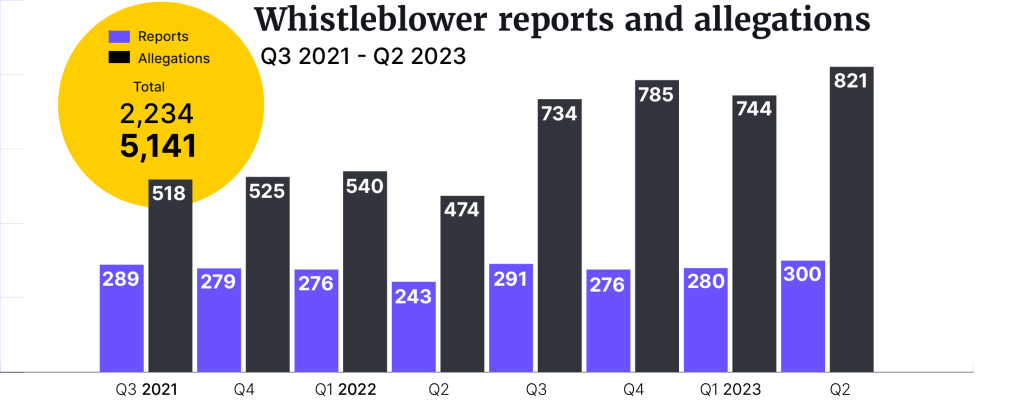

A record high number of 300 whistleblowers turned to the FCA in Q2 2023, the regulator’s new quarterly data report shows. The whistleblowers also brought 821 allegations in total, another new record for the watchdog. June was the busiest month, with 119 whistleblowers coming forward with allegations. The quietest month was in December 2021, where 65 whistleblowers stepped forward.

Since the start of publishing the whistleblower data in late 2021, the subjects of the top allegations have remained constant. This quarter followed the trend, and showed allegations in relation to:

- compliance – 162;

- fitness and propriety – 103;

- the Culture of the organization 100; and

- treating customers fairly – 95.

Many of the allegations were also in relation to the Financial Services and Markets Act 2000 (FSMA).

Looking back at the all total allegations from last year, most claims were around Fitness and propriety (416), Compliance (362), and culture of organizations (310).

Whistleblowers provide identity

The FCA started publishing its whistleblower data in late 2021, and has since then received 2,234 reports, containing 5,141 allegations in total. Unlike in the US, where financial incentives for whistleblowers follow successful regulatory action, no financial rewards are given out to whistleblowers in the UK for providing information. Even so, most whistleblowers (67%) do provide their identity when reporting an allegation, and have been doing so since start. This quarter, 209 whistleblowers provided their name and 91 stayed anonymous.

The FCA’s own online reporting form also continues to be the most popular choice through which to send in the allegations. For Q2 2023, FCA was contacted by:

- online reporting form – 140;

- email – 69;

- Telephone – 68;

- letter – 13; and

- other – 10.

Before this record quarter, most reports had been seen in Q3 2022 (291), and the most allegations in total in Q4 2022 (785).

Rob Mason, our Director of Regulatory Intelligence, commented on the rising numbers, and believes that the culture around raising issues has enchanced.

“The logical conclusion is that education around ‘speaking up’ has improved, so those who are reporting are more aware of the issues which translate to allegations, which are pertinent and behavior that is expected. This may also coincide with the growing impact of employee activism, potentially millennials who are especially cognisant of being treated decently,” Mason said.

Even though reports and allegations seem to consistently increase, FCA received some criticism earlier this year, when a qualitative survey of whistleblowers showed concern about the process of reporting to the regulator. Some respondents felt that the regulator was “not really interested” and had “failed to take allegations of serious wrongdoing seriously”.

Since then, the regulator has set out steps to enhance the whistleblower journey to improve confidence and to provide more information and updates to whistleblowers on their cases.