Registered investment adviser compliance teams say the SEC’s strict stance on off-channel communications has relaxed this year, even though the underlying recordkeeping rules have not changed. This is according to a recent report from Citywire based on conversations held at the Schwab Impact conference in Denver.

For roughly three years starting in 2021, the SEC ran a broad sweep targeting firms that failed to capture and retain texts, emails, and other electronic messages with clients. That campaign produced billions of dollars in penalties and made messaging surveillance a top risk category for compliance officers.

The most recent settlement concerning off-channel comms came in mid-January 2025, when 12 firms agreed to pay a combined $63m in penalties tied to electronic communications recordkeeping failures.

Since then, FINRA has taken up some of the slack, bringing its own recordkeeping and communications cases including a recent $850,000 fine against Ally Invest for recordkeeping violations.

According to Citywire, advisers now report that examinations still probe off-channel communications, but in a more focused way than in previous years.

Better targeting

Instead of multi-year, backward-looking reviews, firms say exam teams are concentrating more on current practices and tighter, better-targeted request lists. One trade group leader summed up the change by saying examiners are still asking about texting and messaging apps, but “they’re not in a hostile mood,” and that the mindset has shifted with exam lists “more appropriately scaled.”

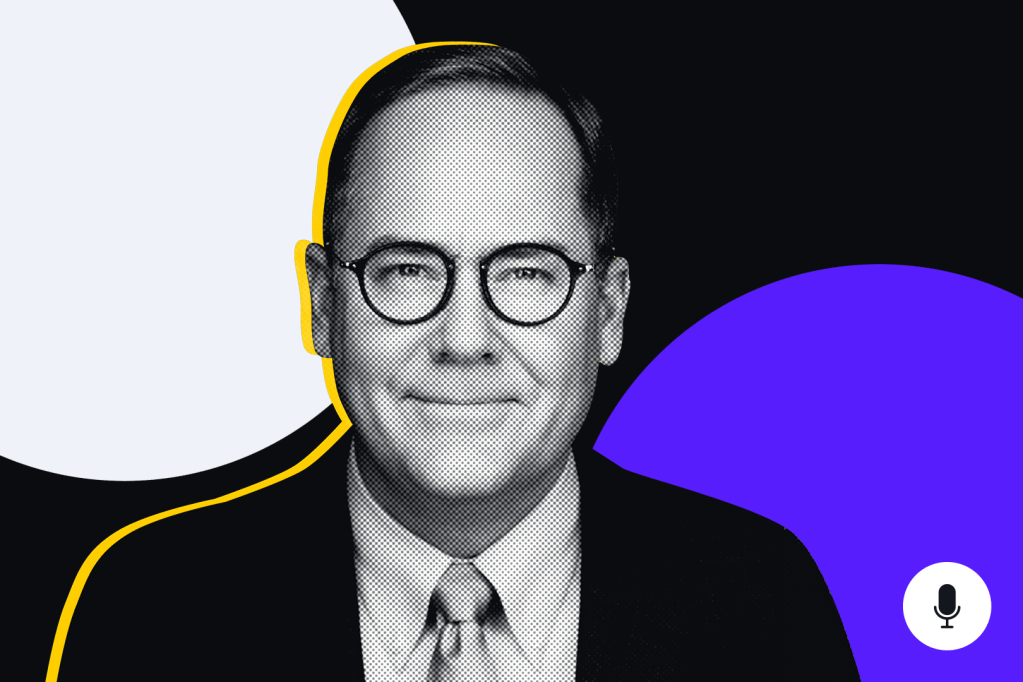

The softer tone tracks with public remarks from SEC chairman Paul Atkins, who has questioned the agency’s reliance on standalone books-and-records enforcement actions as effective deterrence.

In an October keynote speech, Atkins stated that his agency “must go after cases of genuine harm and bad acts, but we must view cases of benign or innocent actions differently. In the past, we have seen examples of enforcement actions in areas, such as retention of books and records, that consumed excessive Commission resources not commensurate with any measure of investor harm.”

Compliance professionals quoted in the Citywire piece stress, however, that the SEC’s current posture is a lull, not a blanket amnesty.

Now, firms are using the breathing room to retrain staff, discourage the use of texting and private messaging apps such as WhatsApp and Signal for business, and clamp down on forwarding work product to personal email accounts, on the assumption that, as one consultant put it, the “pendulum will likely swing back” to a renewed focus on recordkeeping rules.