A total of A$215m ($136m) was adjusted due to the Australian Securities & Investments Commission’s (ASIC) financial reporting and audit surveillances between July 1, 2022 and June 30, 2023, the regulator’s Annual financial reporting and audit surveillance report 2022–2023 shows.

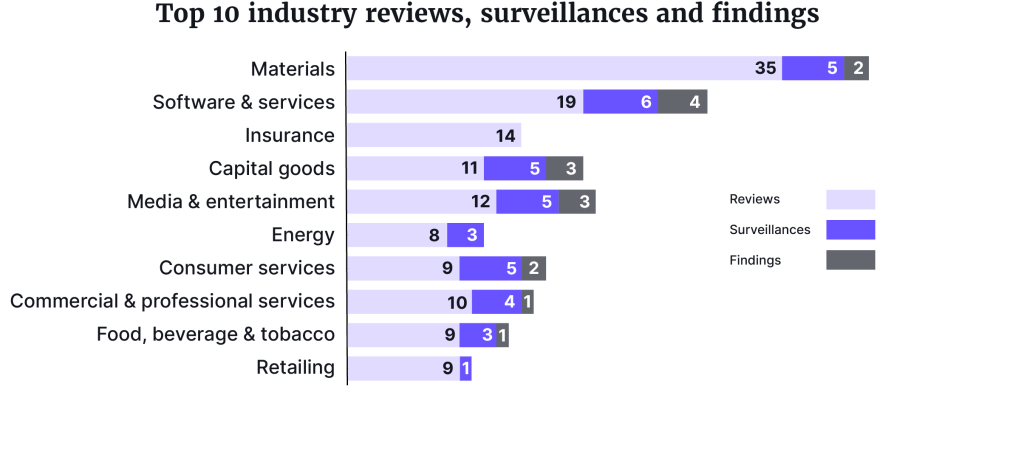

During the period, 180 financial reports of ASX-listed entities and other large unlisted entities were reviewed, including 15 related audit files at 11 audit firms. ASIC then started 55 surveillances covering 93 issues. After concern was voiced, 25 of those entities made adjustments to previously released financial information, which then led to 15 audit surveillances.

The majority of the financial reporting surveillance was found relating to insufficient disclosure of material business risks in the operating and financial review (OFR), impairment of assets, revenue recognition, and other financial report disclosures.

“It is concerning that we continue to identify financial reporting findings and audit findings in relation to impairment of assets and revenue recognition,” ASIC said and urged all stakeholders to make a “concerted effort” to improve these areas.

Audit findings

Key areas for the audit findings were impairment of non-financial assets and asset values and revenue and receivables, the report revealed.

Some of the findings resulted in enforcement actions, which included the conviction of a former auditor of Big Un Limited for failing to comply with auditing standards, an accountant charged with falsifying signatures on audit documents, and the firm Grant Thornton and an auditor being charged over its 2018 audit of the company iSignthis.

“It is concerning that we continue to identify financial reporting findings and audit findings in relation to impairment of assets and revenue recognition.”

ASIC

To ensure proper focus on future financial reporting and audits, ASIC says that all audit firms and auditors should:

- set a strong culture that focuses on audit quality, which has accountability at all levels of partners and staff;

- have effective communication and relevant education with directors (including audit committees) and management of audited entities – to enable them to document their positions including detailed analysis and conclusions with reference to accounting standards;

- make sure that the audit is properly resourced with the right skills and expertise, including having robust supervision and review processes to identify and address issues early;

- run quality reviews of audits, and remediate findings by obtaining the evidence to form an audit opinion on the financial report;

- identify and address the root causes of audit findings.

- set action plans to address the identified root causes, and monitor and revise the plans to ensure effectivity and sustainability.

“We expect company directors (including audit committees) and auditors to constructively discuss our findings and take action to improve financial reporting and audit quality,” ASIC continued.

Improving the surveillance approach

The urge to improve reporting and audit processes has been voiced before, when ASIC expressed the need for auditors to “bring the knowledge of a business, risks and strategies obtained in the process of auditing the financial report in reviewing the OFR”.

In October 2022, ASIC also made some key changes to enhance its own surveillance approach by:

- merging two programs into a single financial reporting and audit surveillance program;

- improving its risk-based targeting of financial reports by making better use of internal and external data;

- reviewing higher risk financial reports, irrespective of the audit firm;

- setting a routine to select audit files for surveillances based on the results of the financial report reviews;

- focusing audit surveillances on the key audit areas primarily relating to the most significant issues from the financial report reviews; and

- publishing a report of the financial report findings, including a summary of all individual audit findings, in order to provide more transparency of thematic audit quality findings than before.

“The changes to our surveillance approach and reporting will provide a better overview of the financial reporting chain and will emphasise to key stakeholders … accountability for the quality of the financial report and the quality of the audit process,” says ASIC.

In total, ASIC regulates about 29,000 entities that are required to lodge financial reports, which includes over 1,900 ASX-listed entities and over 27,000 unlisted entities. The Commission also regulates 3,200 registered company auditors and authorized audit companies, and more than 500 registered company auditors and authorized audit companies audit one or more listed entities.