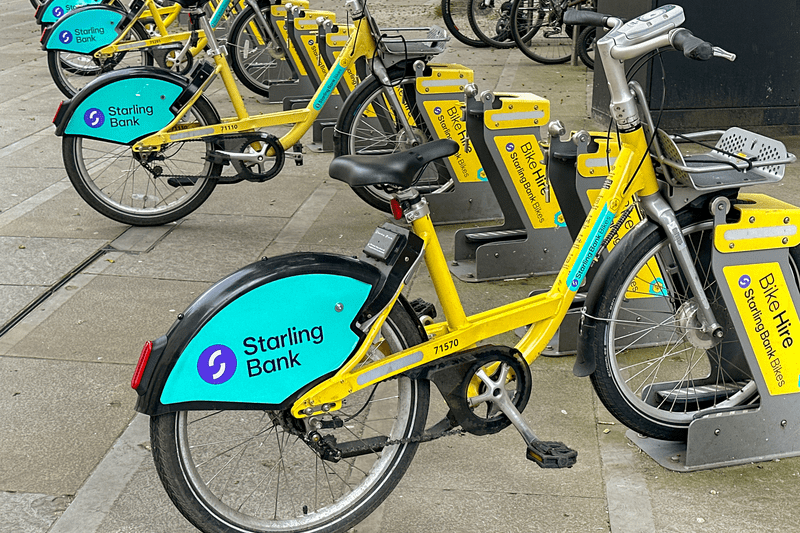

The FCA has fined Starling Bank Limited £29m ($38.5m) for financial crime failings related to its financial sanctions screening. It also repeatedly breached a pre-existing regulatory requirement not to open accounts for high-risk customers.

Starling grew quickly, from approximately 43,000 customers in 2017 to 3.6 million in 2023. However, measures

When the FCA reviewed

Register for free to keep reading

To continue reading this article and unlock full access to GRIP, register now. You’ll enjoy free access to all content until our subscription service launches in early 2026.

- Unlimited access to industry insights

- Stay on top of key rules and regulatory changes with our Rules Navigator

- Ad-free experience with no distractions

- Regular podcasts from trusted external experts

- Fresh compliance and regulatory content every day