The SEC released its long awaited private fund reforms on August 23. These reforms are reflected in the adoption of Rule 211 of the Investment Advisers Act of 1940 (the Private Fund Rule), bringing several significant requirements applicable to private fund managers, including exempt reporting advisers.

The new Rule requires fund managers to:

- provide detailed quarterly statements to investors;

- conduct an annual audit of the fund;

- follow prescribed governance requirements when engaging in secondary transactions;

- comply with new restricted and prohibited activities limitations; and

- provide transparency into investor side letters which may provide preferential treatment to certain investors.

The introduction of these rules raises questions and new compliance considerations for investment advisers. The complexity of these regulations, coupled with the broader context of regulatory intervention, may provide additional challenges and potential ambiguity for private fund advisers as the rules are interpreted.

All advisers have 18 months to implement the required quarterly statements and obtain an audit. The remaining obligations go into effect in 12 months for firms with more than $1.5 billion in private fund assets under management. All other advisers have 18 months to come into compliance.

Additionally, the Commission has conferred legacy status for private funds which are launched before the applicable effective dates as follows:

Non-US based advisers, exempt reporting advisers

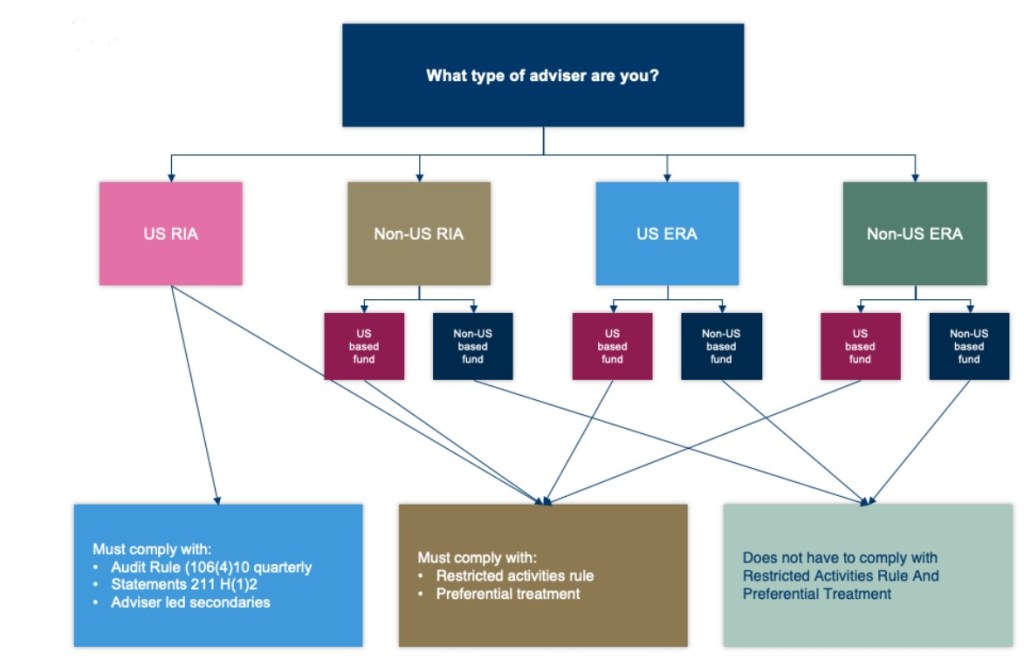

The quarterly statement, audit, and adviser-led secondaries rule applies to all SEC-registered investment advisers (RIAs) who have a principal place of business in the United States.

The restricted activities and preferential treatment rules apply to all US-based advisers to private funds, regardless of whether they are registered with the Commission, this includes Exempt Reporting Advisers (ERAs) and all RIAs.

Non-US based advisers and ERAs may still be subject to the restricted activities and preferential treatment rules if their private fund clients are domiciled in the US. For example, if your principal place of business is outside the US and you advise a Delaware private fund, then the preferential treatment rule applies to you. However, if your private fund is based in the Cayman Islands, the rules will not apply.

Quarterly statements

Rule Section 211(h)(1) of the Advisers Act facilitates simple and clear disclosures to investors about their relationship with investment managers, especially those handling private funds. Under this new rule, investment managers have to provide straightforward, quarterly disclosures about fees and performance, which are viewed as essential to the investor-adviser relationship. The Rule requires quarterly statements detailing fees, expenses, and performance and contains prescriptive formatting and presentation information for the statements.

The quarterly statements must be distributed within 45 days after the first three fiscal quarter ends and within 90 days after the fiscal year-end. For advisers to funds of funds, the requirement is to distribute quarterly statements within 75 days after the end of the first three fiscal quarters and within 120 days after the fiscal year ends.

These quarterly statements need to include the following:

- Private fund fees and expenses: Detailed information about the various fees and expenses charged to the fund. This enables investors to monitor and assess the true cost of their investments. This includes:

- adviser compensation;

- fund expenses; and

- offsets, rebates and waivers.

- Portfolio investment table: The quarterly statement must include a separate table for the private fund’s covered portfolio investments and a detailed accounting of all portfolio investment compensation paid to the adviser.

- Performance metrics: The performance metrics should be presented in a standard format to enable easy comparison across different funds and different market environments as follows:

- Advisers must provide standardized fund performance information in quarterly statements.

- Liquid funds must show performance based on net total return for the last 10 years or since inception, whichever is shorter, over various periods.

- Illiquid funds must show performance based on internal rates of return and multiples of invested capital since inception, and must present a statement of contributions and distributions.

Mandatory private fund adviser audits

The Commission adopted a new Rule 206(4)-10 requiring mandatory audits of private funds. This requirement is consistent with the audit requirements of the Custody Rule 206(4)-2, which is required when an adviser has custody of the private fund. The new Private Fund Audit Rule will require all private funds to receive an audit, regardless of whether the adviser has custody.

In order to comply with the audit provision, the audit must be performed as follows:

- Auditor qualifications: The audit must be performed by an independent public accountant registered with the Public Company Accounting Oversight Board (PCAOB), and subject to its regular inspections.

- Audit definition: The audit must meet the specific definition of an audit as per Regulation S-X.

- Accounting standards: The audited financial statements must be prepared in accordance with generally accepted accounting principles (GAAP).

- Distribution timeline: The audited financial statements must be delivered to investors annually within 120 days of the private fund’s fiscal year-end, and promptly upon the fund’s liquidation.

Adviser-led secondary transactions

The newly adopted Rule Section 211(h)(2)-2 of the Advisers Act sets governance standards for advisers to engage in adviser-led secondary transactions. These transactions, which are initiated by the adviser to sell a portion, or all, of their stakes in the private fund or to convert or exchange their stakes for interests in another fund managed by the same adviser. These transactions can come in various forms, such as single asset transactions, strip sale transactions, or full fund restructurings.

The definition also considers a transaction to be adviser-led if the adviser initiates a process designed to offer investors liquidity options. However, this does not apply if the adviser is merely assisting an investor in selling their stake at the investor’s unsolicited request.

The new Rule aims to be sufficiently broad to capture evolving transaction types while being narrow enough not to include transactions that don’t raise similar concerns. For example, the definition does not include “rebalancing” or “season and sell” transactions, which are primarily used for legal, tax, or operational reasons and don’t offer the choice between selling and converting/exchanging fund interests.

Accordingly, advisers should review all secondary transactions to determine if they meet the definition of an adviser-led secondary. If so, then they must comply with the provisions of the new Rule and obtain either a Fairness or Valuation Opinion from an independent opinion provider. This opinion must be sought before a binding decision is made and be distributed to investors. The opinion should be accompanied by a written summary outlining any material business relationship between the adviser and the opinion provider.

Fairness opinion or valuation opinion

There are two primary types of written opinions that advisers may obtain to complete these transactions:

A Fairness opinion is a professional, independent evaluation performed by an outside party, which determines whether the terms of a financial transaction, such as an acquisition, merger, or share buyback, are fair to the parties involved. Specifically, it focuses on the price at which assets are being bought or sold.

Conversely, a Valuation opinion provides an assessment of the value of a business, business ownership interest, security, or intangible asset. Unlike a fairness opinion, a valuation opinion may or may not relate to a specific transaction. It can be used for a variety of purposes like litigation, financial reporting, or strategic planning.

Differences between fairness and valuation opinions

- Scope: Fairness opinions usually have a broader scope and are typically related to a transaction. Valuation opinions are generally more focused on the asset itself.

- Purpose: Fairness opinions aim to judge the fairness of a transaction for all parties involved, while valuation opinions aim to estimate the value of a specific asset, independent of a transaction.

- Cost: Valuation opinions are generally less expensive to produce than fairness opinions, which may require deeper, more comprehensive analysis.

Restricted activities

The new Private Fund Rule 211(h)(2)-(2) has also instituted some restricted activities to advisers of a private fund without certain disclosure or consent requirements. This rule applies even if these activities are performed indirectly (eg, by an adviser’s related persons). The Commission believes these activities tie to conflicts of interest, and, consistent with traditional mitigation of those conflicts, disclosure and consent, will mitigate those conflicts.

Any adviser that is relying on the disclosure and/or consent provisions to engage in any of these activities needs to make sure that the corresponding support is included in the firm’s books and records process.

These newly restricted activities include:

- Private Funds can no longer charge or allocate fees or expenses associated with an investigation of the adviser or its related persons by any government or regulatory authority without seeking consent from all investors and receiving advanced consent from at least a majority of fund’s investors.

- An Adviser cannot pass on any sanctions imposed by a court or government authority for violating the Investment Advisers Act of 1940 or rules thereunder, even with disclosure and/or consent of fund investors.

- Charging the private fund for expenses related to regulation, examination and compliance fees or expenses will require an after-the-fact disclosure. This rule requires advisers to distribute written notices to investors within 45 days after the end of the fiscal quarter in which the relevant activity occurs.

- Reducing the amount of any adviser clawback by actual, potential, or hypothetical taxes applicable to the adviser, its related persons, or their respective owners or interest holders will require an after-the-fact disclosure. The rule requires advisers to distribute written notices with specific information to investors within 45 days after the end of the fiscal quarter in which the relevant activity occurs.

- If an adviser or its related persons have invested in the same portfolio company, they may not charge fee expenses related to a portfolio investment on a non-pro rata basis without a before-the-fact disclosure-based exception. The rule restricts this practice unless:

- the non-pro rata charge or allocation is fair and equitable under the circumstances and

- prior to charging or allocating such fees or expenses to a private fund client, the investment adviser distributes to each investor of the private fund a written notice of the non-pro rata charge or allocation and a description of how it is fair and equitable under the circumstances.

- Borrowing money, securities, or other private fund assets, or receiving a loan or extension of credit, from a private fund client without seeking consent from all investors and receiving advanced consent from at least a majority of fund’s investors is prohibited.

Preferential treatment

The final new rule adopted, Rule 211(h)(2)-3, targets private funds which engage in side letters with investors. This rule aims to enforce the equal treatment of investors among the various conflicts a side light might generate. These new requirements, encapsulated in Rule 211(h)(2)-3, come at a time when the private fund sector is facing increased scrutiny and demands for transparency.

The introduction of these rules by the SEC represents a significant development in the regulatory landscape that warrants careful examination and consideration. When exploring the specifics of these regulations, firms should critically assess the implications and carefully navigate the complexities of compliance within the contemporary investment management sphere.

Restrictions on preferential treatment

Preferential redemptions: Advisers may not grant an investor the ability to redeem its interest on terms that may have a material, negative effect on other investors, except if:

- it is required by applicable laws, rules, regulations, or orders.

- the same redemption ability is offered, without qualification, to all other existing and future investors in the private fund and any similar pool of assets.

Rationale: The Commission noted that such practices often have internal conflicts of interests which can harm other investors in the private funds.

Providing portfolio information: Advisers may not provide information regarding the portfolio holdings or exposures if it reasonably expects that providing the information would have a material, negative effect on other investors, except if the information is offered to all other existing investors at the same or substantially the same time.

Written notices for preferential treatment

Advisers must provide written notices regarding any preferential treatment related to material economic terms to both prospective and current investors in the private fund. Specific requirements include:

- Advance written notice for prospective investors.

- Written disclosure of all preferential treatment for current investors in both illiquid and liquid funds.

- At least an annual written notice regarding any preferential treatment provided since the last notice.

Exceptions to restrictions

The restrictions on preferential treatment will not apply to contractual agreements governing a private fund that has commenced operations as of the compliance date and were entered into in writing prior to the compliance date.

These new rules by the SEC provide an update to the framework governing the conduct of investment advisers to private funds. The rules provide specific guidelines on the communication and consent required between advisers and investors, so firms should ensure they meet the necessary requirements. It is important to note that existing contractual agreements are considered, and exceptions are provided to ensure a smooth transition to compliance with the new regulations. Only funds started after the compliance date will be subject to the new rules.

Advice to firms managing private funds

Firms managing private funds will need to adopt policies and procedures addressing the applicable requirements of the Rule. For those considering launching a new Fund, prospective side-letter arrangements should be examined, which may be disclosed publicly.

Advisers should also begin documenting annual reviews in writing, as this requirement will almost immediately be reviewed by the Division of Examinations.

We’re supporting clients to review policies and procedures, training and assess emerging conflicts of interests as the impact of the Rule unfolds.

Valerie Ruppel advises investment advisers and wealth managers on daily operational matters that need to comply with US regulatory requirements. She is an expert in regulatory filings, development and implementation of compliance policies and procedures, annual compliance reviews and regulatory mock exams.

Before joining Bovill, Valerie was an Attorney-Adviser at the US Securities and Exchange Commission in the Division of Examinations where she conducted examinations of registered investment advisers and registered investment companies for compliance with federal securities laws, rules and regulations.