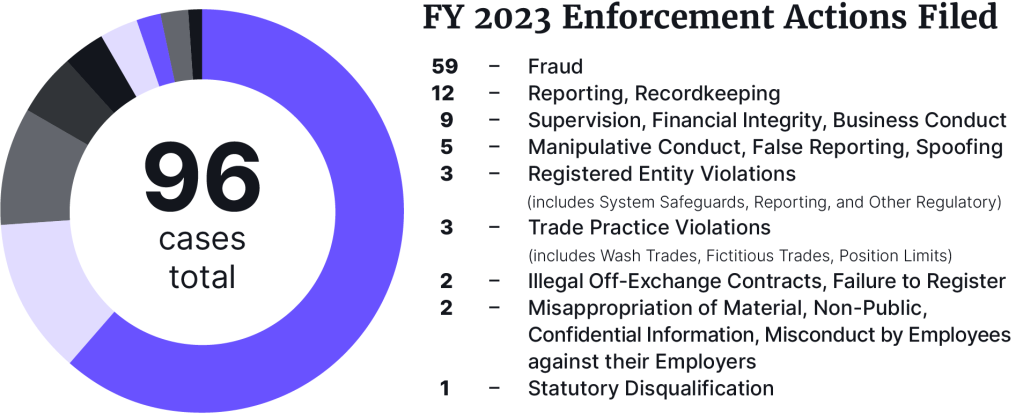

The CFTC last week released its enforcement results for 2023. The number of enforcement actions stands at a relatively modest 96.

A large proportion of the actions centred on instances of fraud, with many of the actions involving “important customer protection elements.”

A total of 47 of the enforcement actions, just under half of the total, included allegations connected to digital assets, including those against FTX, Celsius and Binance as well as a “precedent setting” win against Ooki DAO. The CFTC characterizes a focus on the decentralized finance space as a key to its continuing efforts to protect the public and there is very little doubt that enforcement activity in this space is set to continue in 2024.

Ensuring that market misconduct does not undermine market integrity has been another area of focus, with some key actions against HSBC Bank USA, Glen Point Capital and Goldman Sachs

Compliance and business practice were also in the regulatory crosshairs with action taken against 20 financial services firms in connection with recordkeeping failures.

Only two actions were taken in connection with insider trading or “misconduct involving confidential information” and this is probably a result of the incredibly high burden of proof required to successfully prove rule-breaking in this area.

Whistleblower awards

The CFTC is also emphasizing its expanding collaboration with other agencies, including self-regulatory bodies as well as enforcement, suggesting that market protection efforts are more effective when “working together with colleagues in the enforcement and regulatory community.”

Approximately $16m in whistleblower awards was paid to seven individuals whose information led to successful enforcement action by the CFTC.

Finally, two new task forces were established focusing on “complex and developing” areas:

- Cybersecurity and Emerging Technologies;

- Environmental Fraud.

GRIP View

The establishment of the task forces is a positive, but the timing suggests that the regulator is still playing catch-up. Establishing control now is important, but is unlikely to make good the large number of investors who have lost money to blatantly fraudulent activity in these dynamic areas in the recent past. The focus on collaboration seems a tacit admission that help from others may be required to police an expanding and swiftly changing beat effectively, given the agency’s relatively modest budget ($411m requested for 2024 vs $2.436 billion requested by the SEC) as well as limited staff numbers.