In an effort to recap an interesting year of regulatory adjustment in 2025, GRIP spoke with A Valerie Mirko, leader of Armstrong Teasdale’s Securities Regulation and Litigation practice area, to get her thoughts on the main takeaways and preparations needed to head into the new year.

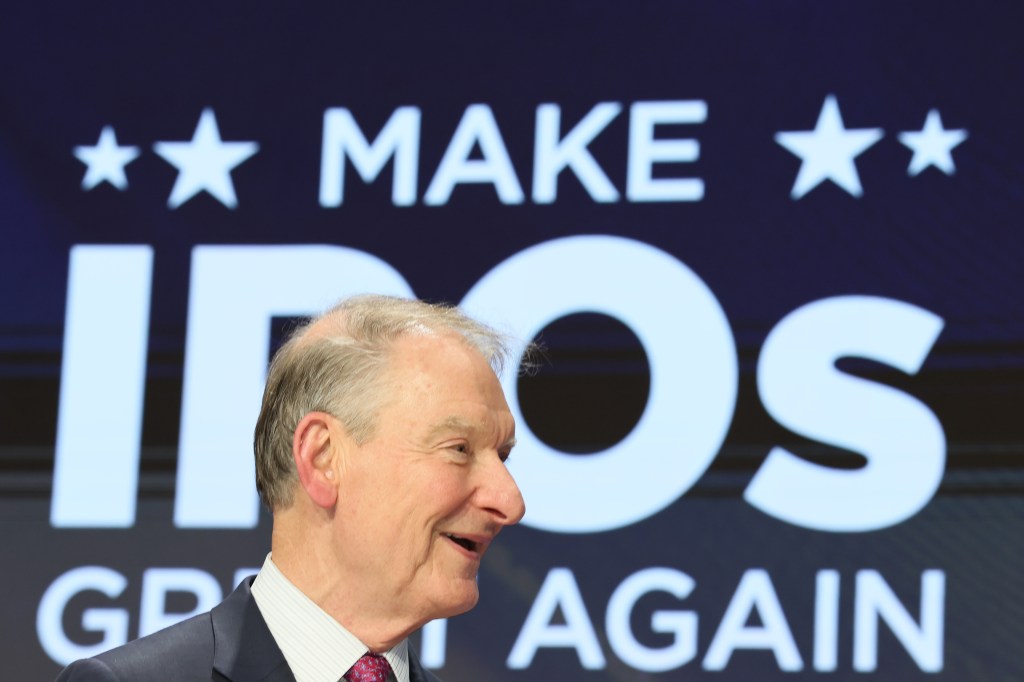

Mirko talked about the SEC’s Chair, Paul Atkins, and his decided deregulatory push, mentioning his commitment to lowering the barriers for initial public offerings, making disclosure more useful and less arduous or rote, and bolstering the private markets so more investors could partake in them.

“We saw a lot of guidance and not so much rulemaking,” Mirko said. “Press releases for enforcement actions have also been scant, so the usual reading of tea leaves of how the Commission thinks is evolving.”

One thing that remains: The institutionalists. The majority of commissioners at the SEC now – Atkins, Mark Uyeda, and Hester Peirce – have lengthy SEC backgrounds and decided viewpoints about what works and does not work in regulating the US marketplace.

As a result, regulatory adjustment is balanced but not wholly deregulatory.

Enforcement

The new director of enforcement is Margaret “Meg” Ryan, appointed in September, who served as a law clerk for Supreme Court Justice Clarence Thomas and more recently as senior judge of the US Court of Appeals for the Armed Forces, a selection that was not surprising.

“Even if enforcement activity is down, and it is, there were some significant fraud matters and settlements brought forward,” Mirko noted. “What is notable is that the real focus with enforcement in 2025 is on actual harm to investors. Meaning, the agency was committed to mostly focusing on cases in which that actual harm had been proven rather than on more performative cases involving such things as recordkeeping where actual harm was not imputed.”

Mirko noted a recalibration in civil penalties with more focus on the fairness element for the registrant population. The case in the first half of the year reflected older ones sitting in the docket, but the more recent ones have featured lower dollar amounts for penalties, Mirko observed.

One key place to look to gain an appreciation for the agency’s enforcement focus in 2025 and the Atkins agenda in leading it is the chair’s speech on the Wells process, Mirko said.

In this October speech, Atkins mentioned how critical a fair and transparent Wells process is, so the positions of the staff in making an enforcement recommendation and those of the individual or entity that would be charged are known. Outlining the charges, the reasons and evidence behind them, and being open to additional background from the potential respondent’s or defendant’s side, is critical, Atkins argued.

Mirko said his call for a new analysis of the processes undergirding it, acknowledging that you cannot do a Wells process in four days – it’s more like four weeks – was a breath of fresh air for businesses and defense counsel such as herself.

Examinations, SEC, and FINRA

In terms of examinations, FINRA just issued its Regulatory Oversight Report for 2026, and the priorities enumerated in it were the ones expected, Mirko said. (Mirko also pointed out that its timely publication signaled that the SEC was returning to business as usual after the government shutdown.)

It’s “back to basics” she said “with an emphasis on fraud cases that harm investors, especially our most vulnerable ones, and an emphasis on investment recommendations being appropriate, in line with Regulation Best Interest and the fiduciary standards of the Advisor’s Act.”

“FINRA wants you to have a supervisory process in place before launching GenAI or other AI tools at your business. This supervisory process needs governance. It cannot just be plugged into your regular BD supervision processes.”

A Valerie Mirko, Armstrong Teasdale’s securities regulation and litigation leader

The important question remains: Was the account type that was recommended appropriate to meet the investor’s unique goals, she said.

“The biggest difference is that digital assets is no longer its own exam focus,” she said. “Instead, it is incorporated into the examination program generally, using general fraud and other bedrock investor-protection principles. Same thing with private funds.”

She explained: “While previous years’ exam priorities specifically addressed cryptocurrency and private funds as separate exam priorities, in 2026, the exams division is now examining these products as part of its assessment of the suitability of certain investment products recommended to retail investors.”

At the SEC, that agency recently allowed registered investment advisers and funds to use certain state-chartered trust companies as “qualified custodians” for digital assets within a no-action letter, Mirko reminded us.

“Previously, this was an area of uncertainty, as the traditional definition of a ‘bank’ as a qualified custodian did not explicitly cover these entities,” she said. “This no-act letter could get hardwired into actual custody rulemaking,” she said, “but this is a good one in expanding custody options in this arena.”

As usual, merged firms will be closely examined for how they integrate, especially as there is increasing consolidation in the investment advisory space. “The SEC exam team will be looking at what clients are being told, the business’s internal controls, their surveillance capabilities, and the training they offer advisors,” Mirko said.

Other focus areas are anti-money-laundering (AML) controls at registered firms and the SEC’s Net Capital Rule, which mandates that broker-dealers maintain sufficient liquid assets (net capital) to cover liabilities, ensuring customer protection, especially during firm failure.

FINRA and broker-dealers

In April, FINRA announced the launch of FINRA Forward, “a series of initiatives to improve its effectiveness and efficiency in pursuing its mission.”

The initiative includes modernizing rules to “eliminate unnecessary burdens,” better support member firm compliance, and combat cybersecurity and fraud risks, especially emerging threats.

Mirko noted that some staff attrition is affecting it, but noted how digital assets were highlighted in the context of FINRA supporting innovation and wanting to pave the way for the US to keep up with other jurisdictions in allowing for more regulatory breathing room to do such innovation.

She also noted we are seeing the same thing in the context of the SEC Crypto Roundtables, noting especially the recent December 15 roundtable where SEC commissioners emphasized the importance of crypto in the future.

“Finally, digital assets can be treated as a true asset class like other ones, and this is in keeping with investors’ demand for it,” Mirko said.

A new topic for FINRA in its Oversight report (noted above) is generative artificial intelligence (GenAI), and the emphasis here is on the internal controls: Businesses have to control faulty output, Mirko said. “It’s guidance and not at all prescriptive,” she said.

“FINRA wants you to have a supervisory process in place before launching GenAI or other AI tools at your business. This supervisory process needs governance. It cannot just be plugged into your regular broker-dealer supervision processes,” Mirko added.

And in the AML space, examples of updated trends in this sector were added, with more granularity provided, she pointed out.

“Basically, both agencies are focused on a common enemy, which is more specifically the bad actors and fraudsters and not necessarily the businesses employing them,” she said.