Nordic and Baltic banks should take efforts to strengthen their anti-money-laundering and counter-terrorism financing (AML/CFT) supervision framework further, a new report from the International Monetary Fund (IMF) says.

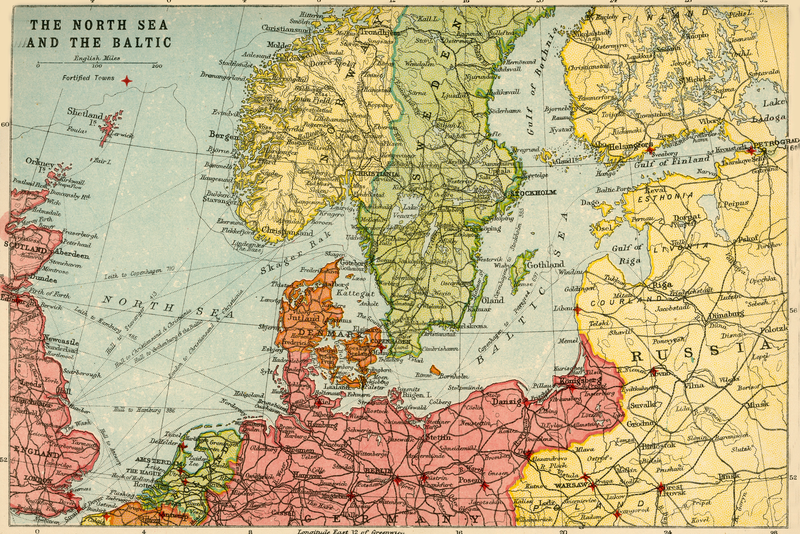

After a request from eight Nordic and Baltic countries, the IMF analysed threats and vulnerabilities arising from recent money laundering and terrorist financing in their regions. The report, which covers Denmark, Estonia, Finland, Iceland, Latvia, Lithuania, Norway, and Sweden, says that a more effective monitoring of cross-border financial flows would provide a deeper understanding of their external ML threat environment and the evolving cross-border related risks.

“These breaches have shown the importance of understanding ML risks inherent in cross-border financial flows, the need for effective domestic AML/CFT regulatory frameworks, and strong regional and international cooperation,” IMF’s report says.

The IMF suggests that by primarily enhancing the analysis of cross-border payments, the countries’ national risk assessment and the supervisors’ risk assessment would evolve.

Money laundering and terrorist financing

The IMF is also pushing for more collaboration between the countries, and for exchange of information on structural changes in the national economy. “Countries could also further leverage supervisory colleges – such as through cross-border supervisory strategies and joint inspections – for more coordinated regulatory action.”

Nonetheless, the IMF’s findings show that much has been done to identify countries where there is a high risk of money laundering, and where there have been investments in ML/TF risk models across the regions. Yet, some gaps still remain, such as on advanced data collection and analysis.

“These breaches have shown the importance of understanding ML risks inherent in cross-border financial flows, the need for effective domestic AML/CFT regulatory frameworks, and strong regional and international cooperation.”

IMF

“More granular data collection, particularly on cross-border payments and increased investments in data analysis, are required to ensure that robust ML/TF risk assessments underpin the supervisory approach for banks,” IMF suggests.

Samu Kurri, Head of Department at Finanssivalvonta, Finland’s Financial Supervisory Authority (FIN-FSA), welcomes the adoption of these new procedures.

“At the FIN-FSA, we have made a lot of effort to identify ML/TF risks, but effective supervision is a continuous race against criminals. The monitoring of cross-border financial flows is an important area of development, since a significant proportion of money laundering is associated with international credit transfers.”

Crypto asset risks

The analysis also names crypto assets, and says that an increased focus is needed to tailor risk-models to crypto providers to support the AML/CFT risk-sensitive supervision of the financial sector.

“As countries advance their supervisory approaches for the newer crypto asset sector, effective market entry controls, investments in resourcing and specialized tools, as well as regional information exchange would be key,” the IMF continues.

Kurri thinks that one of the most significant proposals is to unite in order to enhance the supervision of virtual currency providers by all the Nordic and Baltic countries.

“Virtual currency providers have been covered by our supervision since 2019. The sector has seen significant evolution since then. I expect cooperation with the neighbouring regions to bear fruit in this case, too,” Kurri added.

Money laundering scandals

For this report, IMF analysed events that occurred between 20025 to 2017, with various international money-laundering banking scandals around ABLV, Danske Bank, Nordea, and Swedbank.

Most recently, both Danske Bank and Swedbank have been in the spotlight over big money-laundering charges.

In December 2022, Danske Bank, Denmark’s biggest bank, was charged and fined $413m for misleading investors about its AML compliance program in its Estonian branch, where a lot of suspected money laundering took place. Between 2007-2013, 44% of all deposits came from non-residential customers, which conducted 7.5 million transactions with a total value of €200bn ($214.5bn).

The SEC also charged the bank for failing to disclose the risks posed by the program’s significant deficiencies.

“The monitoring of cross-border financial flows is an important area of development, since a significant proportion of money laundering is associated with international credit transfers.”

Samu Kurri, Head of Department, Finanssivalvonta

In March 2022, Sweden’s oldest bank Swedbank was also served with a suspicion of money laundering notice at its Estonian branch for events in the period 2014-2016.

“In the Nordic Baltic region, the Danske case stands out due to its extensive cross-border illicit activities across countries in the region, affecting other financial institutions,” the report concludes.

Another big scandal happened back in 2019, when the Swedish TV news show Uppdrag Granskning revealed extensive suspected money laundering within Swedbank. Journalists found that at least SKr40bn ($3.9bn) had been channelled between accounts in Swedbank and Danske Bank in the Baltics. The suspected crimes were linked to a former minister in the Russian government, Mikhail Abyzov.