The following is a transcript of a podcast Matt Galvin on leveraging AI and data analytics to revolutionize compliance programs in which GRIP’s US Content Manager Julie DiMauro discusses compliance, technology, and regulatory priorities with Matt Galvin, co-founder of Gentic Global Advisors and formerly counsel in the DOJ’s Compliance and Data Analytics Unit and Global VP of Ethics and Compliance at Anheuser Busch InBev.

[INTRO]

Julie DiMauro: Greetings, everyone, and welcome to a Global Relay Intelligence and Practice, or GRIP, podcast. I am Julie DiMauro, the US Content Manager for GRIP, talking to you from New York City.

GRIP is a service that features a daily website of articles on a variety of compliance and regulatory topics, plus podcasts and other deep dives into compliance trends and best practices. You can find the service at grip.globalrelay.com, and we hope you’ll connect with GRIP on LinkedIn.

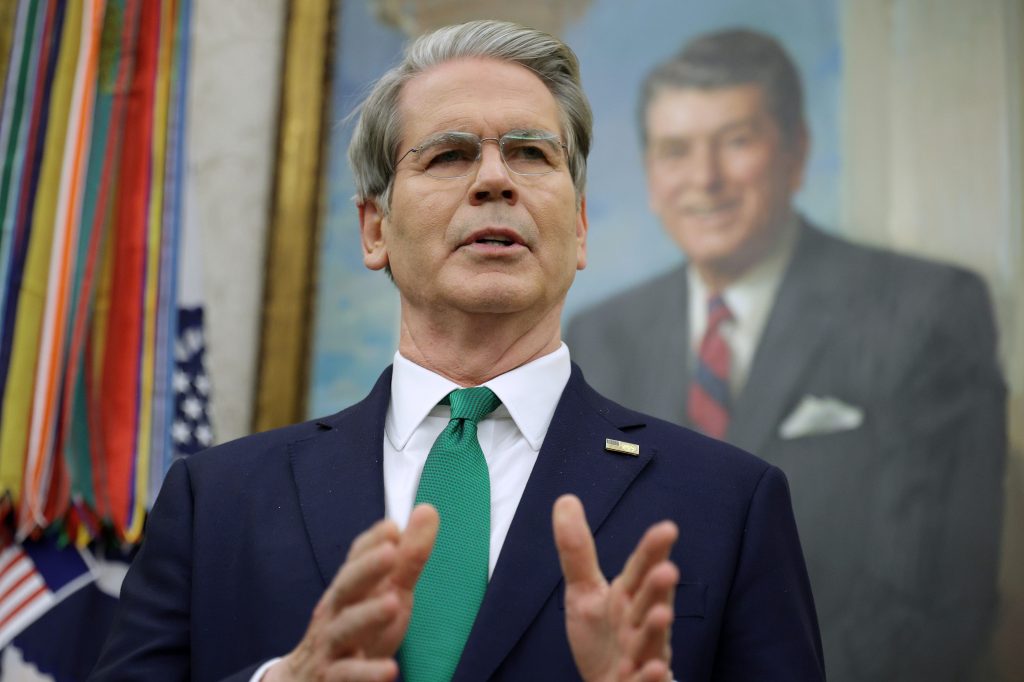

I am so pleased to announce that today’s podcast session features Matt Galvin, co-founder of Gentic Global Advisors, and, just recently, counsel in the DOJ’s Compliance and Data Analytics Unit. I’m going to ask Matt to please introduce himself and more thoroughly describe his background before we kick off the program. Over to you, Matt.

Matt Galvin: Thanks, Julie. It’s really great to be here. I’m a big fan of the podcast. As you said, a few months ago, I left the Department of Justice, where I had two roles as counsel for compliance and data analytics for the fraud section. The fraud section sits in the Criminal Division and is primarily focused on the Foreign Corrupt Practices Act, securities market manipulation, and any fraud against the government, including healthcare fraud.

I had two main jobs. One was to build out data analytics to streamline investigations in any of those areas. The other was to review compliance programs as part of determinations for deferred prosecution agreements, the appointment of monitors, or whether to proceed to trial.

I recently left government and co-founded a few entities. One is Gentic Global Advisors, which, to me, is the law firm of the future. It’s a combination of legal experts and data scientists to solve complex problems, usually in risk management for clients. I’m also co-founder of Transforming Legal, which is a digital transformation boutique with global reach.

We have lawyers and professionals in Europe and Asia. And I’m going back to my nonprofit, Integrity Distributed, which works with MIT to democratize access to cutting-edge compliance technologies. So that’s what I’m doing today.

Julie DiMauro: That’s a lot. Thank you for sharing that. And I want to take a deeper dive, though, into something you did prior to your work at the DOJ, if we could. You were at the world’s largest brewer, AB InBev. And when you were there, Matt, you championed the use of machine learning to help compliance detect and prevent employee misconduct or help companies in their compliance departments do so.

Since you were there for almost seven years, how did the idea for, and the transition to, such a data analytics focus come into play at the company? Who was involved, and what did it require of the firm?

Matt Galvin: Yeah, I think when I look back, I became a lawyer at the worst time in the history of lawyers to be a lawyer, where data was exploding. The ability and the technical ability of law firms and lawyers to deal with this explosion of data were trailing. It was a brief time that was really good for law firms, because you had huge amounts of data – email, financial data – and as a young lawyer, I was just thrown into pits of data and asked to climb out of it. A lot of lawyers perish in the climb out of those pits.

With that, I always had an interest in better ways to manage that and get signal, because a lot of it was: here are terabytes of data, go create a binder.

So I was always open to better solutions. At AB InBev, when you suddenly have your in-house team, and at the time I was head of investigations, you don’t have the pressure to create large teams. In fact, you have the converse pressure – how do you manage problems efficiently? I looked at the problem of integrating with SABMiller, which was a $100 billion acquisition, with 24 separate countries, and doing post-acquisition diligence on that was a huge challenge.

The way the initial lawyers that were advising me were suggesting was to do transaction testing and random sampling of six of the 24 countries, and then you’ll change some rules, do some investigations, and fire some people. What does next year look like? Well, we’ll send people to three of the countries you did and three new ones. What is year three?

Well, we’ll do another three and another six. And I’m like, this is a recipe for perpetual external advising. It wasn’t really solving the problem. All it was, was a set of processes that would be plausible to an uneducated third party that I was trying to integrate and get management and resolve issues. But it didn’t make a lot of sense.

And so, to me, it was somewhat intuitive: instead of sending people out to get this data, let’s centralize it. And I think when I reflect on it, this was part of a broad trend in industry. Because 10 years ago, we were in the early to mid-stages of the creation of data loops. And that’s because, on a broad tech perspective, cloud computing was becoming available and more ubiquitous.

It was right around that period that, if you look at your macro tech trends, Microsoft surpassed IBM in revenue right around 10 years ago, which is because of a drive towards cloud computing.

So I think that made that solution more affordable and more technologically possible than it had been. And it was on trend with what was happening in other areas of companies, where they were looking at sales data and using tools like Salesforce, which was booming and becoming a giant company right around the time. In a sense, what I did was look at the trends that were driving across at least B2B technology in that era, and use those tools to solve a problem that those tools hadn’t really solved before.

Julie DiMauro: Let’s drill into that. Solving problems in terms of being able to map risk, handling vendor management challenges, what were your objectives in using this technology and refining it?

Matt Galvin: Well, I mean, ultimately, from a legal perspective, it was like, how do you integrate two companies?

Julie DiMauro: Got it.

Matt Galvin: And from a more nuanced perspective, when you looked at the opinion releases and the state of DOJ guidance at the time, it was, OK, how do you make a good faith effort to understand where the skeletons were and what you had to acquire to fix that? And then when you look at the tactics of that, it was, huh, I could look at some small swath of that randomly, and having tested and looked at the efficiencies of that, it was about 1 in 3,500 things you would find. So you’d have to look at 3,500 random transactions to likely have a chance of finding something. O

r you could start applying a set of rules, and it was over-measuring. I saw that that would get us to about 1 in 700. And then when we got into the machine learning space, those numbers got a lot better.

But the idea was, if you redefine compliance from a set of processes to show an attempt to solve a problem, how do you drive transparency that you’ve brought to the business to know where to direct your attention as a CCO? Technology offered a much better solution than what was common practice in the market. And so that was kind of, in a sense, using technology, but it was also allowing technology to redefine, really, in some respects, the standard of care for operating a compliance program.

Julie DiMauro: Now, I’m interested to know, Matt, how your team and the other departments that you needed to collaborate with, how you achieved buy-in from them and their participation, particularly if skill sets were not ready for it?

Matt Galvin: Yeah, it’s a great question, because we started with EY to do some of the accelerants for it. But you’re right, we needed access to the data, and we needed some support. And it wasn’t always sunshine and roses. But what we did discover in the course of doing diligence was that there was this brilliant young guy in the SAP audit function who had already created data access portals or APIs to data all across SAP Africa.

And we could use what he had done and pull the data out that we needed to operate the system. So that one guy… We had to do a roadmap that would take a few years, and we were going to do static data pulls. We had to build, and he accelerated a roadmap by two years by having these structures already in place. Then he became a key engineer and architect for BrewRight.

It was really cool, and it was amazing the work that he had done. And then we still needed high-level support from IT.

And it’s funny, I’ve given this talk so many times. And two weeks ago, I actually got to give it with the former Chief Legal Officer for AB InBev, Sabina Chalmers. She’s now at British Telecom. We were both winning awards in London. And I was reflecting on it, getting ready for that talk with Sabina. But she had told me that year, she’s like, Matt, you have three things.

You got to resolve the investigation with the SEC and DOJ. You got to figure out how to integrate this business. And you should work more with IT. Very high-level mandates.

With those high-level mandates, I met with the Chief Technology Officer at the time and set it up. He agreed not to stop me. At that time, with different challenges, I was accused by different people of setting up like shadow IT, I was accused by people of going around them.

We had all sorts of security reviews. And all of it made the project better. There was a lot of scrutiny on it as we went. But as I learned over time, I got agreement from senior levels of the functions to have portions of IT’s bonus targets tied to the project. With AB InBev, everyone had five things they needed to accomplish in a given year, and they were targets. And once you achieved them, you got 20% of your bonus approved.

And so we got very senior people in IT early on to have targets to facilitate the project. So they made it run because they were compensated to do it. And then as it evolved, it became more important to have external recognition. Because early on, I was really worried about whether the DOJ would even accept this way of doing things.

And low and behold, I would never have imagined six years later I would be sitting in the DOJ evaluating whether people had done things. Because early on, I was like, I don’t think they will. And so there’s a huge amount of effort to get external recognition. That led to a lot of external awards. And I would share… I remember we won the Financial Times Innovative Company Award.

And I remember putting that award on the CTO’s desk, and not mine, which was politically savvy. But he’s got the award now. I’m sure it’s somewhere prominent in his gorgeous apartment in Miami.

Julie DiMauro: I’m sure. Now, how did you get buy-in from the board and the top leadership to begin this journey?

Matt Galvin: Whew. I mean, I remember fighting it out at the time. I wasn’t even Chief Compliance Officer. And I remember having a lot of battles with him about whether to do it. I worked with external counsel. We got rid of the first group of lawyers because they were suggesting a random sample that would have cost $30m. And I started to do the math.

And we piloted the project in AB InBev entities before SABMiller. And so that allowed me to do two things, because I had a budget to do integration. But by piloting it, and it was in Brazil and India, I got to integrate two key strategic markets for me for free and in a nice test case. And we showed a lot of victories and drove down a lot of investigation costs.

But then you compare. And a lot of this, and you see it in parallels now as people are moving towards AI, is you need to think more like a scientist and less like a lawyer. And you need to say, what are the objective criteria for success? And lawyers don’t like to think of things that way. They like to just defend and argue. But if you do that, it allows you to say, OK, if I’m doing an investigation traditionally, here’s the level of effort.

Here’s what I found. If you look at this many transactions and this kind of output, you come up with a set of metrics, and then you redo either a comparable investigation or the same one, and you say, oh, I did that much more efficiently across these metrics. I can actually demonstrate it to you.

And you start to use kind of base-level statistics and math to justify being more efficient. I think that’s where the future is going for law, is that we’re going to have to demonstrate our levels of efficiency across metrics that really other corporate stakeholders have been held accountable to for much longer. And I think with the advances in technology, we’re now going to be held accountable to those functions, to those sorts of data structures.

So there’s a little bit less room for subjectivity, where the ability to get signal from data isn’t kind of obfuscated by people.

Julie DiMauro: That makes sense. But I’m still thinking about the training that might be required of people to be able to use this functionality, to use the technology effectively, to get the results that you were looking for. Was there ongoing training? Did you do new hiring? What did that look like in terms of skill sets?

Matt Galvin: Yeah, I mean, at first we leaned heavily upon EY, who was the key partner. And then I brought in folks into the company, including a guy, one of the lead data forensic accountants from EY, who I wanted to come work with us.

He built out eventually a whole team. As we put more of those target systems in place again, we wouldn’t just have targets cascading across the IT parts of the business, but the risk management functions as well. When they started to get targets that their bonuses were contingent upon, well, that gave them a pretty strong incentive to hire someone that knew how to do it.

And so they would share the target, but then hire, like, a forensic accountant or borrow one from auditor controls who knew how to do it. And a bigger portion of their target would be on it, which is fine.

So they were supervising someone with a skill set.

So from a top-down managerial perspective, it was a study in managerial incentives. From a bottom-up perspective, you’re right, it was kind of like they had to create the skill set to meet the demand. But it’s not like that exotic of a skill set. A lot of lawyers doing investigations, you become kind of an amateur forensic accountant, just the same way a lot of forensic accountants become amateur lawyers. We drive each other crazy, you know, because we know just enough about what each of us does.

But you know, like what they’re doing, and you learn to work as a team. And so there is a dimension of this that was very team-sport-oriented, particularly with the version of technology that we were at, like, you know, 2016 to 2020, when this is really picking up steam.

Now, I mean, there are all these cool tools in the market that haven’t quite permeated the legal tech market, but are permeating everywhere else. Where a lot of this work can now, you could train agents to do a lot of this pretty well. And I’ve seen it kind of happening. Then you can create interfaces that are much more chat-oriented or intuitive.

So I don’t think, you know, the way this is evolving is going to be so challenging. I think the way the tech is going, it’s going to be much more accessible to folks. In the skill set that we’re going to need, well, there’s some scientific discipline, some kind of native curiosity, and some creativity that’s going to be there that may not have been as necessary before. I think that almost replaces kind of formal training and like forensics or, you know, to do it.

Julie DiMauro: For sure. Now, thinking about artificial intelligence and the different technologies that fall under it, do you have some concerns about a lack of regulation in the area or about companies using them without the appropriate guardrails? What are your thoughts on that?

Matt Galvin: Yeah, I mean, we were part of the Justice AI Initiative. We put in a bunch of questions, you know, in the ECCP for folks to start asking questions about how AI is used. And I think one of the best things we did in that structure was refer to NIST’s guidelines, because that’s where the real experts are focused on the mismanagement and misuse of AI.

We were increasingly getting instances of where AI was driving fraud or misconduct, which I think is another set of kind of questions. Because I think there are corporations misusing AI, there’s AI to manage risk, and there’s also like how fraudsters are using AI to commit crimes. I think it’s essential to think of all of those. I don’t think there are great solutions yet to each one.

I think in the first one, the misuse of AI, I mean, right, there was a new release by Microsoft that allowed people to unleash agents across corporations. There’s probably some need for rules for that, you know, and concepts of like, even internal controls, the right to appeal to a human, or when’s a human in the loop or when’s a human on the loop, or how’s a human designing that.

The best thing I can say with that is you need diversity of views. Like where AI goes wrong, it goes wrong because it’s overly confident and often in answers that it shouldn’t be overly confident about. Now that’s a problem with almost every senior man that I’ve ever worked with.

And similar diverse structures to mitigate the groupthink capability that a single person can have in non-diverse environments is important. I think in terms of risk management, it’s awesome. Like the AI capability to do forensic investigations, to piece together asset tracing, to do pierce through huge amounts of data to get issues is really cool, which is not all available necessarily in legal tech, but it’s kind of available in adjacent spaces.

And then in terms of the last, it’s the biggest challenge because, you know, we’re living in a world where kind of authenticity is really like a currency that’s usually counterfeit. And so how do you know what’s real or what’s not?

And so one of the projects that we’re anticipating getting funded on very soon with the nonprofit is to set up ways to evaluate bias in the application of social media algorithms. I’m really passionate and excited about this project because it’s like THE problem, right?

Like, can you manipulate groups or can you take a perspective and then target people the same way that there’s case studies of airlines charging people with Apple devices more than those with IBM devices, or, you know, for airline tickets.

Can you feed people in certain demographics, you know, certain political things to push them in a certain direction? Or is it more crowd-driven? And these are really important questions that I would love to see structures to be more transparent about. But I think we’re all learning as we go and with all three areas.

Julie DiMauro: Absolutely. Now, getting back to your work at AB InBev, Matt. If you can, even generally, just tell us a little bit about the few things that you were most proud of in terms of implementing new technology, data analytics into the program, and a couple of the takeaways that were most significant to you that you deem successes.

Matt Galvin: You know, when I look back, I mean, I’m more proud of the people that have copied the AB InBev program. I’m proud that it got the chance to work with the evaluation of corporate compliance guidelines and put structures of data in place.

I’m proud that so much more talent has come into compliance and compliance has gotten cool. And just the caliber of people I see wanting to go into the field now, as opposed to 10 years ago, is so much deeper – it’s just such a deeper bench. There were all-stars in compliance 10 years ago, but it’s just such a deeper league now. That’s really cool.

I’m proud that, you know, companies have moved into this space and moved on. I’m proud of all the people that I’ve met in the journey, some people that worked for me directly, some people in different advisory roles, but there were really kind of great people at different levels that worked on BrewRight. You know, some of whom now are like CCOs of different companies or senior leadership positions in other places.

A lot of the EY people, like, you know, the people that really did BrewRight, they’re all like partners, either at EY or somewhere else. And they’re doing like tech startups and all of that. So the ecosystem around that is a microcosm that has been really cool to see.

And, you know, it was a huge amount of my life and energy, but a huge amount of life and energy for so many other people as well. And I’d like to kind of look and see that that had a pretty big impact on how compliance was done. There’s still resistance in some places, but that’s OK, because there used to be so much resistance when we started. So that’s kind of almost like a warm blanket in a way.

I guess the same way someone comes out of a difficult home, you know, has a difficult marriage – it’s very comforting.

Julie DiMauro: Absolutely. Now, you were talking a little bit before about regulators not exactly using cutting-edge technology themselves back in the day, but they are more so now. And there’s this regulatory expectation that companies are spending in this area and the compliance departments are. And you’ll see that even in their enforcement decisions, sometimes they talk about, you know, whether or not they use technology appropriately if they put some funding into that area of compliance. How is that moving the needle for companies? Do you see that that is actually inspiring companies to invest appropriately?

Matt Galvin: It’s interesting. I don’t think, you know, when I went into government, my views on this were different from what they were as I lived through government, because when I went in, the DOJ is not a regulator, but the ECCP is very much so.

I think there are some things that, by putting them in the ECCP, I received kind of feedback, and we talked to folks in compliance spaces as we worked on that, that they would try to implement and kind of live up to those guidelines and achieve. And I think there’s some incremental change. But what I learned was that you don’t change the world in the Department of Justice, certainly not independently, because it’s like a large bureaucracy, and everything has to be done as part of a large group.

You do it by changing enforcement. You do it by enabling agents and lawyers to operate with a higher degree of efficiency and to use AI and other models. And so, you know, in the securities space, we looked at gaps in enforcement and how other regulators, like FINRA, SEC, and CFTC, would look at different markets to see if we could do a little bit better job of pulling different available data sources together with market data to identify issues of securities manipulation.

We worked within the FCPA arena to develop fairly sophisticated tools to pull data from either global media or other transparency-initiative-based NGOs in different markets or quasi-intergovernmental organizations to produce data.

The ability of Large Language Models [LLMs] to synthesize complex sets of data really makes the landscape big, from where you can get signal to identifying where you want to prioritize investigative resources. And so, by doing that, I haven’t seen the reaction yet in the market to it, but I don’t think there’s a great deal of understanding – correct me if I’m wrong – because we don’t really talk about it in any detail, for good reason.

But I do think that the more advanced companies and the best risk managers are rethinking where they can, you know, the data sets that you can now think of to manage risk are so much more profoundly large than they were, you know, only so long ago.

And then, in the government fraud and healthcare space, in some respects, that was the easiest, because you have, in government, the data there, and healthcare analytics wasn’t invented in my watch, but we got really good at it in terms of looking at fraud. And you saw, in the latest numbers in the DOJ release this week, you have $14 billion recovered, and they make explicit reference to the analytics team supporting that.

Julie DiMauro: It certainly did.

Matt Galvin: And that’s where I think that, to me, will probably drive compliance over the next five years, more than minor tweaks or the fact that we used the word “data” in the ECCP, or even the concept of proportionality, which suggests that you’re supposed to use different parts of the company’s capability. And so, my thinking on how to have an impact evolved as I was in government.

Julie DiMauro: That makes sense. I’m thinking about companies not going at it alone. What would you recommend in terms of a company that wants to bring more technology into their compliance and legal teams?

Should they talk to their regulators? Should they go to trade groups, share with each other in… you know, it can be hard and competitively speaking, you don’t want to exactly share your secret sauce, but how do you do that effectively? Are there such collaborative efforts that you would recommend?

Matt Galvin: I mean, that’s kind of why I founded Integrity Distributed with a friend of mine at MIT. You know, I don’t think… like, there were four reasons why companies said they didn’t do analytics, basically. One was, they didn’t understand the technology. And so there’s an opportunity to educate, you know?

Another was, it’s going to be too expensive. Well, by working together, and we did this kind of paper right before I went to government four years ago, by allowing companies to collaborate and share algorithms for fraud and anti-corruption, you make them work that much more effectively. And then, if you make them work more effectively, they operate much more effectively with fewer people and resources. I think, as you get agentic overlays in it, they’re going to operate even less expensively. And that’s really cool.

But by operating in a federated structure, you allow for the sharing of insights without sharing underlying data or anything incriminating. That’s even cooler, because you allow, right, for like super models to be created.

And there’s an MIT paper that I’m happy to send to anyone who reaches out, that documents the math, and we’re putting together a new cohort now. And so, we’re looking for companies that want to inexpensively operate world-class anti-corruption and anti-fraud analytics at low cost, because it doesn’t need to cost a lot to be good.

And then, the third reason companies didn’t do it… I forgot which order of the reasons, right? One is, they don’t understand it. One is, they think it’s not going to work. Oh, it’s too expensive.

Another is, it’s not going to work. You know, by math, I can show you how it works, right? It’s definitely going to work, which really leads to the fourth reason why people don’t do this, and that’s because it’s going to work too well. And I think a lot of compliance… if you look at the generation of compliance structures that were like, well-meaning people that kind of thought, 15 years ago, like the Morgan Stanley case, and you know, at the time of the UK Bribery Act and the corporate compliance defense, a lot of that’s process-oriented stuff.

And a lot of it was geared to kind of create plausible deniability. None of it was really geared to work.

And if you think there’s a lot of people that are still prominent folks in the compliance bar, and they’re like: “Well, you’re trying to get everything towards this idea that you find a rogue employee acting.” But it’s such a fallacy, right? Because if you really understand compliance systems, there should be no such thing as a rogue employee that can be successful, because base-level controls stop a single person from running amok.

And so, by trying to drive everything to this rogue employee defense, you’re driving everything by definition to a compliance system that’s not working. And so, my vision for compliance is one that… yeah, it can’t be expensive, it has to work really well. But you have to want it to work.

And the way to do that is through organizations like Integrity Distributed, which are kind of bringing technology to folks.

Julie DiMauro: That makes total sense. I’m glad you brought up the ECCP, the evaluation of corporate compliance programs, and the 324 defendants that were just charged in the takedown. The 2025 takedown data analytics is mentioned significantly in the enforcement action and in the ECCP. And again, I just see references to it more and more with this expectation that companies are going to be using this technology, up-skilling in these areas. It just seems incredibly top of mind.

But I still wonder, though, if companies are going to be able to keep up with the demands, if they are smaller organizations or if they just don’t really appreciate the power or efficiency that comes along with this technology. What are your words of encouragement for firms, especially ones that are struggling with resources?

Matt Galvin: Yeah. One of the things that’s a pain point is just so much noise. A lot of money has gone into legal compliance tech, and it feels like a lot of that money is being spent on marketing legal and compliance tech, and not as much on the underlying technology, which is super frustrating. Another thing is, you see a lot of solutions designed by kind of folks who did a couple of years, maybe at a law firm, maybe not, maybe they did six or seven years, they were a mid-level kind of compliance thing.

Maybe they were like a director or something. And they can solve the mid-level compliance problem really well. And if you delegate, as a CCO, a lot of the tech stuff to your mid-level people, they’ll be like: “This is really exciting. It speaks to me,” but it doesn’t necessarily… having been very senior in an organization, you work your way up and work with people throughout.

You have to have empathy for multiple levels of it. And it’s easier to have empathy for multiple stakeholders in an organization if you’ve had multiple jobs in an organization.

And if you can think about what a board’s expectations are going to be, what the senior leadership’s expectations are going to be, what the director’s expectations are going to be, what the manager’s expectations are going to be… it’s so much easier to design something that’s really good and nimble and can do all of that. And so, there’s just not a ton of solutions that do all of those things well.

One of the things we’re trying to do to help is invest in this platform, GOLT, that we just put in beta form this week and made it free for legal compliance, whoever. Where you can just use a chatbot and query, “I want a tech solution to do this,” and it will give you a list. And then they can pay to get accredited and all of that. But some of that is like… I spent a lot of time, I traveled to Israel, I traveled to India, looking for good tech when I was a CCO. Not a lot of CCOs invest their time to do that. So, I want to enable people to kind of access this global marketplace of things that work and can help them get to the shortlist fast.

And, of course, with the clients that I work with, I have pretty educated views of like… “Oh, we can solve this problem this way, or we can put these two technologies together, instead of buying the super expensive solution, you can do this cheap one and hire an engineer.”

And it’s a really cool moment right now, because Large Language Models are making us able to do more, just with the credits that we have in our Azure or AWS accounts, that the CTOs probably have. And that, by the way, is something that CCOs, very few know, that when you have a subscription to a cloud computing service, like any of the Google, AWS, or Azure, there are credits for solutions, and you can get compliance tools with those credits.

Oh, you can actually purchase really good tools on Azure with kind of like “casino credits” that your CCO probably has, and that’s what I told you about. So that’s just a pro tip for cash-strapped, budget-strapped folks, that you can operate within those marketplaces, and your company might already have invested in those tools, and you can get them with less budgetary friction than you otherwise might.

Julie DiMauro: Exactly. Tell us a little bit about Gentic Global Advisors, PLC, this exciting new adventure, Matt. What do you hope to accomplish? And what are some of the successes you’ve already had?

Matt Galvin: I mean, on some level, I want to put my kids through college. But no, professionally, I think it’s really an interesting moment, because for the first time, a few years ago, companies were like, “You still see some folks that are like, don’t use AI.”

And some are like, “Well, I use AI, but use it very securely or use it for this.” Now you’re beginning to see clients ask your firms, “Don’t do anything with a human that an AI could not do better.” And I think that client demand is going to be increasingly driving the market faster than a lot of leaders think.

I think, in some sense, the technology is a great equalizer at scale. I think, well, I fully expect Gentic to grow, but it won’t ever really need to be so massive that we can’t do really complicated things. Because the technology allows us to do these really cool, complicated projects, whether it’s like redesigning the compliance program for an AI company, or doing workshops for senior management on real-life case studies and how things go wrong, and how a better data strategy could have prevented catastrophe.

Or designing and piecing together some solutions to do cutting-edge import compliance maintenance, and how do you dynamically ensure that you’re complying with tariffs, but optimize your business in the same way with a single tool. Right? Which is to me the problem, it’s the most 2025 problem ever. Right?

Why settle for bad eDiscovery AI when there’s AI that can, like, take all communications data and have a bot answer the questions and give you the underlying documents and conversation, or you can be interviewing someone and have a bot, a virtual single small Chrome window, next to you, that you’re asking the questions at the same time and can help you cross-examine in real-time.

And as I like an interview kind of ebbs and flows, you have that kind of real-life person that can cross-check everything the person says with underlying data. Like, why spend a huge amount of money on forensic intelligence when you can have a system that, you know, can plug into Integrity Distributed and operate with a wild degree of efficiency, whether you have an issue or not.

Why do kind of really inefficient third-party sources with really good LLMs exist to help you sort through noise and produce traffic and give you real-time feedback and a broader array of sources? Why limit your analysis to media when you can have social media LLMs that can recreate and act more like the government might in terms of looking for risk? To me, there are all these different “why are you doing it that way” questions that I get to help people with. That’s super fun.

Julie DiMauro: Amazing. Matt Galvin, thank you for sharing these incredibly useful insights and your significantly impressive background with all of us and for being on our GRIP podcast program today.

I want to thank our listeners for tuning in, as ever.

Please explore our articles and other podcasts at grip.globalrelay.com, particularly the one coming soon about Matt’s experience at the DOJ, because he and I are going to have another conversation, and you’ll see that in article form on our GRIP website.

Please tell your colleagues about us and have a great day. We’ll see you back here for another podcast session soon.