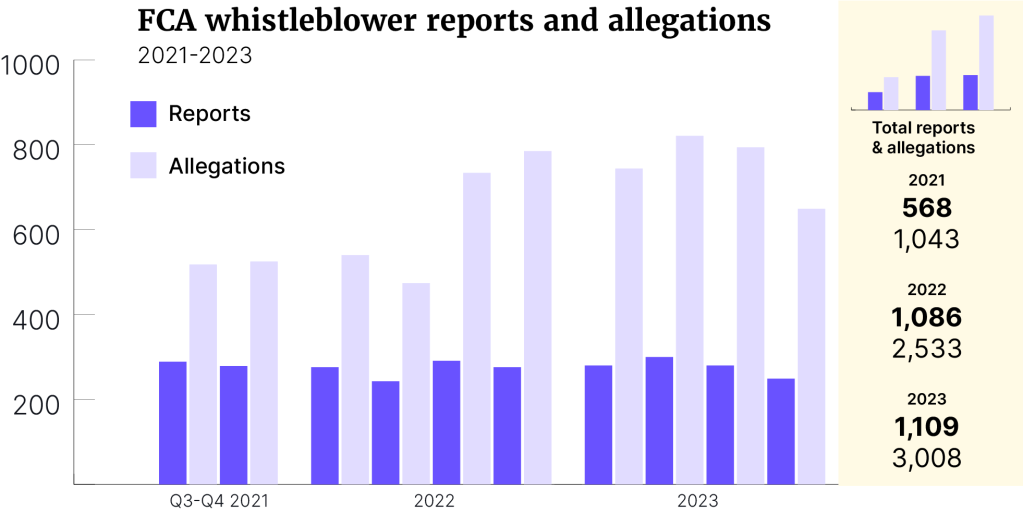

The FCA has published its latest whistleblowing quarterly data for 2023 Q4. The UK regulator received 1,109 reports last year containing a total of 3,008 allegations, a rise of 19% on the 2,533 allegations in 2022.

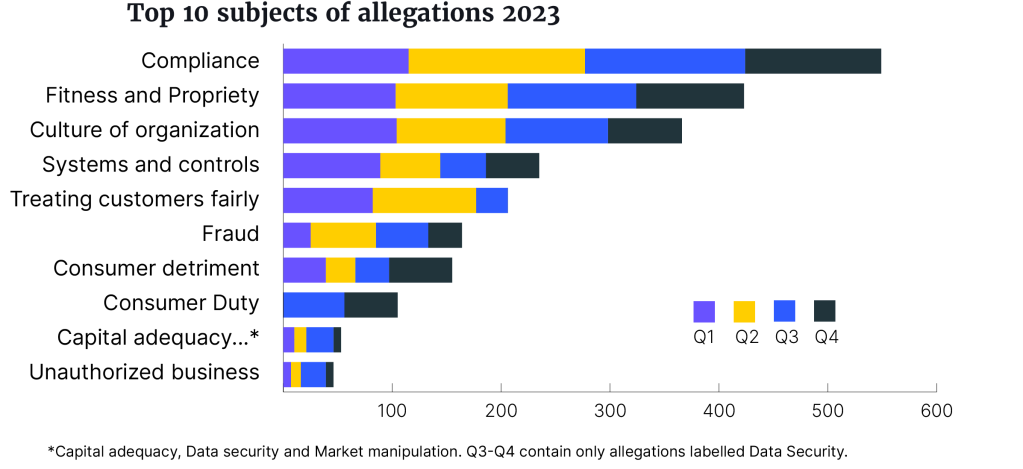

Topping the list of allegations was compliance and conduct (fitness propriety), corroborating concerns expressed through the Treasury Select Committee’s ‘Sexism in the City’ report.

Whistleblowing allegations

The FCA said that every report contains one or more allegations of wrongdoing. Typically, the reports contain allegations that fall under the following five overarching themes:

- fitness and propriety;

- Consumer Duty (replaced treating customers fairly allegation August 2023);

- FSMA;

- culture; and

- compliance.

Whistleblowing reports methods of contact 2023

The FCA’s Whistleblowing team receives reports by telephone, email, online reporting form, and post. In 2023 69% of whistleblowers provided their identity.

Almost half the reports came via the online reporting form. There have been calls (see paragraph below on ‘Sexism in the City’ report) for an awareness campaign to publicise the availability of the FCA’s whistleblowing line and clarify the circumstances in which it can be used.

Transparency

The FCA says it is constantly trying to improve the information it makes public, acknowledging “the greater transparency about whistleblowing reports we receive is important”.

This move follows the FCA’s new approach to publicise enforcement investigations. Under these proposals the FCA will publish updates on investigations as appropriate and be open about when cases have been closed with no enforcement outcome.

The FCA said: “Protecting the identities of the whistleblowers who contact us is vital.”

Sexism in the City report

The recent Treasury report on Sexism in the City was quite damning, stating that “we have heard that whistleblowing processes within financial services firms are often ineffective at tackling bad behaviour or protecting those who report harassment”.

The UK Government is undertaking a review of whistleblowing laws, and the Committee strongly recommends that it seeks to strengthen whistleblowing legislation to provide greater protection and support to whistleblowers in sexual harassment cases.

The Committee said there is limited awareness of the FCA’s whistleblowing line or how it works, and it believes there is scope to enhance its effectiveness and reduce the “fear factor” victims of harassment face when reporting abuse.

The Committee recommends that the FCA launches an awareness campaign to publicise the availability of its whistleblowing line and clarify the circumstances in which it can be used, including the fact that nothing in a non-disclosure agreement can prevent an individual from reporting harassment to the FCA. This could be part of a wider campaign to map out the different options available to women suffering abuse or harassment in financial services.

Fiona Mackenzie MBE told the Committee: “We have the FCA whistleblowing hotline, which no one knows about. It is not very clear to women what happens when you call that number. Is your life about to get much worse?”

The FCA told the Committee that there had been a steady increase in reports made to the whistleblowing line since a previous evidence session in the summer of 2023. From the data, there were 42 calls reported in Q4 2023, with 40 reported in Q3. However, April-June (Q2) saw 68 calls reported.

The FCA said in its response to the report: “We will also consider the Committee’s recommendations on whistleblowing and the use of non-disclosure agreements, building on our existing work.”

GRIP Comment

Whilst publication of the FCA’s whistleblowing data should be applauded, many commentators have suggested that the allegation subjects are labeled too broadly. This makes it hard to extrapolate any meaningful information.

There is also no clarity on how many cases have resulted in decisive action by the FCA. Questions that should be answered include:

- How many cases are being cleared?

- Is there any data on whistleblower protection?

- Did the reports remain confidential?

- Where there any repercussions for the whistleblowers – for example, did they lose their job?

Georgina Halford-Hall, CEO WhistleblowersUK and Director of Strategy & Policy All Party Parliamentary Group for Whistleblowing, said: “The FCA is far from a trusted regulator and while it is happy to show that reports are going up there is no substantial data for the clear-up of these cases.”

“I would like to know what is happening to the significant backlog of cases given the alarmingly low number that are ‘resolved’.”

“It is essential that the UK put in place a new office of the whistleblowers as set out in the Whistleblowing Bill drafted by WhistleblowersUK and due for a second reading on March 22 in Parliament. This Bill will set universal standards and support all regulators to be more effective – this will give the public, and more importantly whistleblowers, confidence in the regulator.”