Troy Health, a North Carolina insurer offering Medicare Advantage and related plans, has struck a deal with the Department of Justice to avoid prosecution over allegations of fraud, agreeing to pay $1.43m and cooperate with prosecutors under a non-prosecution deal.

Prosecutors accused the firm of deploying artificial intelligence and automation tools to harvest Medicare beneficiaries’ data and to enroll patients in its plans without consent. The agreement spares the company from criminal charges but underscores how new technologies are being harnessed for old-fashioned swindles.

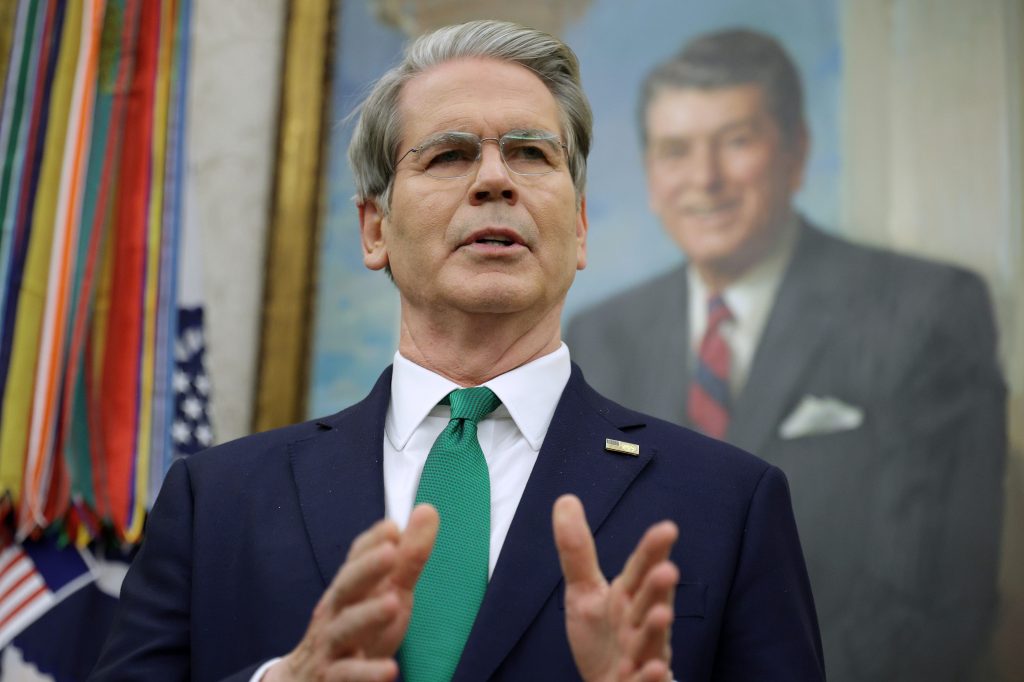

“The subjects in this case defrauded not only their own patients, but also the taxpayers who help fund Medicare,” said Assistant Director Jose A Perez of the FBI’s Criminal Investigative Division. “The FBI remains committed to investigating those who would take advantage of American healthcare programs and bringing them to justice.”

AI and old-fashioned fraud

Troy Health, a North Carolina insurer, has avoided prosecution by admitting to a scheme that mixed cutting-edge software with classic grifting. From late 2020 through 2022, the firm and its executives directed employees to use a bespoke platform to pilfer pharmacy records and customer lists.

Armed with names, Medicare numbers and other personal details, sales staff made unsolicited calls, misleading pensioners into believing they were signing up for a supplement to their existing coverage rather than a new plan.

The company’s own artificial-intelligence platform, Troy.ai, was also bent to illicit ends. Marketed as a tool to reduce costs and improve care, it was instead deployed to funnel referrals.

“Troy told low-income Medicare beneficiaries that it would use new technologies, including its proprietary artificial intelligence platform, to improve patient health outcomes,” said Acting Assistant Attorney General Matthew Galeotti of the Justice Department’s Criminal Division. “Instead, the company misused patient data to enroll beneficiaries in its Medicare Advantage plan without their consent. Today’s resolution reflects the Criminal Division’s emerging focus on corporate enforcement in the health care space and holding both individuals and companies accountable when they defraud our medical system to enrich themselves at the expense of the American taxpayer.”

Pharmacies that used the system were offered kickbacks if they steered customers toward Troy’s Medicare Advantage policies, a practice that prosecutors said corrupted both enrolment practices and patient trust.

At the peak of the racket, during the 2022 open-enrolment season, Troy signed up more than 2,700 beneficiaries, often without their knowledge. One March day saw 300 new names added in a near-automated batch, with entries logged on the government’s website at minute-long intervals.

The firm has now acknowledged responsibility for the actions of its officers, directors and employees. The non-prosecution agreement spares Troy a criminal conviction but leaves a clear warning: regulators are watching how new technologies are used – or abused – in America’s healthcare market.

Carrot and stick

In the end, Troy Health escaped prosecution but did not get off scot-free. The firm agreed to pay a $1.43m penalty, reduced to reflect its limited ability to pay, and to continue assisting the Justice Department with any further investigations.

The deal reflects a familiar bargain: prosecutors secured admissions of wrongdoing and cooperation without pushing the company into bankruptcy or stripping beneficiaries of coverage.

“The defendant’s use of stolen identities to fraudulently enroll individuals in Medicare Advantage plans was a deliberate scheme to boost profits at the expense of vulnerable patients and the integrity of the Medicare program.”

Christian J Schrank, Deputy Inspector General for Investigations, Department of Health and Human Services Office of Inspector General

The Justice Department weighed both aggravating and mitigating factors. Troy failed to preserve key documents at the outset, and its misconduct was serious, involving thousands of fraudulent enrollments. Yet the firm later provided investigators with detailed facts about the scheme, reported its 2022 mass-enrollment episode to regulators before they discovered it, and accepted responsibility.

With no prior criminal history, remedial compliance measures in place, and an ongoing pledge to cooperate, Troy received credit for cooperation, though not the more generous credit reserved for voluntary self-disclosure. The case shows how prosecutors calibrate punishment to balance deterrence with the practical realities of keeping a health insurer afloat.

Crowded enforcement docket

Troy’s agreement with prosecutors is distinctive for its reliance on artificial intelligence to enrol beneficiaries without consent. Yet the logic of the case fits a broader pattern. CVS Caremark’s $95m penalty for inflating Medicare drug prices and the Justice Department’s lawsuit against Aetna, Humana and Elevance for paying brokers to shun costly patients all reveal the same underlying concern: private actors exploiting Medicare’s rules to shift costs and maximize revenues.

The government’s toolkit, meanwhile, is remarkably consistent. Prosecutors have leaned on the False Claims Act, whistleblower suits and the threat of treble damages to draw out evidence from insiders and force settlements.

The targets may differ – a pharmacy benefit manager, an insurer, a health-tech start-up – but the playbook is the same: expose hidden incentives, press firms into cooperation and calibrate penalties to punish misconduct without destabilizing coverage for millions of beneficiaries.

The lesson is not that Medicare is uniquely vulnerable to fraud, but that its scale makes it a prime arena for testing enforcement strategy. By coupling cooperation incentives with visible penalties, the Department of Justice aims to shape behavior across an industry where margins are tight, compliance costs rising and technology creates both new efficiencies and new avenues for abuse.

“The defendant’s use of stolen identities to fraudulently enroll individuals in Medicare Advantage plans was a deliberate scheme to boost profits at the expense of vulnerable patients and the integrity of the Medicare program,” said Deputy Inspector General for Investigations Christian J Schrank of the Department of Health and Human Services Office of Inspector General (HHS-OIG). “HHS-OIG, alongside our law enforcement partners, will continue to relentlessly pursue those who exploit Medicare and threaten the security of enrollees’ personal health information.”

The Troy case, like those against CVS and the insurance giants, suggests that enforcement is less about one-off scandals than about setting norms for how public money and private innovation are meant to coexist.