FCA fires warning shot over market soundings and insider trading

The UK FCA's Market Watch 75 has published observations on market soundings, voicing concern about potential insider trading.

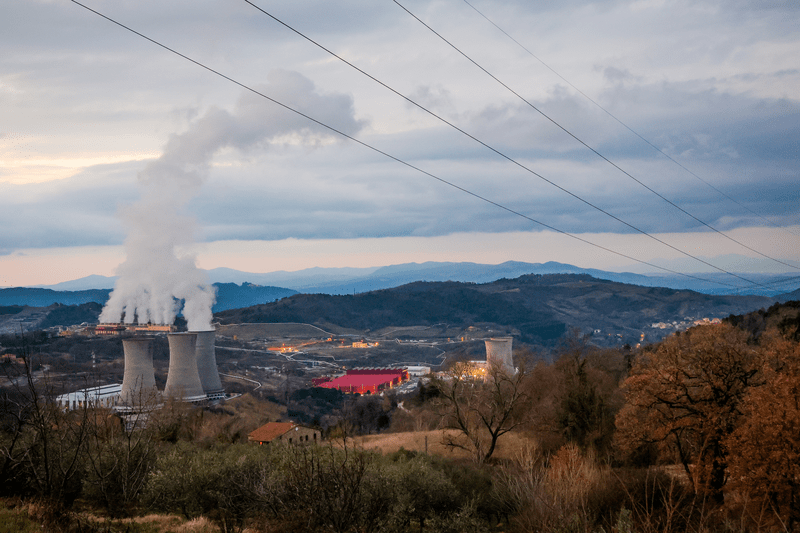

MAR applies to financial instruments and also emission allowances and related auction products.

FCA fires warning shot over market soundings and insider trading

The UK FCA's Market Watch 75 has published observations on market soundings, voicing concern about potential insider trading.

Thomas Hyrkiel2 min read

FCA outlines market abuse prevention best practice at CFD firms

Regulator's granular observations useful to other market participants in order to ensure that their surveillance approach meets expectations.

Rob Mason1 min read

FCA provides more advice on insider lists

Accurate lists that include personal information are required in the UK in order to fully comply with MAR.

Thomas Hyrkiel2 min read

FCA

FCA fires warning shot over market soundings and insider trading

FCA

FCA outlines market abuse prevention best practice at CFD firms

FCA

FCA provides more advice on insider lists

Thematic review points to persistent recordkeeping issues at firms stemming from inadequate controls and use of error-prone manual systems.

Thomas Hyrkiel4 min read

ESMA’s final report also includes technical advice on MAR and MiFID, plus where disclosure of information is required because it contrasts with previous announcements.

Thomas Hyrkiel2 min read

Proposed new templates are intended to reduce the administrative burden on listed companies as well as those wishing to list.

Thomas Hyrkiel3 min read

Cantor failed to report suspicious transactions and lacked effective governance arrangements for detecting and reporting them.

Jean Hurley2 min read

The share price of 39 companies was swayed in order to generate profits for members of the group.

Thomas Hyrkiel1 min read

This panel discussion featured experts from the National Futures Association and Dutch financial markets authority AFM.

Alex Viall4 min read

Regulator Finansinspektionen issues remark and fine over insider trading and unauthorized trading concerns.

Martin Cloake<1 min read

Assessing amendments to the regulation on wholesale market integrity and transparency.

Anna Carrier | Norton Rose Fulbright12 min read